Reply To:

Name - Reply Comment

By First Capital Research

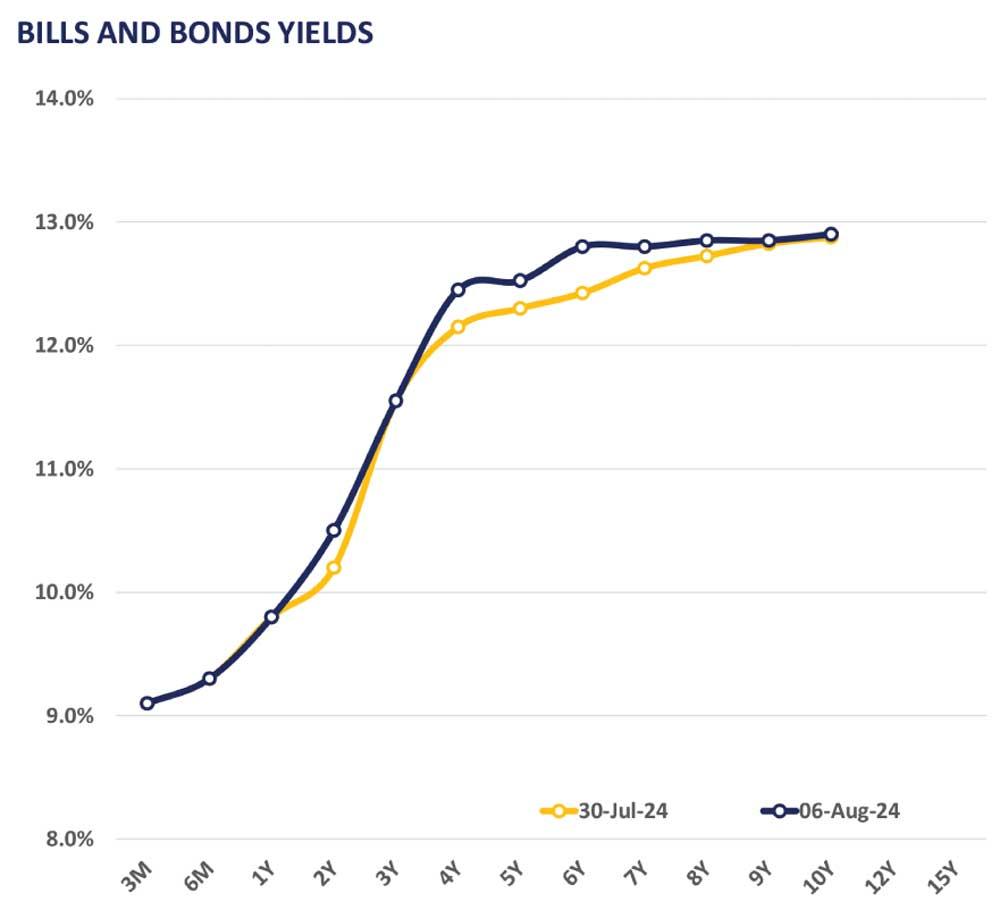

The secondary market witnessed continued sellinginterest from the previous session whilst selected maturities slightly edged higher during yesterday.

However, thin volumes were traded with limited activity due to the surrounding uncertainty in the broader market direction. Among the limited maturities traded, Liquid maturities 2028, 2029 and 2030 enticed trades during the day whilst 15.02.28 traded at 12.23%, 15.03.28 traded at 12.30% and 01.07.28 traded at 12.47%. Moreover, 15.09.29 traded at 12.55% and 15.10.30 traded at 12.88%.

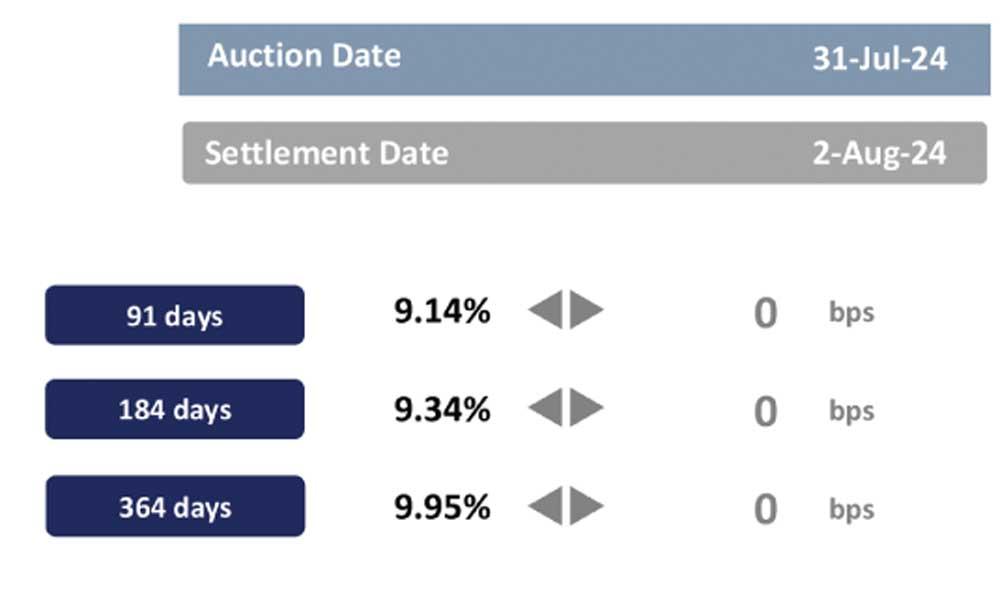

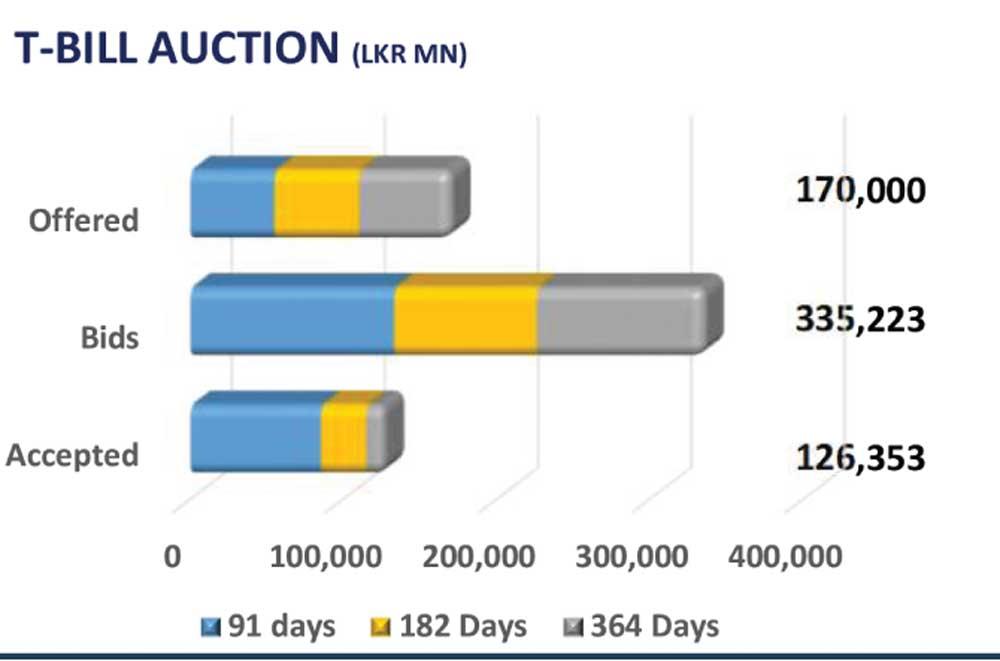

Meanwhile, the CBSL plans to raise Rs. 155.0bn through a T-Bill auction today (7 Aug), where Rs. 55.0bn is to be raised from 91 day maturities and another Rs. 55.0bn is to be raised from 182 day maturities whilst, Rs. 45.0bn is to be raised from 364-day maturities.

Overnight liquidity deteriorated to Rs. 34.2Bn from Rs. 99.5bn recorded during the previous day whilst CBSL holdings remained stagnant for over a week recording at Rs. 2,575.6bn.

On the external side LKR slightly depreciated against the USD registering at Rs. 302.2 during the day.