Reply To:

Name - Reply Comment

By First Capital Research

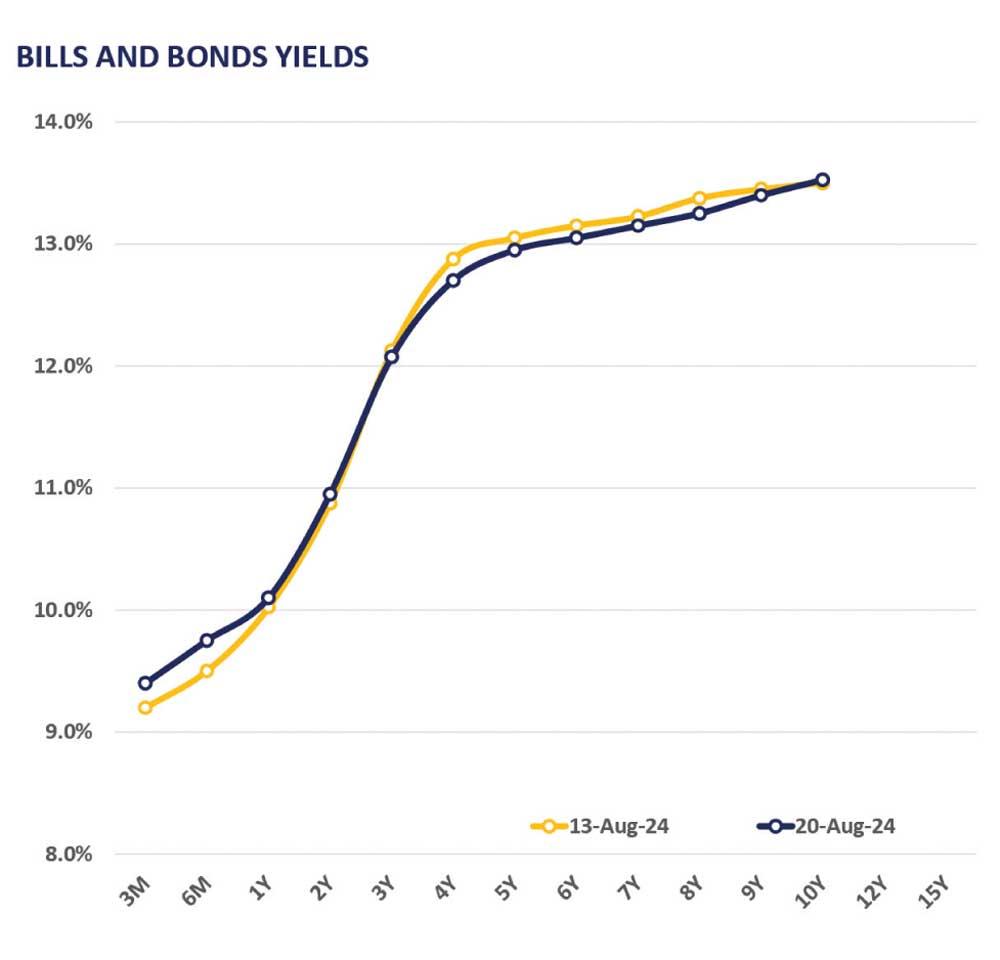

The secondary bond market yield curve continued to slide on the mid to long tenors as buying momentum extended for the third consecutive day.

Among the traded maturities, mid tenors including 01.07.28 and 15.12.28 maturities were seen trading in the range of 12.85%-12.70%.

Meanwhile, Investor interest also shifted to long tenors notably 01.12.31 and 01.06.33 which changed hands between 13.25% -13.20%. However, the overall market remained subdued and displayed thin volumes.

On the external side, LKR further appreciated against the greenback closing strongly at Rs. 298.7. On a YTD basis, LKR appreciated 7.8% against the USD, showcasing a robust overall performance despite recent fluctuations.

However, the LKR experienced depreciation against other major currencies during the day, including AUD, GBP, and EUR. For the week ending 16th Aug 2024, the AWPLR further increased by 02bps to 9.07% compared to the previous week whilst AWDR stood at 8.04% as of July 2024.

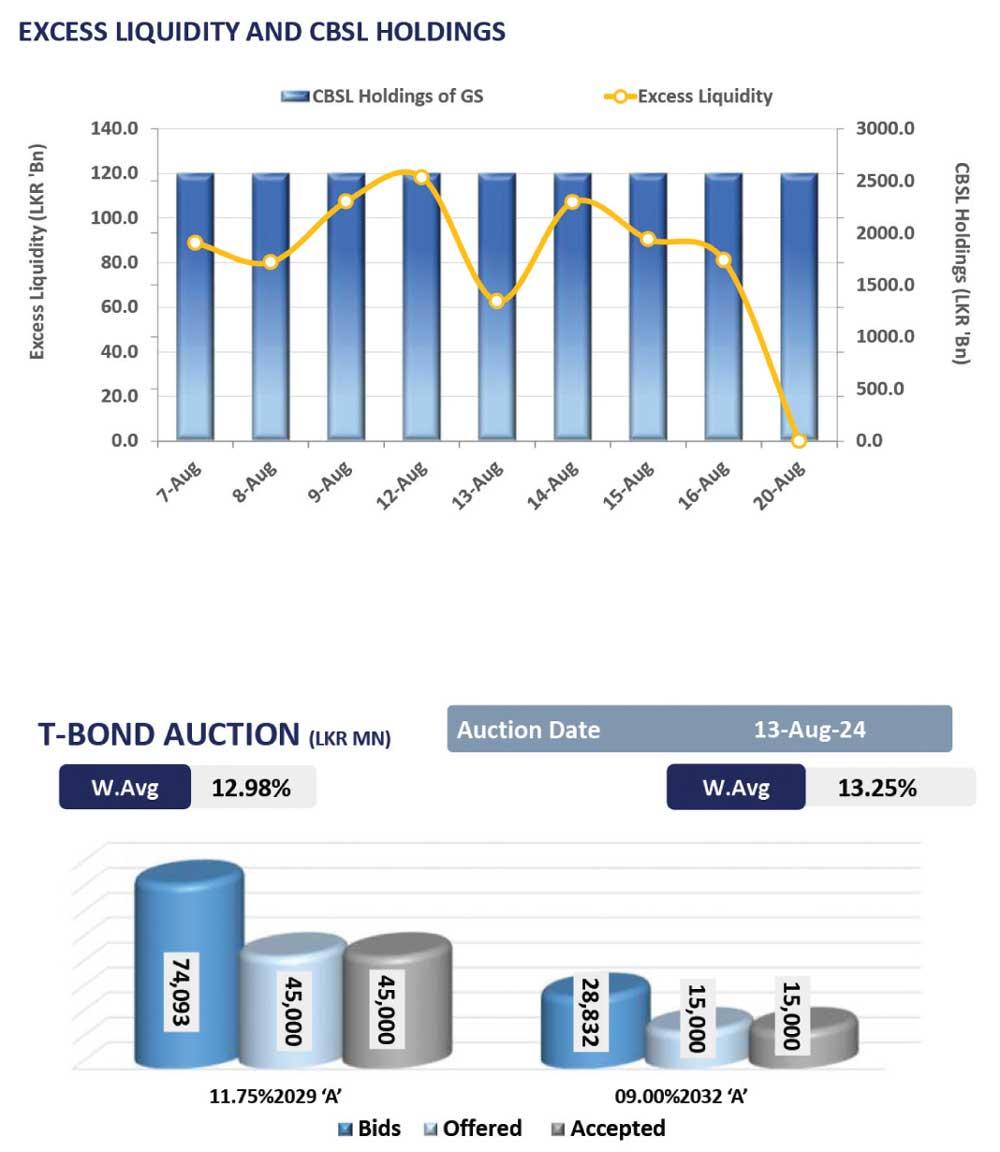

Furthermore, foreign holdings in government securities decreased by 6.2% WoW, registering at Rs. 45.1bn as of 15th Aug 2024. Notably, CBSL holdings remained steady for near 1-month at Rs. 2,575.6bn.