Reply To:

Name - Reply Comment

By First Capital Research

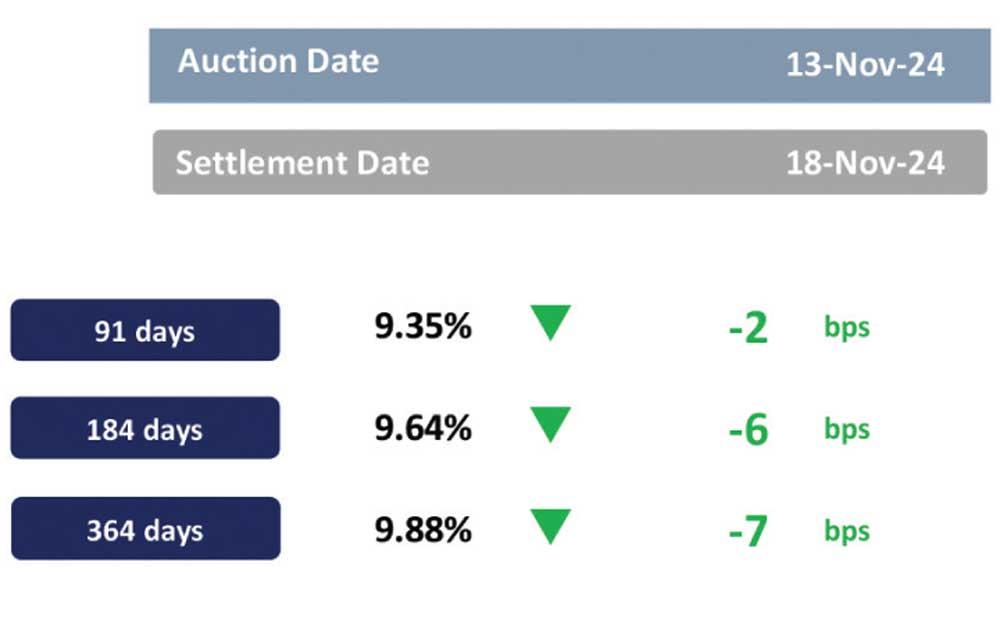

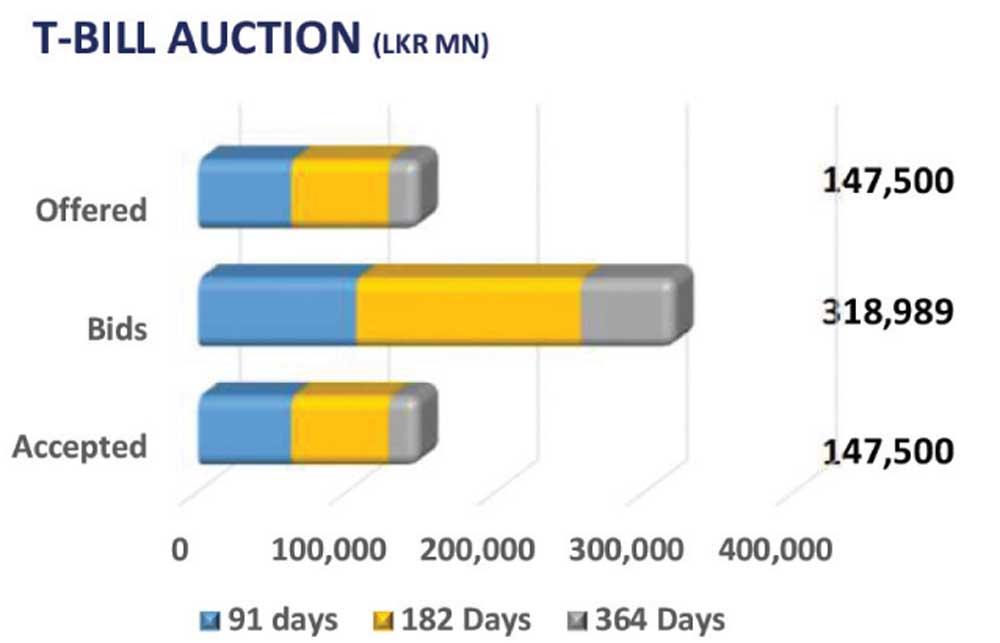

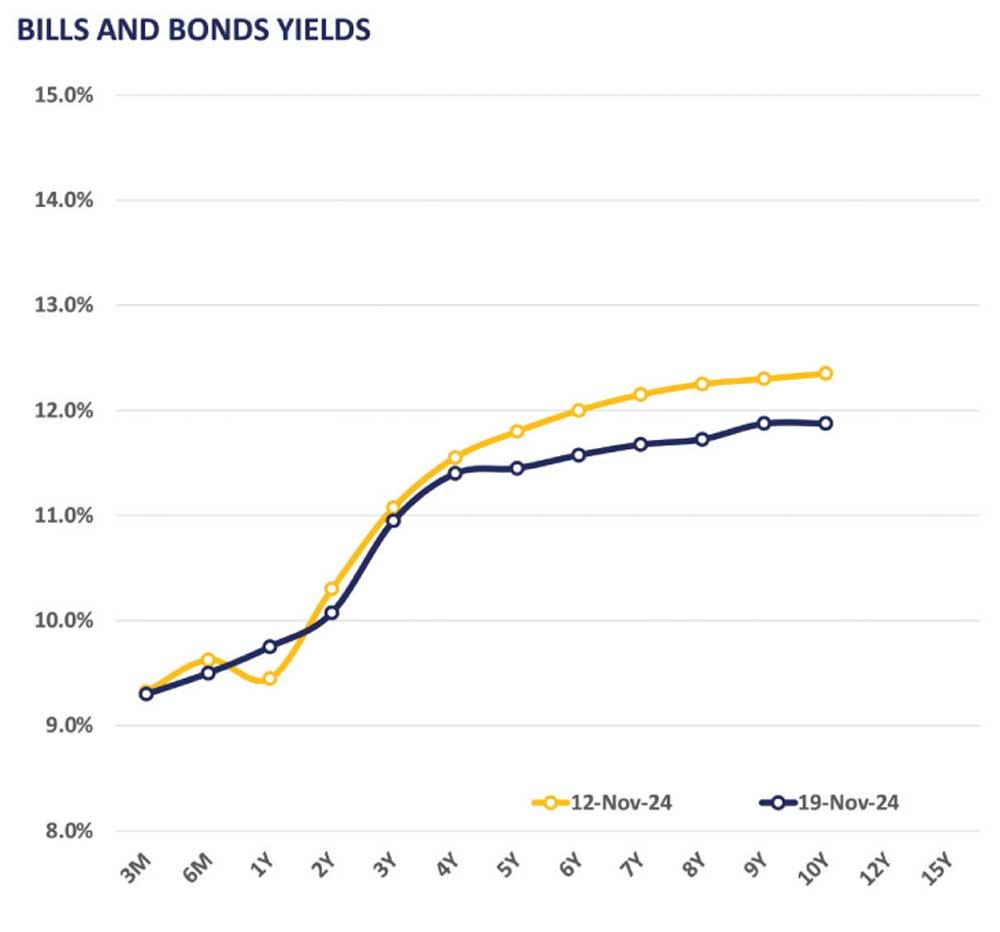

The secondary market yield curve yesterday experienced a slight upward shift from the previous day, influenced by marginal profit-taking activities ahead of the Rs. 145.0bn T-bill auction scheduled for today.

Trading was predominantly focused on the belly-end of the curve, with notable activity across the 3-5 year tenors. Key trades included 2027 maturities, such as the 15.09.27 and 15.12.27, which closed trades at 10.95% and 11.00%, respectively.

Similarly, 2028 maturities, including 01.02.28 and 01.05.28, recorded trades at 11.20% and 11.25%, respectively, while the 2029 maturity, 15.09.29, traded at 11.53% during the day.

The AWPR for the week ending 14thNov-24 declined by 5bps, registering at 9.11% compared to the previous week’s closing of 9.16%. Moreover, foreign holdings in government securities marginally increased by 0.1% WoW, registering at Rs. 54.8bn as of 13th Nov-24. Consequently, the foreign holding percentage remained stagnant at 0.3% over the week.

Meanwhile, the overnight liquidity for the day was recorded at Rs. 64.7bn, whilst CBSL holdings remained stagnant at Rs. 2,515.6bn.

Furthermore, in the forex market, the LKR continued to slightly appreciate against the USD for the 3rd consecutive session, closing at Rs. 291.6 for the day.