Reply To:

Name - Reply Comment

By First Capital Research

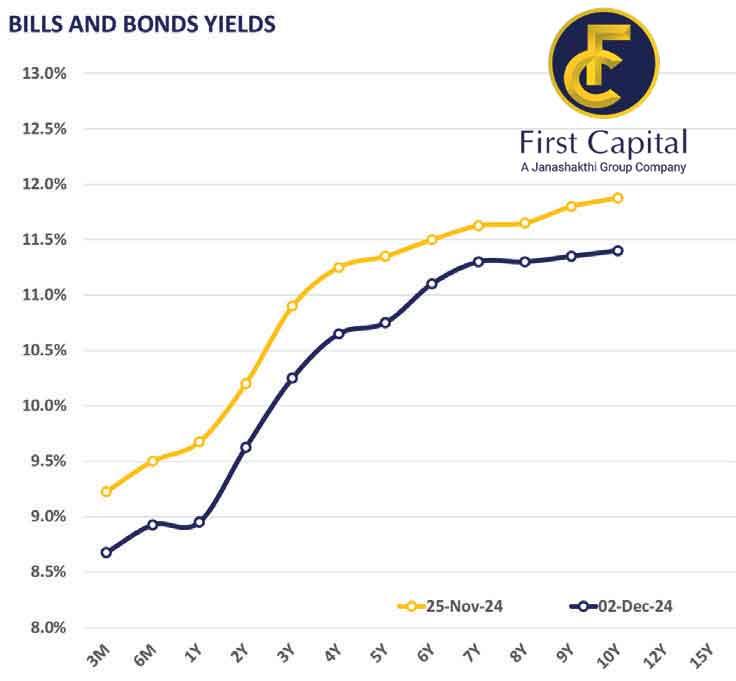

The secondary market yield curve remained broadly unchanged, marked by slight profit-taking and moderate volumes. Trades were concentrated on the short-end of the curve, with 2027 maturities—15.09.27 and 15.10.27—yielding at 10.25 percent and 10.22 percent, respectively. The belly end of the curve reflected a subtle upward shift, as 2028 maturities, including 15.02.28, 15.03.28, 01.05.28 and 01.07.28, traded at 10.40 percent, 10.43 percent, 10.55 percent and 10.60 percent, respectively. At the longer end, the 01.06.33 maturity stood out, trading at a yield of 11.46 percent.

For the week ending November 29, 2024, the AWPLR increased by two basis points (bps) to 9.10 percent compared to the previous week, whilst the AWDR stood at 7.59 percent as of November 2024. Furthermore, foreign holdings in government securities increased by 5.15 percent week-on-week, registering at Rs.58.4 billion as of November 28, 2024. Consequently, the foreign holding percentage marginally increased to 0.33 percent compared to the previous week.

Notably, the overnight liquidity recorded at Rs.163.9 billion, whilst the Central Bank holdings remained steady at Rs.2,515.6 billion for the day.

Furthermore, in the forex market, the Sri Lankan rupee continued to appreciate against the US dollar for the third consecutive session, closing at Rs.290.7 for the day. Moreover, for the year up to November 29, 2024, the Sri Lankan rupee has appreciated against the US dollar by 11.3 percent, reflecting a strong overall performance despite the recent fluctuations.