Reply To:

Name - Reply Comment

By First Capital Research

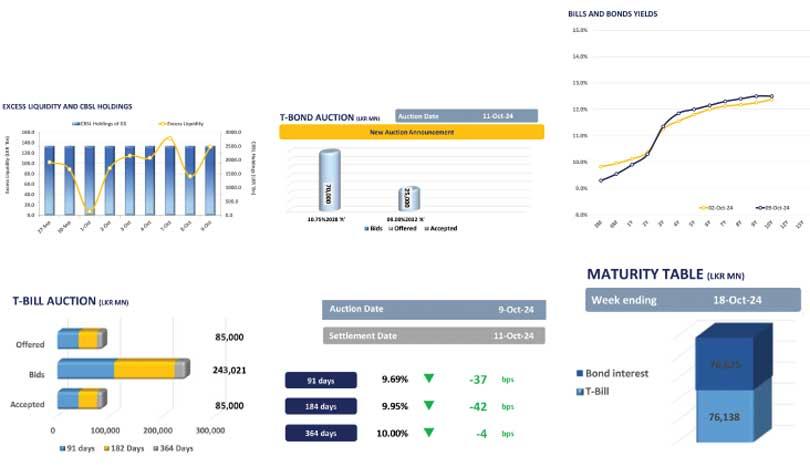

At the T-bill auction held yesterday, the Central Bank fully accepted the bills offered totalling Rs.85.0 billion.

The Central Bank fully subscribed to all three bills, where the three-month T-bill was fully accepted at Rs.40.0 billion, the six-month T-bill was accepted at the offered amount of Rs.35.0 billion and the one-year T-bill was fully accepted at Rs.10.0 billion. The weighted average yield rates saw significant declines, where the three-month bill saw a decline of 37 basis points (bps) at 9.69 percent. The six-month bill also saw a decline of 42bps at a rate of 9.95 percent. The one-year bill saw a slight decline of 4bps at a rate of 10.00 percent. Meanwhile, the secondary market yield curve faced some selling pressure ahead of the bond auction to be held on October 11, 2024 and the market experienced slight buying interest following the T-bill auction results. Notable trades were on the short to mid end of the curve, primarily amongst the 2027 and 2028 maturities. On the short end of the curve, 01.05.27 and 15.09.27 traded at rates of 11.30 percent and 11.40 percent, respectively. On the belly end of the curve, 15.02.28, 15.03.28, 01.05.28 and 15.12.28 traded at rates of 11.90 percent - 11.77 percent, 11.90 percent, 11.90 percent - 11.80 percent and 12.00 percent, respectively. Additionally, 15.09.29, was seen trading between rates of 12.05 percent - 12.00 percent.

Following the results of the T-bill auction, the six-month bill traded at a rate of 9.55 percent. On the external front, the Sri Lankan rupee appreciated against the US dollar, closing at Rs.293.36/US dollar, compared to Rs.293.55/US dollar recorded the previous day. The Central Bank holdings of government securities remained unchanged, closing at Rs.2,515.62 billion yesterday. Overnight liquidity in the banking system expanded to Rs.132.21 billion, from Rs.75.23 billion recorded the previous day.