Reply To:

Name - Reply Comment

By First Capital Research

The secondary market experienced mixed sentiment amidst limited activities and thin trading volumes, ahead of the upcoming monetary policy announcement scheduled for the 24th of this week.

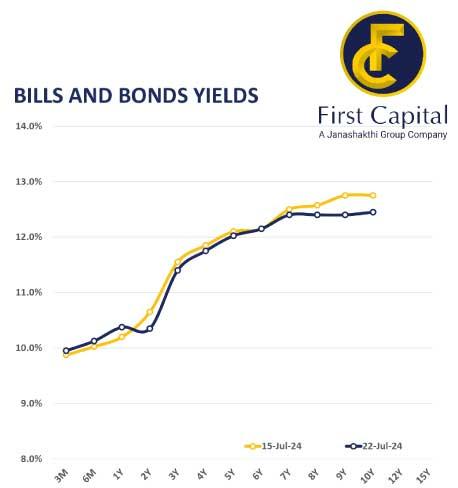

This mixed sentiment was particularly evident in the short-to-mid end of the yield curve, with the 01.02.26 and 15.12.26 maturities trading within the range of 10.20 percent-10.45 percent. Additionally, the 01.09.28, 15.09.29, 15.05.30, and 01.12.31 maturities traded at 12.00 percent, 12.04 percent, 12.15 percent and 12.42 percent, respectively.

For the week ending July 19, 2024, the AWPLR increased by 27 basis points to 9.12 percent compared to the previous week, whilst the AWDR stood at 8.38 percent as of June 2024.

Furthermore, the foreign holdings in government securities decreased marginally by 0.85 percent week-on-week, registering at Rs.52.7 billion as of July 18, 2024. Consequently, the foreign holding percentage marginally decreased to 0.31 percent compared to the previous week.

Notably, the overnight liquidity for the day was recorded at Rs.111.4 billion, whilst the Central Bank holdings remained steady at Rs.2,595.6 billion.

In the forex market, the Sri Lankan rupee appreciated against the US dollar yesterday, ending a three-session streak of depreciation and settled at Rs.303.7. Moreover, for the year up to July 19, 2024, the Sri Lankan rupee has appreciated against the US dollar by 6.6 percent, reflecting a strong overall performance despite recent fluctuations.