Reply To:

Name - Reply Comment

By First Capital Research

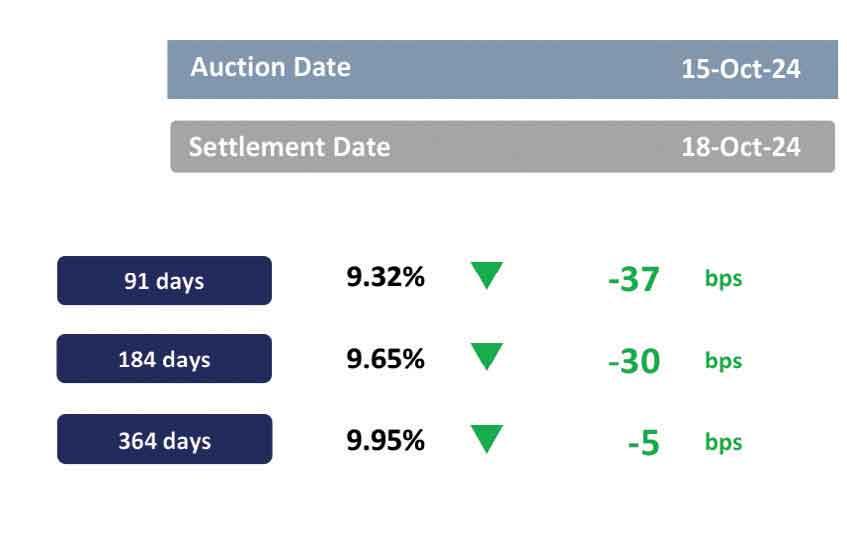

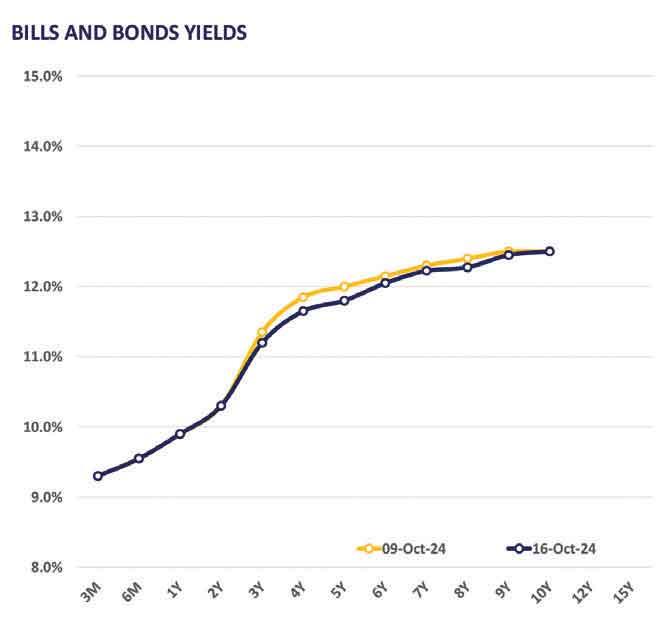

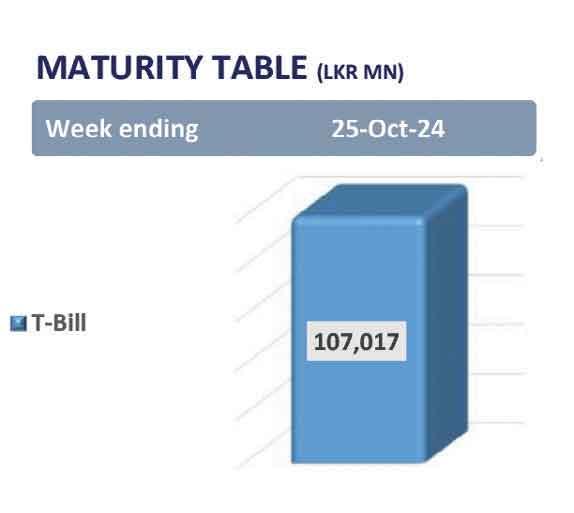

The secondary market yield curve remained broadly unchanged, amidst thin trading volumes and limited market activity. The market experienced some selling interest on the short to mid end of the curve, following the weekly T-bill auction held on Tuesday, where the Central Bank fully subscribed to the total offered amount of Rs.97.0 billion. Amongst the traded maturities, notable trades were amongst the 2026, 2027 and 2028 maturities. On the short end of the curve, 15.05.26 was seen trading at a rate of 10.50 percent. Similarly, 15.09.27 and 15.12.27 traded at rates of 11.20 percent and 11.25 percent - 11.30 percent, respectively. Meanwhile, on the belly end of the curve, 01.07.28 was seen trading at a rate of 11.70 percent. On the external front, the Sri Lankan rupee depreciated against the US dollar, closing at Rs.293.69/US dollar, compared to Rs.292.89/US dollar recorded the previous day. Similarly, the Sri Lankan rupee depreciated against the other major currencies, including the GBP, EUR, CNY, and JPY. The Central Bank holdings of government securities remained unchanged, closing at Rs.2,515.62 billion yesterday. Overnight liquidity in the banking system expanded to Rs.119.88 billion, from Rs.63.77 billion recorded the previous day.

The secondary market yield curve remained broadly unchanged, amidst thin trading volumes and limited market activity. The market experienced some selling interest on the short to mid end of the curve, following the weekly T-bill auction held on Tuesday, where the Central Bank fully subscribed to the total offered amount of Rs.97.0 billion. Amongst the traded maturities, notable trades were amongst the 2026, 2027 and 2028 maturities. On the short end of the curve, 15.05.26 was seen trading at a rate of 10.50 percent. Similarly, 15.09.27 and 15.12.27 traded at rates of 11.20 percent and 11.25 percent - 11.30 percent, respectively. Meanwhile, on the belly end of the curve, 01.07.28 was seen trading at a rate of 11.70 percent. On the external front, the Sri Lankan rupee depreciated against the US dollar, closing at Rs.293.69/US dollar, compared to Rs.292.89/US dollar recorded the previous day. Similarly, the Sri Lankan rupee depreciated against the other major currencies, including the GBP, EUR, CNY, and JPY. The Central Bank holdings of government securities remained unchanged, closing at Rs.2,515.62 billion yesterday. Overnight liquidity in the banking system expanded to Rs.119.88 billion, from Rs.63.77 billion recorded the previous day.

1

1