Reply To:

Name - Reply Comment

By First Capital Research

The secondary market stayed muted during the day, mirroring yesterday’s subdued trend as the investors held back, seeking more clarity on the market sentiment.

Consequently, the overall activity remained limited, with trading volumes notably thin throughout the day.

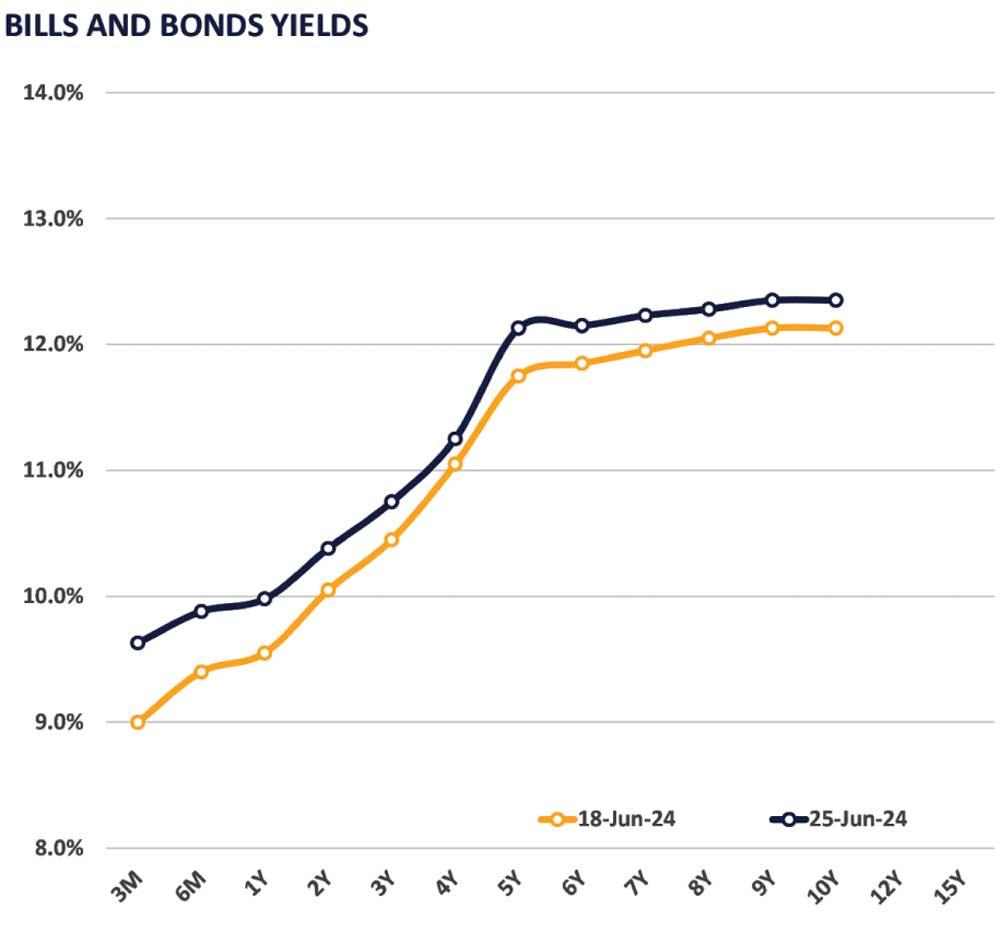

Among the few notable trades, there were some mixed activities witnessed on the 15.09.29 maturity, with transactions occurring within a narrow range of 12.10 percent to 12.15 percent, whilst the 15.12.31 maturity traded at 12.15 percent.

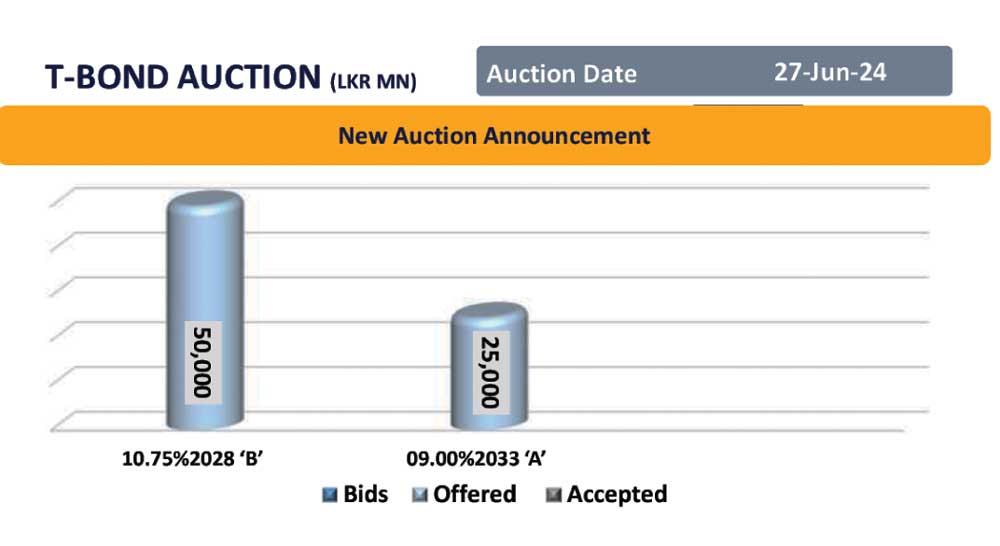

The Central Bank has announced the issuance of Rs.75.0 billion in T-bonds through an auction scheduled on June 27, 2024. This issuance includes Rs.50.0 billion under the 15.02.28 maturity and Rs.25.0 billion under the 01.06.33 maturity.

Additionally, the latest data from the Census and Statistics Department indicates a significant decrease in the overall rate of inflation, as measured by the National Consumer Price Index. In May 2024, the NCPI declined to 1.6 percent year-on-year (YoY), showing a decrease from 2.7 percent YoY recorded in April 2024.

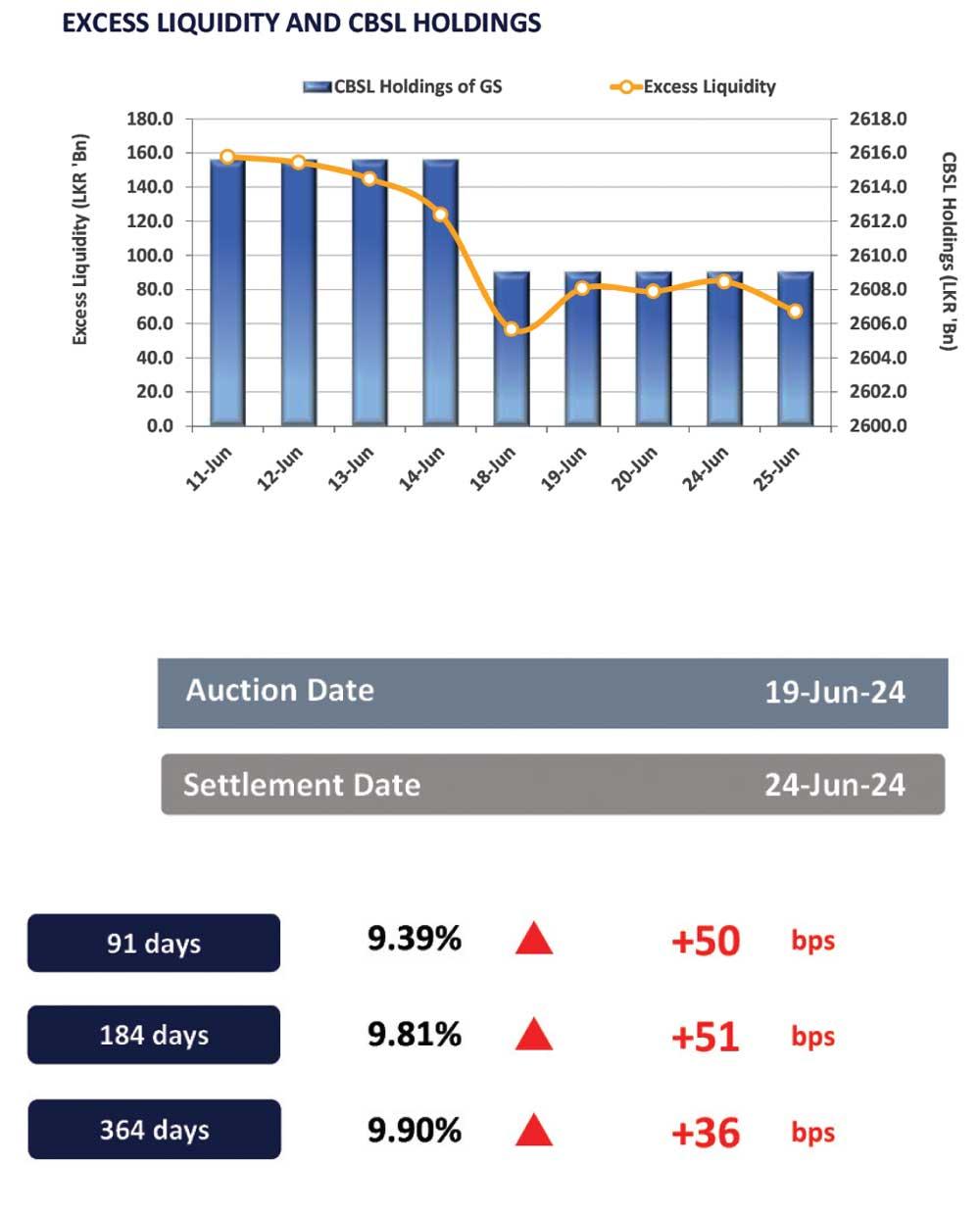

Moreover, overnight liquidity for the day was recorded at Rs.67.3 billion, while the Central Bank holdings remained steady at Rs.2,609.1 billion.

On the external front, the Sri Lankan rupee appreciated against the US dollar, closing at Rs.305.3 during the day.