Reply To:

Name - Reply Comment

Sampath Bank PLC announced the introduction of touchless cash withdrawals at automated teller machines (ATMs) for the first time in Sri Lanka, and possibly the first time in the region.

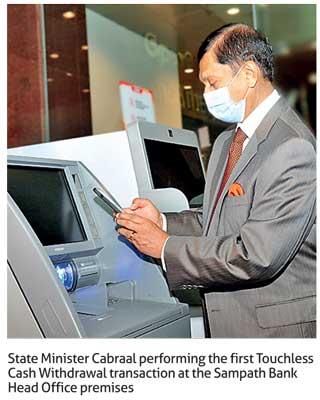

State Minister of Money & Capital Markets and State Enterprise Reforms, Ajith Nivard Cabraal was the Chief Guest at the commissioning of this service at the Sampath Bank Head Office premises.

State Minister of Money & Capital Markets and State Enterprise Reforms, Ajith Nivard Cabraal was the Chief Guest at the commissioning of this service at the Sampath Bank Head Office premises.

He performed the first touchless cash withdrawal transaction in the presence of Harsha Amarasekera, Chairman, Sampath Bank PLC; Nanda Fernando, Managing Director, Sampath Bank PLC; Ajith Salgado, Group Chief Information Officer, Sampath Bank PLC; and Ayodhya Iddawela Perera, Senior DGM – International Trade and Credit Control, Sampath Bank PLC.

Sampath Bank customers and customers of all other banks in the country will now be able to withdraw the funds in their accounts and cards at any Sampath Bank ATM around the island by simply scanning the QR code displayed on the ATM screen using the Sampath WePay app.

State Minister Cabraal performing the first Touchless Cash Withdrawal transaction at the Sampath Bank Head Office premises

Doing away with the need to physically touch the surface of the ATM, this is set to minimize risk and enhance customer safety, thereby serving as an ideal means of withdrawing cash from ATMs during the current global COVID-19pandemic.

This is yet another trailblazing digital solution brought to the Sri Lankan market by Sampath Bank. Right from its inception, the bank has continued to deliver several innovations to the market including the introduction of the country’s first multi-point network of ATMs back in 1988. Commenting on the occasion, State Minister Cabraal said, “As the government continues to strive to offer all possible assistance to citizens during this pandemic, I would like to commend Sampath Bank on the launch of Touchless Cash Withdrawals - a timely innovation that offers a safer means of withdrawing cash to customers of all banks in the country. I am informed that this could be the first solution of its kind in the region - a fact that we can all take great pride in. Let’s continue to work together as a nation to develop more such innovative solutions that will help us overcome the challenges brought about by this global health and financial crisis.”

“While we work on developing and rolling out more innovative digital banking solutions, we are aware of the fact that the need to withdraw cash for certain transactions will always be present. Taking this into account, it is our privilege to introduce a safer, touchless means of withdrawing money through any of our ATMs with the launch of Touchless Cash Withdrawals. This is the first solution of its kind to be introduced in Sri Lanka,” said Nanda Fernando, Managing Director, Sampath Bank PLC. To make a touchless cash withdrawal at any Sampath Bank ATM, they just need to select the QR option on their Sampath WePay app, scan the unique QR code that comes up on the ATM’s screen, enter the amount and select the account or card they would like to make the withdrawal from. The system processes the request upon the customer’s authorization, debits the relevant account or card and issues the cash requested through the ATM, almost instantaneously. The need to scan the QR code which is unique to each transaction makes it necessary for the customer to be physically present at the ATM, thus offering an added layer of security. Users can learn more about going touchless by giving a call to 0112303050. Sampath WePay is a one stop digital wallet where users can store all types of financial instruments from Just Pay allowed local banks and carry out real-time online transactions. Offering Social Share – social network-based fund transfers, QR based payments, Sampath Bank and third-party fund transfers, bill payments, and more, the widely popular app allows users to make contactless payments, thereby protecting them from the possibility of contracting any infections during the pandemic. The Sampath WePay app can be downloaded for free from the Apple App Store, Google Play Store and Huawei AppGallery. Users can then onboard themselves by entering their National Identity Card (NIC) details and begin transacting through the app by updating their Sampath Bank or any other bank’s account, credit card or debit card details. Customers of other banks need to complete the mandatory Know Your Customer (KYC) formalities and top up their Sampath WePay wallets to be able to use the Touch Cash Withdrawals facility at Sampath Bank ATMs. Sampath Bank does not charge any annual fees, commissions, or transaction fees for Sampath WePay.