Reply To:

Name - Reply Comment

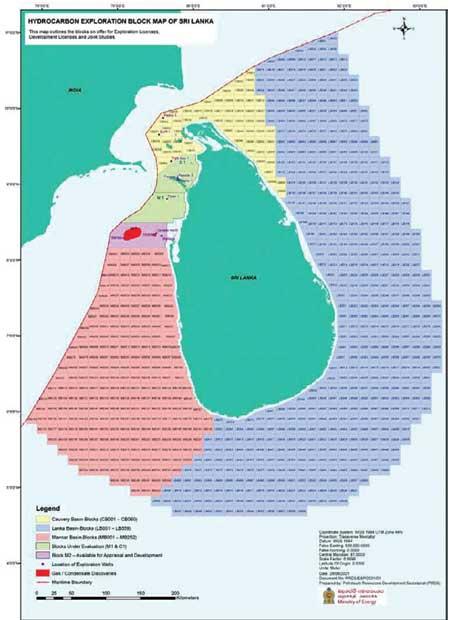

The long-delayed Mannar basin M2 block (exploration and production) tender and commencement of exploration work by the selected bidder for the M1 and C1 July 2019 tender could cost Sri Lanka over a billion dollars in foreign direct investment (FDI).

Moreover, the delays conducting a marketing campaign to attract further investment while the oil and gas prices have been at historically high levels could be foregoing

Moreover, the delays conducting a marketing campaign to attract further investment while the oil and gas prices have been at historically high levels could be foregoing

billions more.

Cairn India drilled three completed exploratory wells between 2011 and 2013. Two of the wells, Barracuda and Dorado, contain gas estimated to be 1.8 TCF and 300 BCF, respectively. While they were not commercially viable when the oil and gas prices collapsed in 2014, there is a strong possibility they will be at today’s prices. There are technologies that have reduced capital expenditure such as gas-to-wire power generation that help make the economic case for production of these

gas finds.

Cairn India has invested nearly US $ 200 million in Sri Lanka but it would require an investment of over US $ 1 billion to build production infrastructure. Therefore, it is vital to urgently attract as many investors as possible for exploration and production to maximise the benefits to Sri Lanka – especially in light of the global energy crisis and concomitant energy price increases, which have enhanced investor appetite.

While one must drill to ascertain the actual existence and quantity of resources, seismic studies estimate nine TCF of gas and several billion barrels of oil in the Mannar basin.

This could fulfil several decades of the country’s energy needs while potentially saving US $ 6-7 billion p.a. in expenditure on energy. It also opens opportunities for Sri Lanka to earn revenue through production sharing agreements with investors, who take 100 percent of the risk.

The industry, which holds the potential to contribute crucial foreign exchange, both in terms of investment and possible future revenue from production, has largely been ignored or mismanaged in recent times. It is imperative that Sri Lanka does not miss the small window of opportunity available with high prices and supply pressures, fast-disappearing internal combustion engines as well as the displacement of fossil fuels with the advent of ‘net zero’.