Reply To:

Name - Reply Comment

By First Capital Research

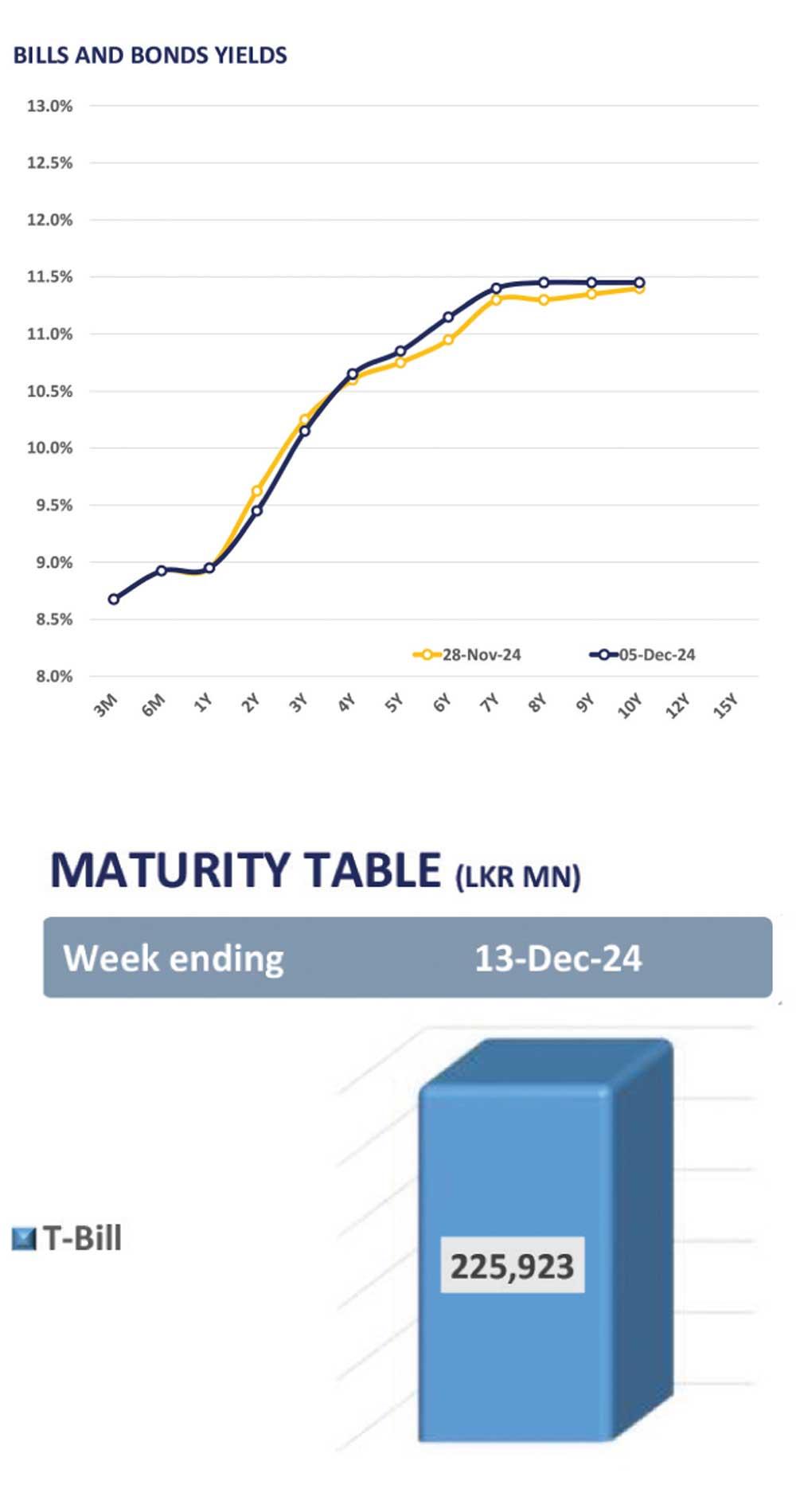

The secondary market yield curve yesterday shifted slightly amidst mixed activities which were centered around mid-tenors.

The secondary market yield curve yesterday shifted slightly amidst mixed activities which were centered around mid-tenors.

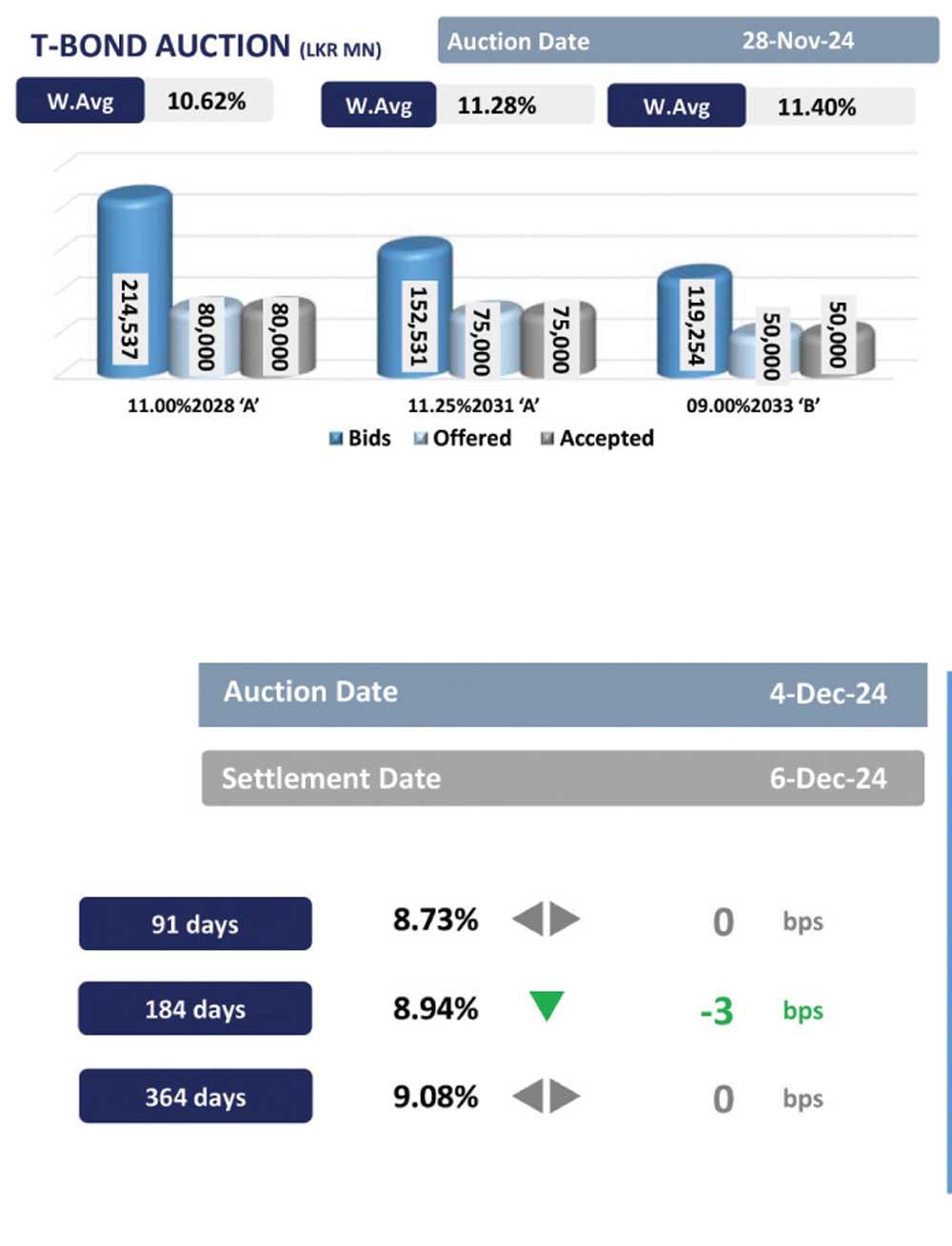

Buying interest emerged on the 2027 bonds, resulting in a 10-15bps decline in the yields. Accordingly, 01.05.2027, 15.09.2027, 15.10.2027 and 15.12.2027 traded within a range of 10.00%-10.20%.

Meanwhile, the 2028 bond and various other maturities experienced mixed activities yesterday. The morning session saw a surge in buying interest, but this was later overshadowed by selling pressure during the evening session. The secondary market continues to see some profit taking despite emerging buying interest.

Accordingly, on the 2028 maturities, 01.02.2028, 15.03.2028, 01.05.2028, 01.07.2028, 15.10.2028 and 15.12.2028 registered trades between 10.40%-10.60%. Moreover, 15.09.2029 closed transactions at 10.80% whilst 01.10.2032 closed transactions at 11.48%.

On the external side, LKR continued to appreciate against the greenback closing at Rs. 290.52/USD compared to Wednesday’s closing of Rs. 290.54/USD.

Similarly, the rupee appreciated against the JPY and AUD. However, on the contrary, the rupee depreciated against other currencies including EUR, GBP and CNY.

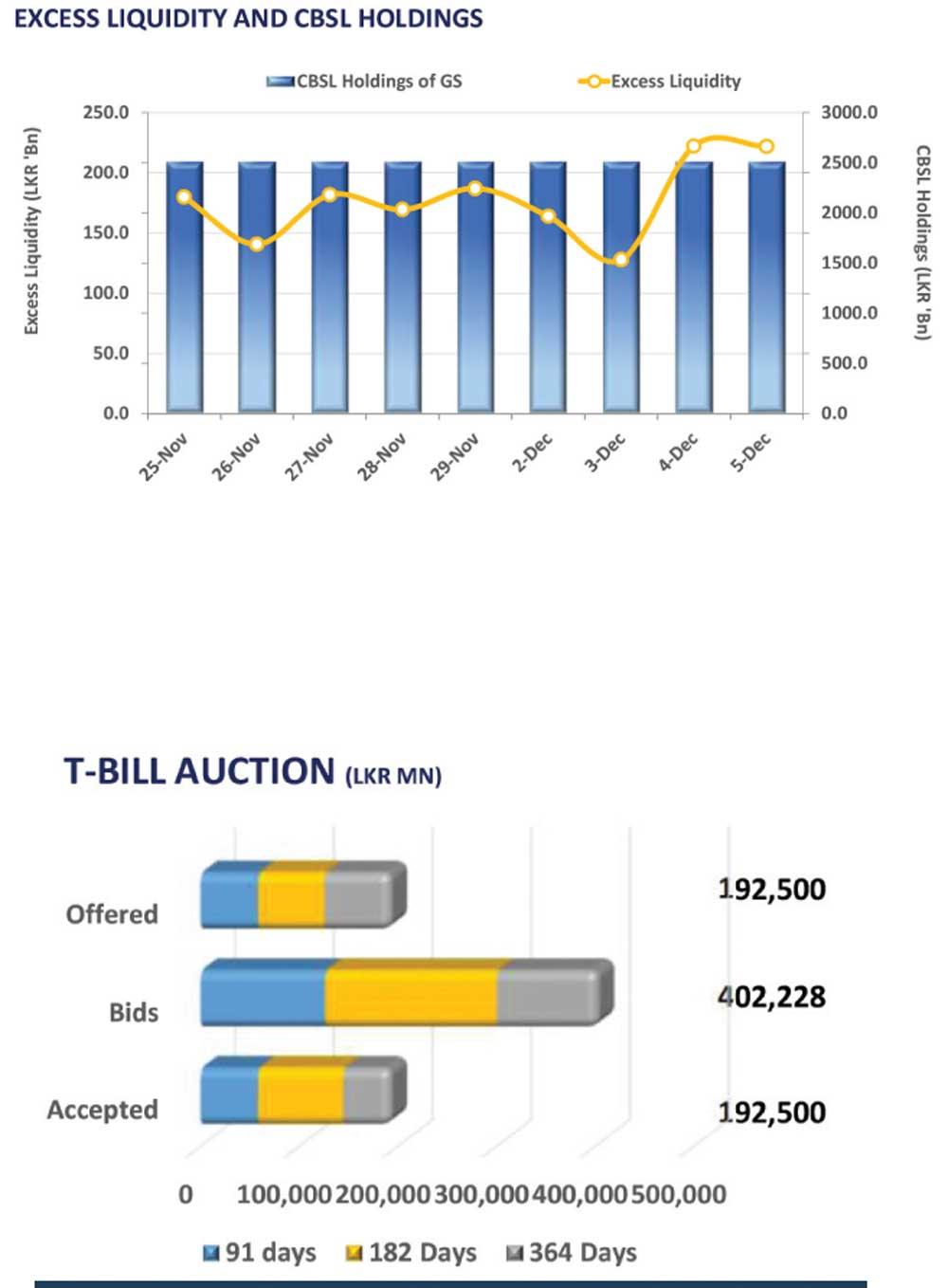

Meanwhile, Overnight liquidity closed at Rs. 221.89bn whilst CBSL holdings continued to remain stagnant at Rs. 2,515.62bn.