Reply To:

Name - Reply Comment

By First Capital Research

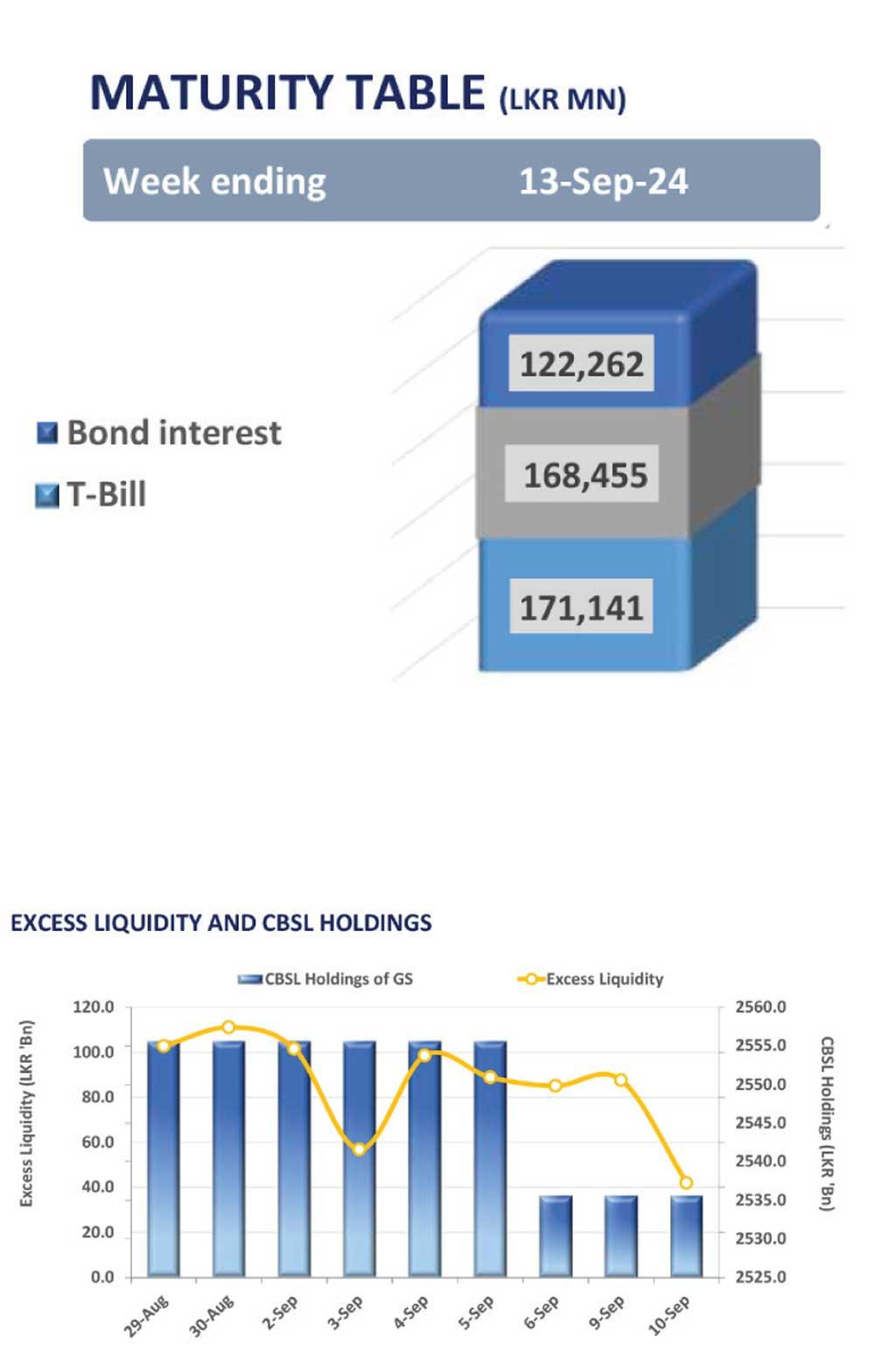

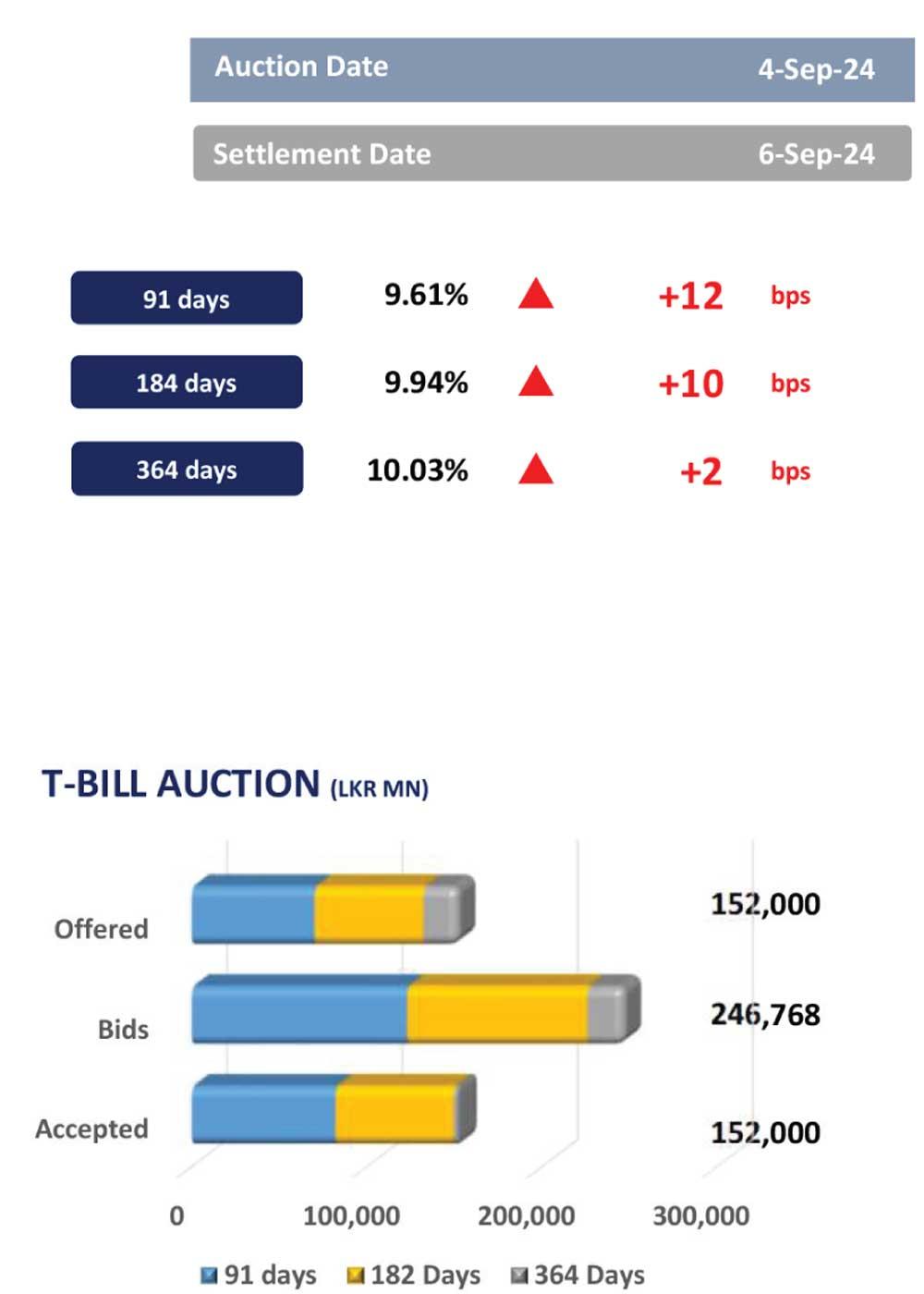

The secondary market saw subdued trading activity and thin volumes yesterday, as market participants exercised caution ahead of today’s Rs. 180.0bn T-Bill auction and this Thursday’s Rs. 290.0bn T-Bond auction, amid ongoing election-related uncertainty.

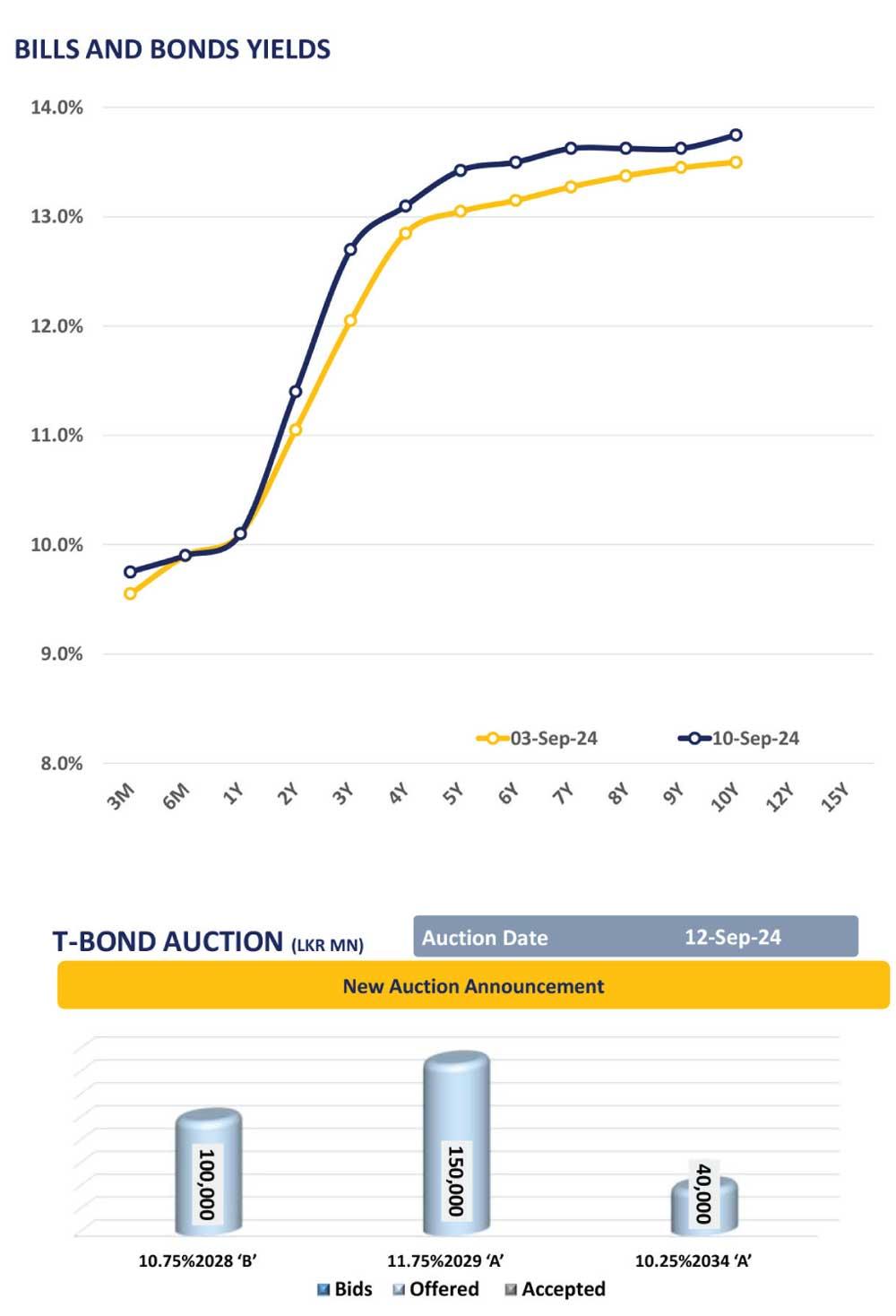

On the mid-end of the curve, 2028 maturities, including 01.07.28 and 15.12.28, traded at 13.20%, while 15.07.29 traded at 13.35%, and 15.09.29 saw trades in the range of 13.45%-13.50% during the day.

Furthermore, foreign holdings in government securities decreased by 4.0% WoW, registering at Rs. 40.4bn as of 05th September 2024. Consequently, the foreign holding percentage marginally decreased to 0.24% over the week.

Notably, the overnight liquidity for the day declined to Rs. 41.98bn, whilst CBSL holdings remained stagnant at Rs. 2,535.6bn for the 03rd consecutive session.

Furthermore, in the forex market, the LKR significantly depreciated against the USD after3 consecutive sessions, closing at Rs. 300.1 for the day. As of 06th September 2024, the LKR has appreciated by 8.4% against the USD, reflecting a strongoverall performance for the year.