Reply To:

Name - Reply Comment

Sri Lanka has been ranked among the most vulnerable economies exposed to interest rate shocks over the next four years, due to the relatively short average debt maturities and weak debt affordability, ahead of the country’s bunched up external debt repayments from 2019 to 2022, according to a Moody’s investor service report released yesterday.

“The sovereigns most vulnerable to an interest rate shock are generally low rated, with shorter maturities and weak debt affordability,” said Elisa Parisi-Capone, a Moody’s Vice President-Senior Analyst and co-author of the report.

“In our view, exposure to a shift in financing conditions is highest for Lebanon (B3 stable), Egypt (B3 stable), Pakistan (B3 stable), Bahrain (B1 negative) and Mongolia (B3 stable). Sri Lanka (B1 negative) and Jordan (B1 stable) are also highly exposed,” she said.

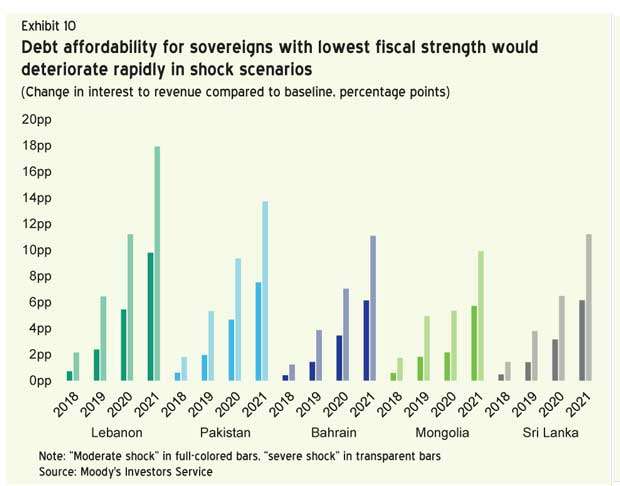

According to Moody’s, Sri Lanka’s interest to revenue ratio could increase by 5.3 percent and 10.4 percent over the next four years, from the current 35 percent, in a potential moderate or severe shock, compared with the 0.8 percent decline expected in the baseline.

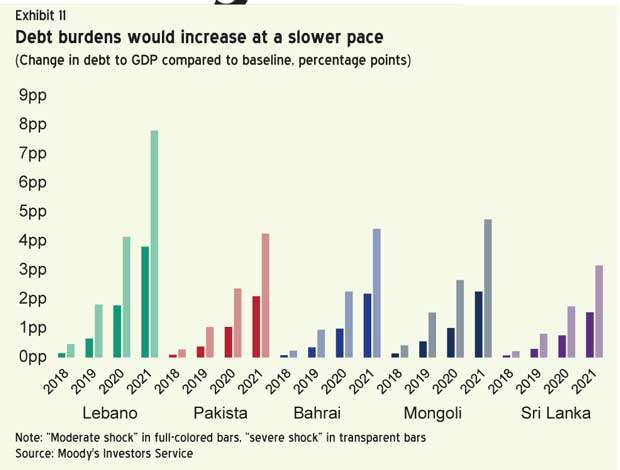

A potential moderate or severe shock could also limit the fall of debt to gross domestic product ratio to 4.0 percent and 2.4 percent, respectively over the next four years, compared to 5.6 percent in the baseline from 79.6 percent in 2017, the rating agency pointed out.

Sri Lanka also remained as one of the weakest economies in terms of fiscal strength, as the country is ranked among the nations which scored the lowest points on the 15-rung scale in Moody’s global sovereign rating methodology.

Moody’s stated that in particular, a severe shock and absence of policy response could strain the ratings of the economies with the lowest fiscal strength by weakening the fiscal strength up to three notches.

The rating agency warned that deterioration in fiscal metrics in these countries that would further exacerbate liquidity and external risks could weaken the country’s credit quality, resulting in a moderate or severe shock.

“A deterioration in debt affordability could lower investors’ willingness to invest in these countries. Pressure on capital flows and the exchange rate would erode foreign exchange reserves and exacerbate external vulnerability.

This is particularly relevant for Lebanon, Pakistan, Bahrain, Jordan and Sri Lanka (although the latter is moving toward a more flexible exchange rate),” Moody’s pointed out.

The rating agency highlighted that Pakistan, Mongolia, Sri Lanka and the Maldives are most exposed to higher cost of debt in the Asia Pacific that feeds mostly through weaker debt affordability, while noting that frontier markets such as Egypt, Pakistan, Mongolia, Sri Lanka, Belarus, the Maldives, Ghana, St. Vincent, the Grenadines and Kenya, which are rated Ba1 or lower, rely on concessional financing for more than 40 percent of their external government debt.

Sri Lanka raised US $ 2.5 billion in sovereign debt in April, which was partly to settle the bunched up debts early, while the Cabinet has already approved to raise US $ 3 billion in Sri Lanka Development Bonds this year.

Sri Lankan parliament also approved the new Liability Management Bill recently allowing the government to borrow money in excess of what is required for that particular year to face the bunched up debts.