Reply To:

Name - Reply Comment

By First Capital Research

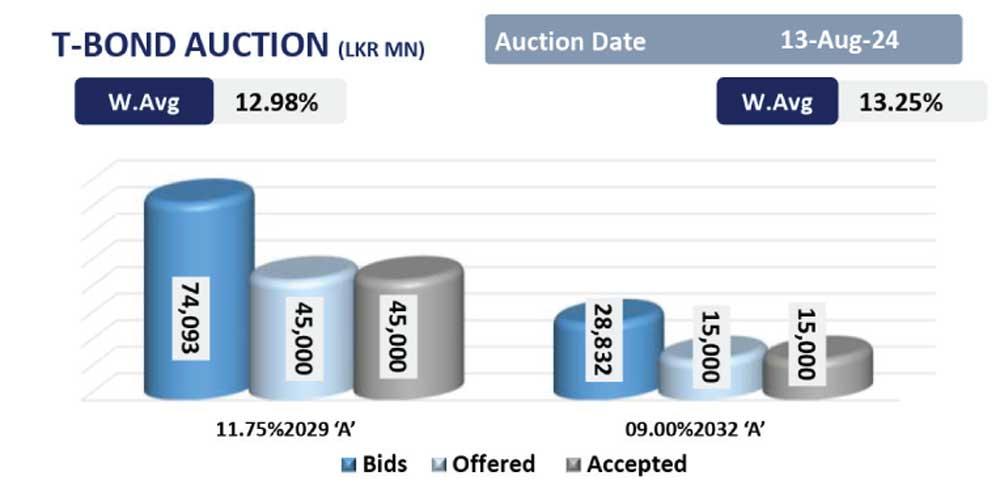

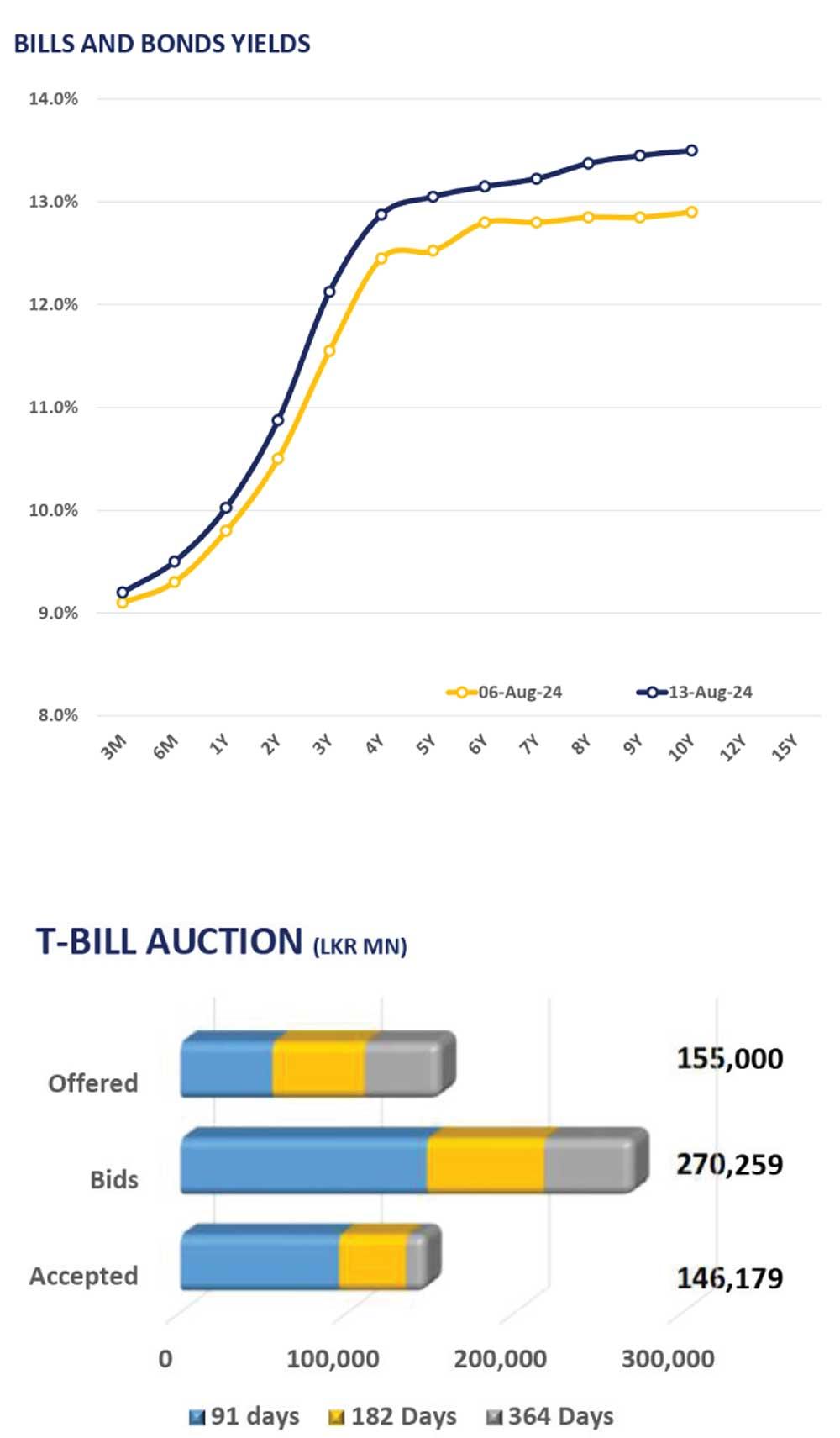

The secondary market witnessed limited activities as investors remain stunt after yields spiked sharply across both maturities at the Rs. 60.0bn T-bond auction held yesterday.

Meanwhile, CBSL conducted the first T-bond auction of the month, fully subscribing the entire offered Rs. 60.0bn by investors during the second and third phases of the auction.

Total of the offered amount was accepted in yesterday’s T-bond auction compared to the previous T-bond auction’s acceptance rate of 73.1%.

Accordingly, 15.06.29 tenor was accepted at a weighted average yield rate of 12.98% whilst 01.10.32 was accepted at a weighted average yield rate of 13.25%.

Notably, in the secondary market 01.02.26 and 01.06.26 maturities traded at 10.45% and 10.90% respectively, further highlighting the limited trading activity.

However, the overnight liquidity for the day decreased to Rs. 62.7bn, whilst CBSL holdings of government securities remained steady at Rs. 2,575.6bn for the 13th consecutive session. In the forex market, the LKR continued to appreciate against the green back for the 4th consecutive session, closing at Rs. 299.7 for the day.