Reply To:

Name - Reply Comment

By First Capital Research

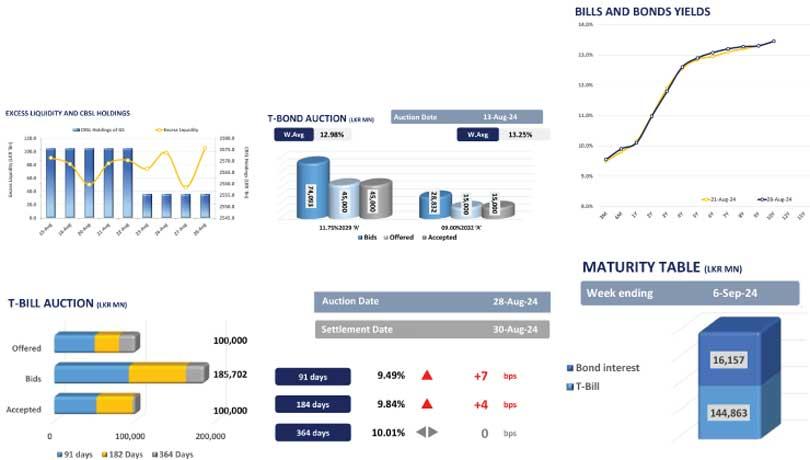

The Central Bank conducted the weekly T-bill auction yesterday, accepting the total offered amount of Rs.100.0 billion.

However, the auction yields continued to tick higher on the three-month and six-month tenures while attracting higher acceptance.

Accordingly, the three-month and six-month tenures were oversubscribed accounting for 97 percent of overall acceptance while the weighted average yield rates closed at 9.49 percent(+07 basis points (bps)) and 9.84 percent (+04 bps), respectively.

However, the one-year bill enticed only an Rs.3.3 billion acceptance while the weighted average yield rate remained unchanged at 10.01 percent.

Meanwhile, the secondary market yield curve inched up slightly on short to mid end, as selling pressure took charge amidst thin volumes. Accordingly, on the liquid maturities, 15.12.2026 witnessed trades at 11.05 percent while on the 2028 tenure, 15.02.2028 and 01.07.2028 registered trades at 12.35 percent and 12.60 percent, respectively.

Moreover, 15.06.2029 closed trades at 12.86 percent while on the mid-end, 15.05.2030 enticed transactions at 13.10 percent during the day. Investors are seen to take a cautious stance while adapting to macroeconomic and political uncertainties in the country.

On the external environment, the Sri Lankan rupee continued to depreciate against the greenback for the second continuous day, falling to Rs.300.7/US dollar, compared to Tuesday’s closing of Rs.300.6/US dollar.