Reply To:

Name - Reply Comment

By First Capital Research

The secondary market displayed a mixed sentiment during the day amidst ultra-thin volumes and limited activity as investors yearned for further clarity on the market direction.

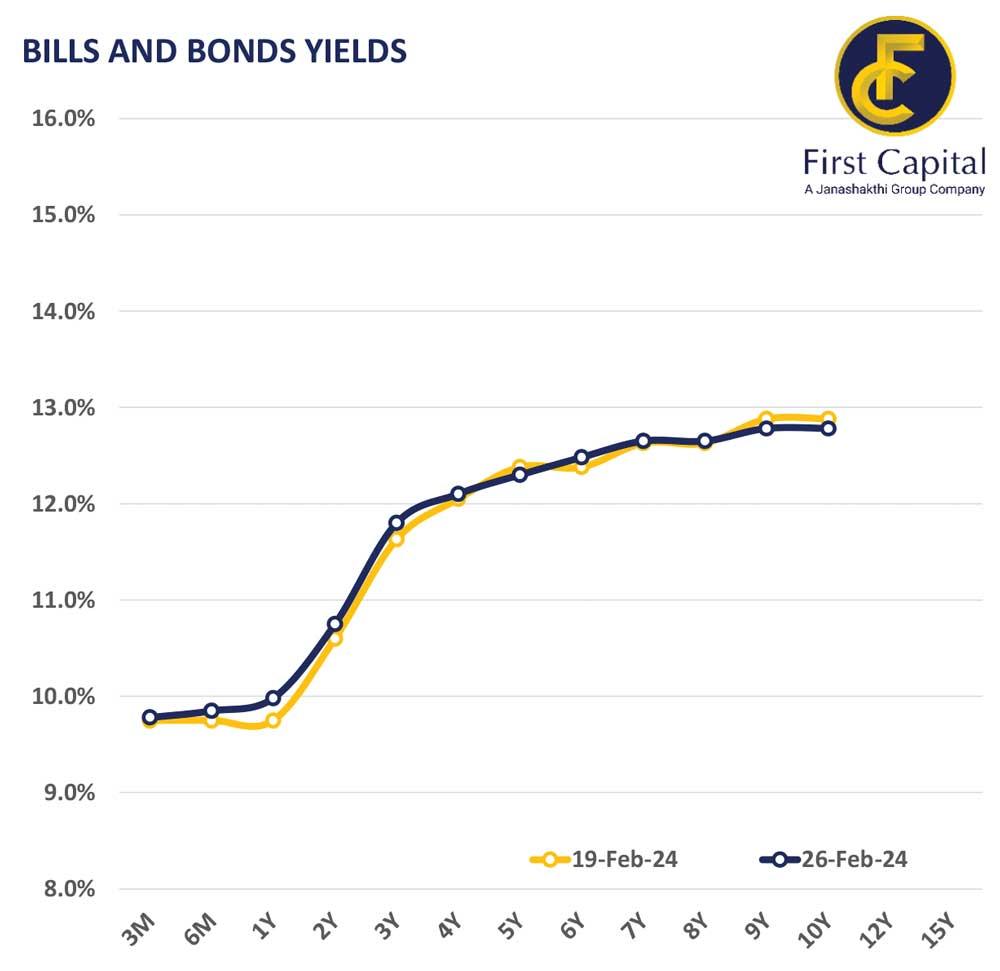

Among the limited maturities traded, liquid maturities on the short end of the curve enticed trades during the day. Namely, 01.02.26 traded at 10.50 percent, 15.12.26 traded at 11.10 percent, 15.09.27 traded at 11.90 percent, whilst 01.07.28 traded between the range of 12.50 percent - 12.60 percent.

On the external side, the Sri Lankan rupee slightly appreciated against the US dollar, recording at Rs.300.5, compared to Rs.301.1 recorded during the closing of the previous week.

However, the Sri Lankan rupee depreciated amongst most of the major currencies such as GBP, EUR, JPY, CNY and AUD.

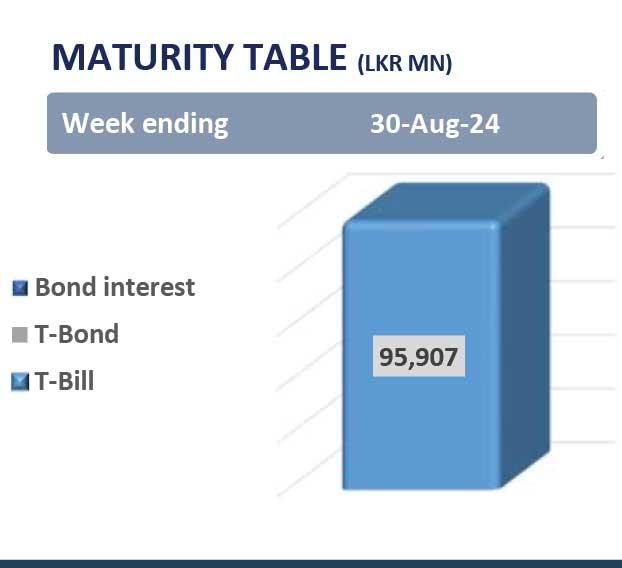

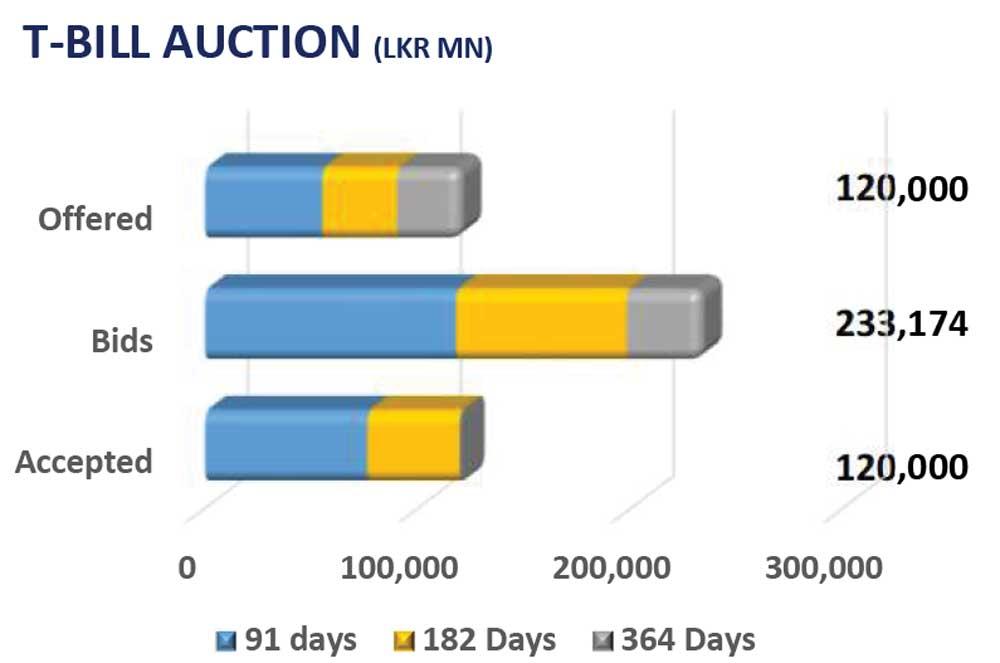

Meanwhile, the Central Bank plans to issue Rs.100.0 billion at the weekly T-bill auction on August 28, 2024, where Rs.50.0 billion is to be raised out of the 91-day maturities, Rs.30.0 billion is to be raised out of the 182-day maturities, whilst Rs.20.0 billion is to be raised out of the 364-day maturities.

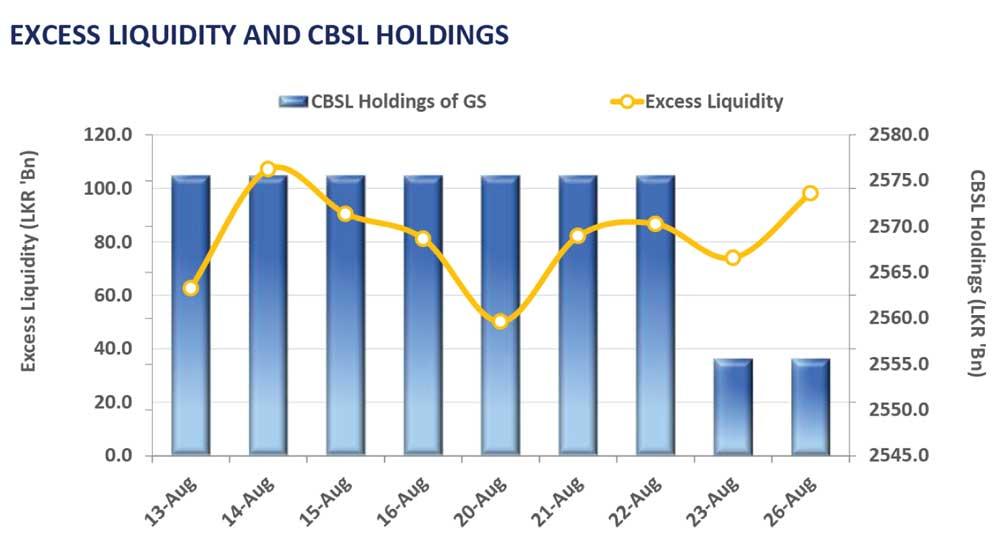

Overnight liquidity increased during the day and recorded at Rs.98.1 billion whilst, the Central Bank holdings registered at Rs.2555.6 billion for the second consecutive day.

The AWPR increased by six basis points and recorded at 9.13 percent for the week ending on August 23, 2024.