Reply To:

Name - Reply Comment

By First Capital Research

The secondary market experienced a subdued tone prevailing throughout the day, marked by minimal trading volumes, as the investors remained on the sidelines, awaiting today’s monetary policy review.

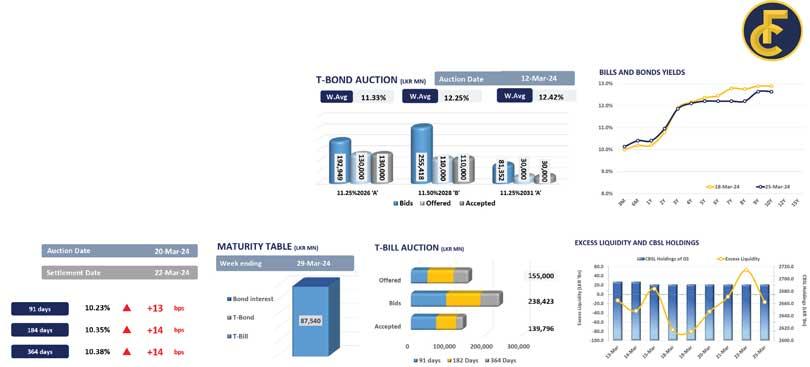

However, amid this subdued atmosphere, notable activity was observed in the four-year bonds, including the 15.03.28 and 15.12.28 maturities, which witnessed trades at rates of 12.08 percent and 12.12 percent, respectively.

Moreover, on Friday, the Central Bank announced a bill auction worth Rs.80.0 billion, scheduled on March 27, 2024, out of which Rs.20.0 billion is to be raised from the 91-day maturity, Rs.30.0 billion is expected to be raised from the 182-day maturity, whilst another Rs.30.0 billion is to be raised from the 364-day maturity.

Meanwhile, the overnight liquidity continued to observe swings between positive and negative since the beginning of this year and recorded a negative liquidity position of Rs.16.8 billion yesterday whilst the Central Bank holdings continued to remain stagnant at Rs.2,691.3 billion since last week.

Furthermore, the AWPR continued its downtrend as it shed 31 basis points, closing at 11.04 percent for the week ending on March 22, 2024. Moreover, foreign holdings in government securities decreased by 2.6 percent week-on-week and registered at Rs.86.4 billion as of March 21, 2024.

On the external front, the Sri Lankan rupee appreciated against the US dollar during the day, closing at Rs.303.5, compared to last week’s closing rate of Rs.303.9.