Reply To:

Name - Reply Comment

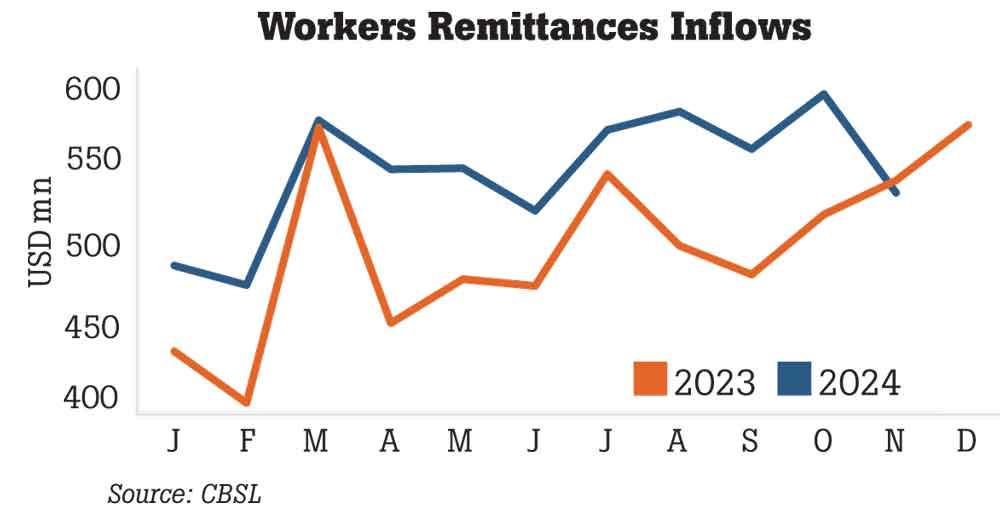

The Sri Lankans working abroad have sent back US$ 530.1 million in November. This brings the total receipts so far this year to just shy of US$ 6.0 billion, taking the total foreign income from remittances to a striking distance from the highs reached in 2020.

The November incomes from remittances marks a slight slippage from the US$ 537.3 million received in the same month a year ago and also a decline from the US$ 587.7 million the country received in October this year. Unless there is going to be a sustained slowdown, the monthly variations in these proportions are always possible and will not hurt the direction.

Strong inflows from remittances, tourism and exports have helped the Central Bank to purchase US$ 327.0 million from banks in November, up sharply from US$ 189.5 million on October, helping to rebuild the reserves which was at US$ 6,462.0 million, slightly down by US$ 6,472.0 million in October.

Typically, Sri Lanka receives the most amount from remittances in March, ahead of the traditional new year and then in December as people working abroad return most of what they earn back home for their friends and family for the holiday season as well as due to the two back to back school seasons.

Hence, it is expected December to see somewhat higher incomes from remittances than was seen in November.

November remittances also took the total for the eleven months to US$ 5,961.6 million, a 10.4 percent growth from the same period in 2023.

The last time the country saw higher annual remittances than what it is seeing now was back in 2020 when the country received US$ 7.1 billion.

Record departures seen in the last three years sparked by the worsening economic conditions in the country should now start translating into higher remittance income if they are sending part of their incomes to the country.

In 2022, the Central Bank also identified and fixed an element of some over-counting of what constitutes remittances by the banks.

The rupee has appreciated by 11.5 percent so far this year on top of a 12.0 percent increase in the value against the dollar in 2023 which translates into less rupees by its recipients.

This should also drive the migrants to send a bit more in remittances in order to ensure that their recipients do not get financially worse off.