Reply To:

Name - Reply Comment

By First Capital Research

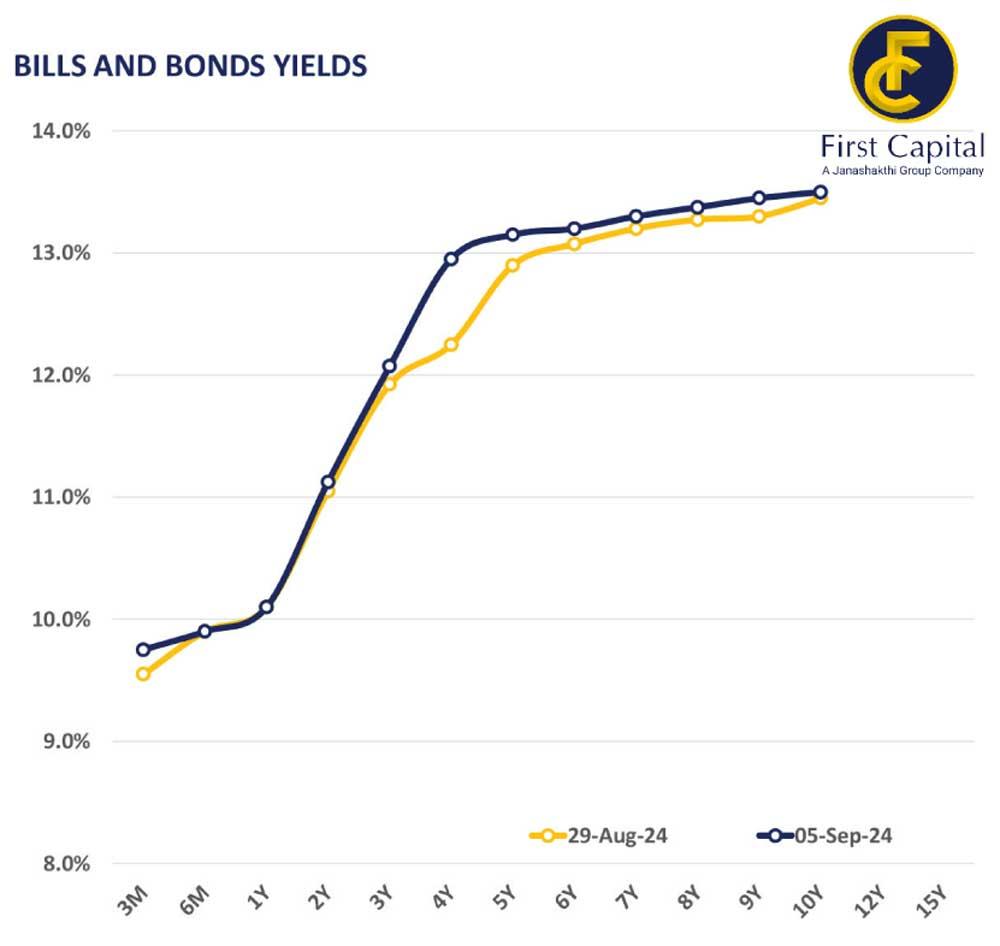

The secondary market yield curve remained broadly unchanged amidst limited activities and low trading volumes across the market.

The market experienced slight buying interest on the mid end of the curve, however trades remained predominantly low as investors adopted a cautious approach in the midst of political uncertainty.

Notable trades were on the short to mid end of curve primarily amongst the 2028 maturities. On the short end of the curve 15.12.27 traded at a rate of 12.20%.

Meanwhile, on the belly end of the curve, 15.02.28, and 15.12.28, traded at rates of 12.60%, and 13.00%, respectively. On the external front, the LKR appreciated slightly against the USD, closing at 298.94/USD compared to 299.17/USD recorded the previous day.

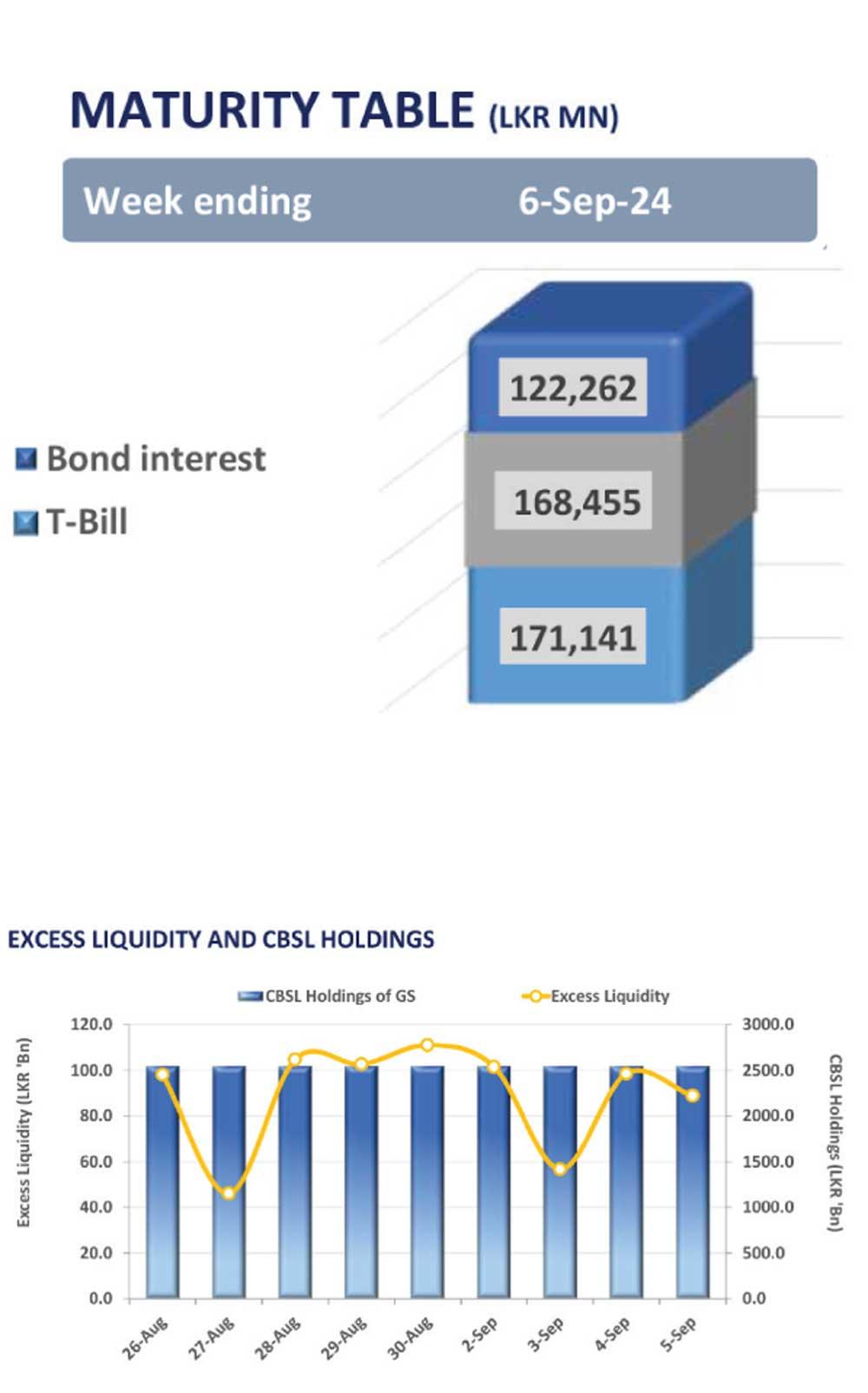

Conversely the LKR depreciated against the GBP closing at 393.22/GBP, compared to 392.21/GBP recorded the previous day. Meanwhile, CBSL holdings of government securities remained unchanged, closing at Rs. 2,555.62 billion yesterday. Overnight liquidity in the banking system contracted to Rs. 88.86 billion from Rs. 98.54 billion recorded the previous day.