Reply To:

Name - Reply Comment

By First Capital Research

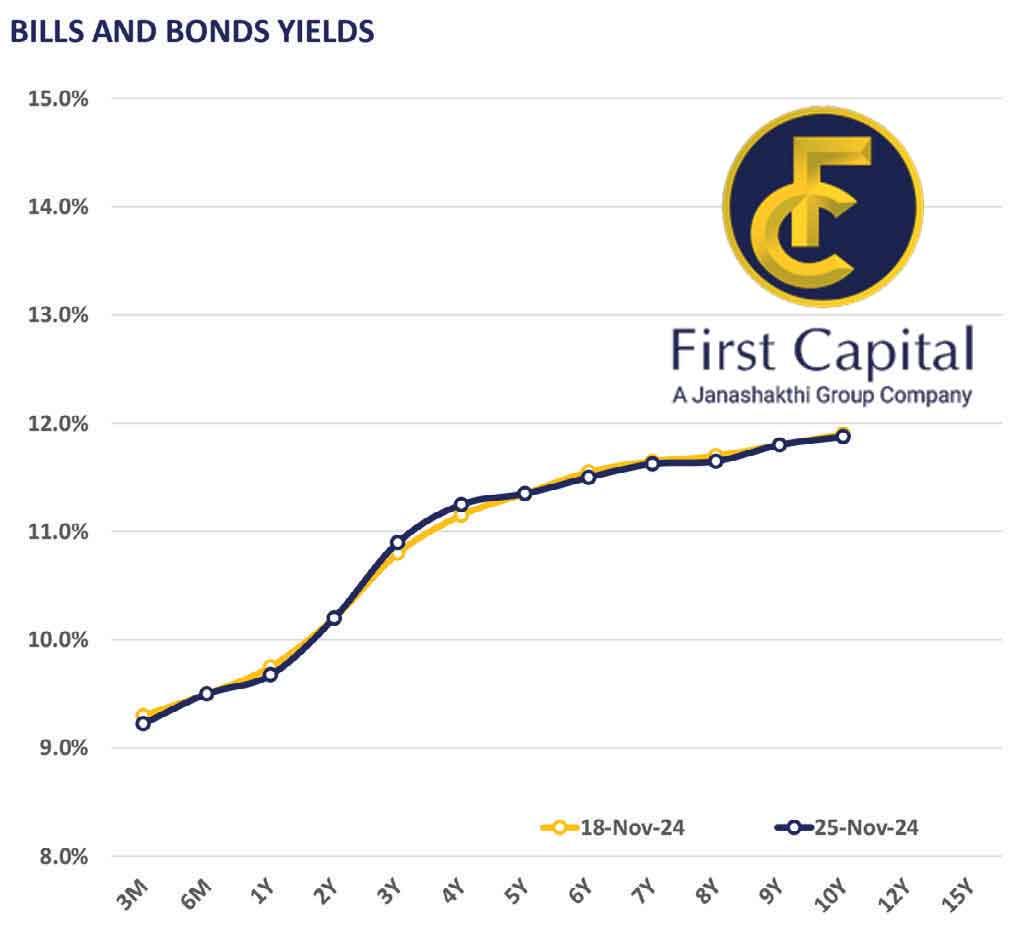

The secondary market yield curve remained broadly stable as the investors continued to be on the sidelines, awaiting for a direction on the interest rates at the upcoming monetary policy review meeting, which is scheduled to be held on November 27, 2024.

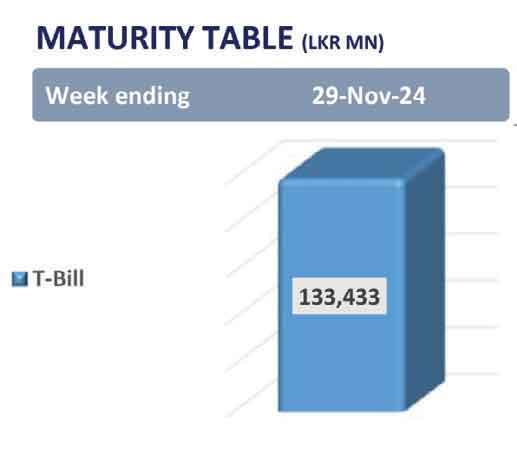

Moreover, the Central Bank announced the issuance of Rs.205.0 billion worth of T-bonds through an auction scheduled for November 28, 2024. This issuance includes Rs.80.0 billion, Rs.75.0 billion and Rs.50.0 billion to be issued under the maturities of 15.10.28, 15.03.31 and 01.11.33, respectively. During the week ending November 22, 2024, the AWPLR continued its downward trajectory, experiencing a decline of 3bps to 9.08 percent. Moreover, foreign holdings in government securities increased by 1.3 percent week-on-week and registered at Rs.55.5 billion as of November 21, 2024. On the external side, the Sri Lankan rupee remained broadly stable against the greenback, closing at Rs.290.9. On the other hand, the Sri Lankan rupee depreciated against most of the major currencies, notably the GBP, EUR, JPY and AUD. Meanwhile, overnight liquidity recorded at Rs.179.9 billion while the Central Bank holdings remained unchanged at Rs.2,515.6 billion.