Reply To:

Name - Reply Comment

By First Capital Research

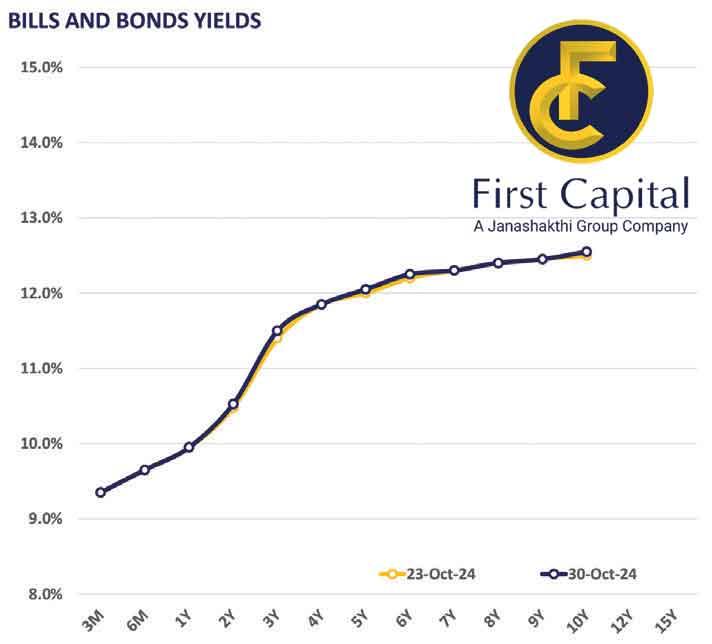

The secondary market witnessed very thin trading volumes and low investor activity during the day, continuing from the previous session. Maturities across the board remained broadly unchanged as investors longed for clear market sentiment. Amongst the limited maturities traded liquid maturities namely, the 15.09.27 maturity traded at 11.50 percent, the 01.05.28 tenure traded at 11.80 percent and the 15.12.28 maturity traded at 11.90 percent. On the long end of the curve, the 15.10.30 maturity traded at 12.24 percent. Notably the CCPI inflation for October 2024 recorded in the negative territory for the second consecutive time, registering at -0.8 percent on a year-on-year basis, compared to -0.5 percent recorded during the month of September 2024. Overnight liquidity increased during the day, recording at Rs.179.5 billion, compared to Rs.126.9 billion recorded during the previous day. Moreover, the Central Bank holdings remained unchanged at Rs.2,515.6 billion. On the externals side, the Sri Lankan rupee slightly depreciated against the US dollar, recording at Rs.293.7, compared to Rs.293.5 recorded during the previous day.