Reply To:

Name - Reply Comment

By First Capital Research

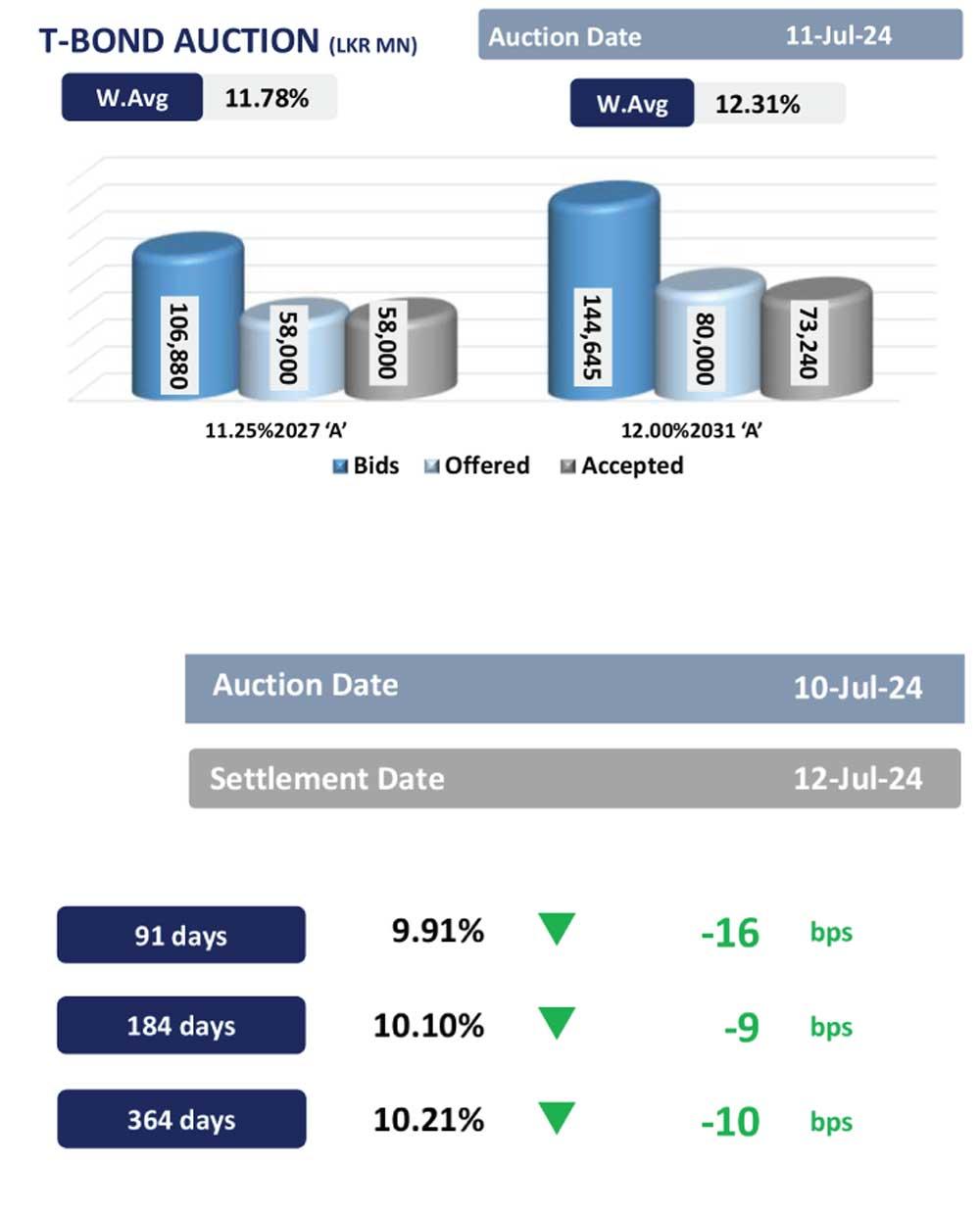

The Central Bank conducted the first bond auction for the month offering Rs. 138.0bn from the 15.12.2027 and 01.12.2031 maturities.

Accordingly, Rs. 58.0bn was offered from the former while Rs. 80.0bn was offered from the latter. Central Bank fully accepted the total offered of Rs. 58.0bn from the 2027 maturity at a weighted average yield rate of 11.78% while only 92% was accepted from the 2031 maturity amounting to Rs. 73.2bn at a weighted average yield rate of 12.31%.

Meanwhile, secondary market witnessed buying interest prior to the auction, centred on the 2028 maturities namely, 15.02.2028 and 01.05.2028 which traded between 11.85%-11.80%.

However, the sentiment reversed entirely post bond auction with selling pressure emerging across the yield curve as investors sought clear direction. Accordingly, on the short end 01.06.2026, 01.08.2026 and 15.12.2026 hovered between 10.70%-10.90% while on the mid end of the curve 01.07.2028 closed transactions at 12.05%. Volumes remained thin during the day amidst the dreary sentiment.

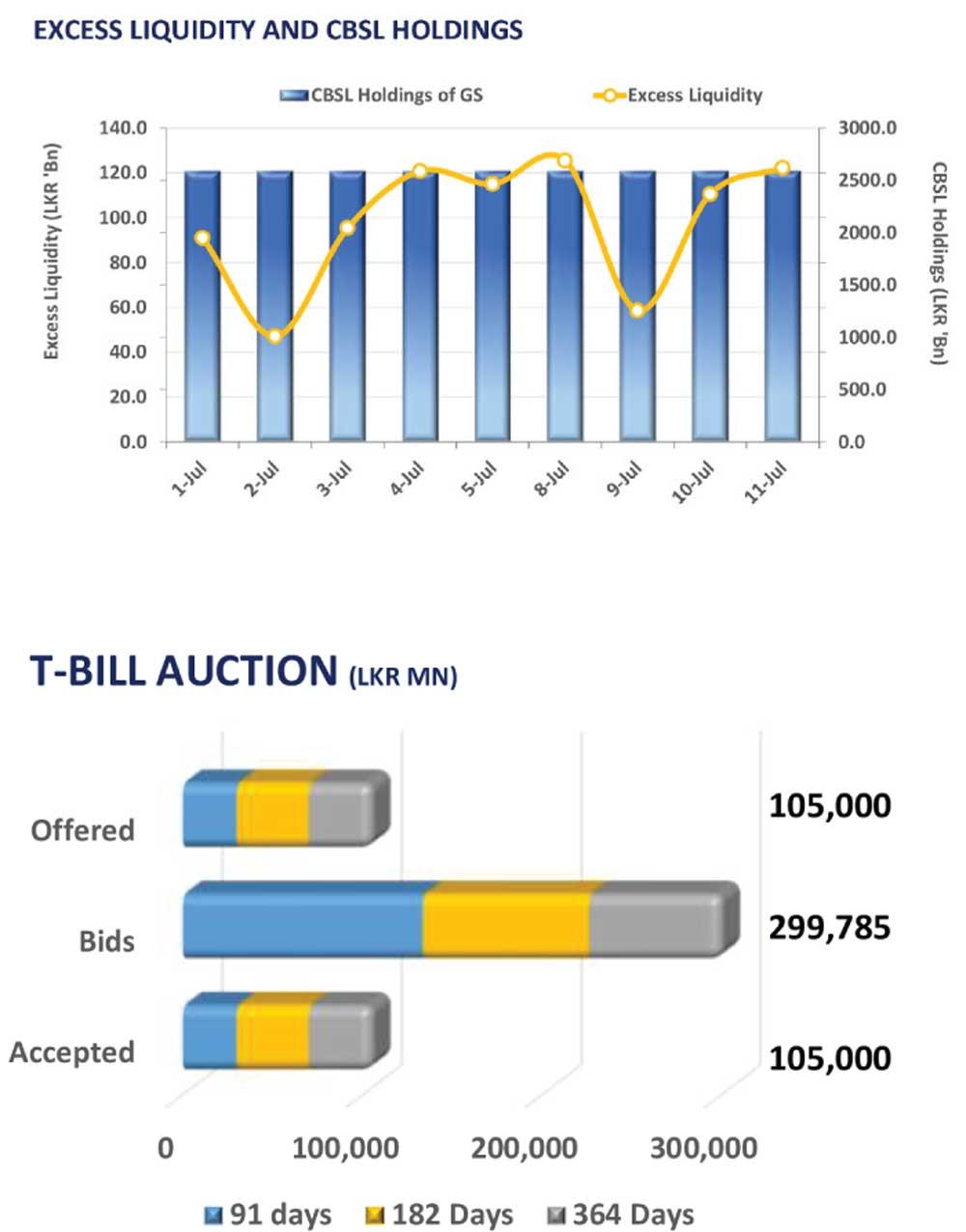

On the external side, LKR continued to appreciate against the USD, closing at Rs. 303.8 compared to previous day’s closing of Rs. 304.2. Meanwhile, overnight liquidity improved to Rs. 122.3bn at the end of the day while CBSL holdings remained stagnant at Rs. 2,595.6bn.