Reply To:

Name - Reply Comment

By First Capital Research

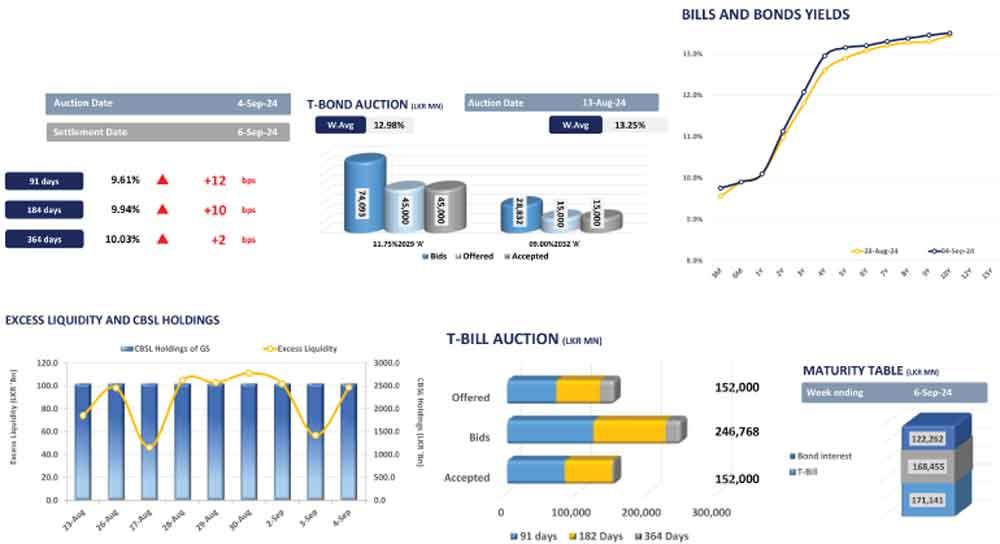

The secondary market experienced a mixed sentiment during the day on the back of heavy trades with active investor participation. Most of the maturities across the yield curve enticed trades during the day. Towards the short end of the curve, 15.05.26, 01.06.26 and 15.12.26 traded between the range of 11.00 percent - 11.20 percent. Towards the mid end of the curve, 01.07.28 and 15.12.28 enticed trades between 12.85 percent - 13.05 percent. Furthermore, longer tenures, including the 15.06.29, 15.09.29 and 15.05.30 maturities, enticed trades between 13.05 percent - 13.20 percent whilst 01.12.31 traded at 13.27 percent. Meanwhile, the Central Bank held its Rs.152.0 billion weekly T-bill auction yesterday. The Central Bank fully subscribed to the total offered amount and there was a notable increase in bid reception across all maturities, whilst yields saw an upward trend during the day. The 91-day maturity was accepted at a weighted average yield rate (WAYR) of 9.61 percent (+12bps). The 182-day maturity was accepted at a WAYR of 9.94 percent (+10bps), whilst the 364-day maturity was accepted at a WAYR of 10.03 percent (+2bps). On the external side, the Sri Lankan rupee slightly depreciated against the US dollar, recording at Rs.299.2 during the day. Overnight liquidity recorded at Rs.98.5 billion, increasing from Rs.56.7 billion recorded during the previous day, whilst the Central Bank holdings remained stagnant at Rs.2,555.6 billion.