Reply To:

Name - Reply Comment

The subdued growth in private sector credit in September has continued through October, despite the lifting of the virus-related lockdowns, largely as a result of the lingering effects of the liquidity shortage in domestic money markets, uncertainty over the direction of the interest rates and persistent anxieties over the future trajectory of the economy, ahead of the budget and

evolving pandemic.

After holding up against initial restrictions and the subsequent lockdowns continued from April this year, the licensed commercial banks gave record high credit of Rs.134.1 billion in August, which fell to Rs.29.1 billion in September, as the effects of the monetary policy tightening were transmitting through the economy while the economy came under

another lockdown.

The rate hike in August and the subsequent increase in banks’ Statutory Reserve Ratio from September drained liquidity out of the overnight money markets, turning it to a deficit of over Rs.200 billion, which

remains to date.

Meanwhile, the uncertainty over how fast the Central Bank would follow up with more rate hikes to bring the soaring consumer prices and the foreign exchange liquidity crunch under control may have also left banks to take a more wait-and-see approach into their lending.

“Credit extended to the private sector expanded notably until the month of August but during the month of September and based on the provisional numbers that we have for October, we have seen some declaration,” said Central Bank Economic Research Director Dr. Chandranath Amarasekara, last week.

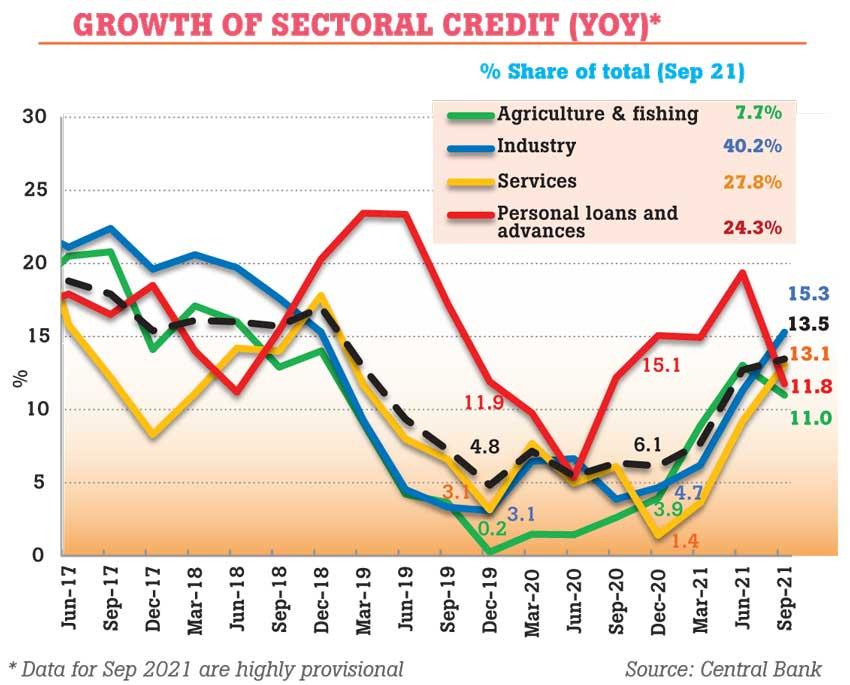

“But within this overall expansion, we have also seen continued expansion in credit flows to industry and services sectors,” he added.

According to the Central Bank data available through September, the loans to the industry sector have continued to grow by a robust 13.5 percent over the same period last year, while the loans to the services sector too have followed suit by logging a YoY growth of 13.1 percent. The two sectors respectively account for 40.2 percent and 27.8 percent of total new loans disbursed to the private sector through the end of September, while personal loans and advances and the agriculture sector’s share were 24.3 percent and 7.7 percent, respectively. The Central Bank last week left its key policy rates unchanged to spur growth although inflation continues to bite harshly into people’s real incomes.

The markets, which for the most part had parked their worries over the pandemic and were looking forward to how early and how fast the world’s major central banks led by the US Fed would start raising rates to tamp down inflation, are faced with fresh concerns over the detection of a new virus variant in several major economies in the world.

While the countries, including Sri Lanka, are fast responding to the new variant identified as ‘Omicron’ through border closures and reintroduction of other restrictions on in-person activities, central banks and governments this time are unable to provide support, as the excesses of their previous rounds of stimulus have returned to haunt the masses by way of soaring consumer prices and commodities shortages, pushing many millions into poverty and hunger.

Further, anymore restrictions would further push up prices due to potential supply constraints and push many others who are already in the verge, out of businesses, exacerbating the economic hardships. “As two years have gone by and still no sign of the virus going away, it’s high time people and countries should change their playbook to how they deal with the virus into living with the virus as unlike in the 1917, the world today cannot afford to hunker down and live on government assistance and Central Bank printed money for a very long time without consequences,” said an economic analyst in response to how the world is overreacting to the new variant after forcing the world into lockdowns, masks and vaccinations, with the false promise of normality.