Reply To:

Name - Reply Comment

By First Capital Research

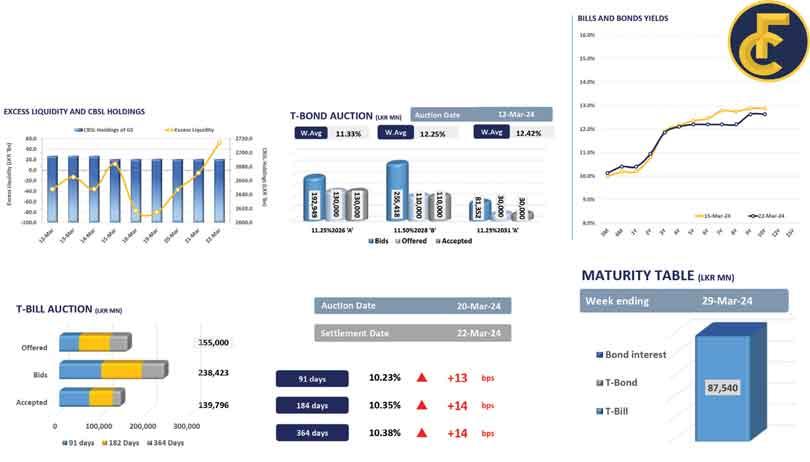

The secondary market exhibited a subdued tone during the day, characterised by ultra-thin trading volumes, as the investors opted to remain on the sidelines in anticipation of the forthcoming monetary policy review scheduled for next week.

However, amidst this stillness, a gleam of buying interest emerged on the two-year and four-year bonds, with 15.12.26 maturity trading between 11.35 percent and 11.32 percent and the 15.03.28 and 01.07.28 maturities recording trades between the range of 12.15 percent and 12.10 percent.

Moreover, the Central Bank announced an issue of Rs.80.0 billion in T-bills, through an auction scheduled on March 27, 2024, out of which Rs.20.0 billion is to be raised from the 91-day maturity, Rs.30.0 billion is expected to be raised from the 182-day maturity, whilst another Rs.30.0 billion is to be raised from the 364-day maturity.

Meanwhile, overnight liquidity turned positive during the day, recording a surplus of Rs.52.2 billion, whilst the Central Bank holdings remained stagnant at Rs.2,691.3 billion.

On the external front, the Sri Lankan rupee appreciated against the US dollar during the day, closing at Rs.303.9, compared to yesterday’s closing rate of Rs.304.3.