Reply To:

Name - Reply Comment

By First Capital Research

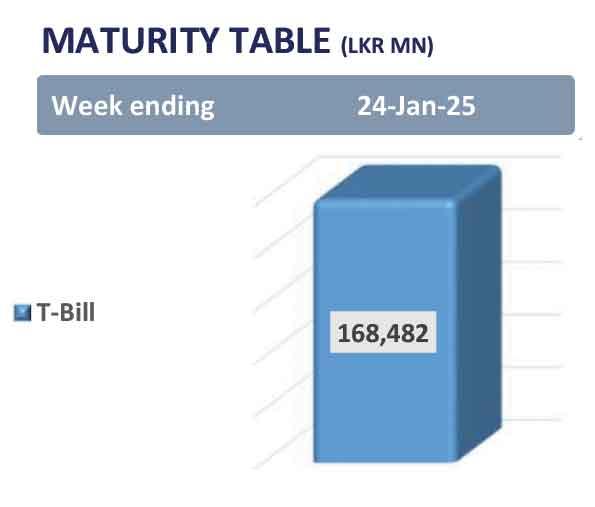

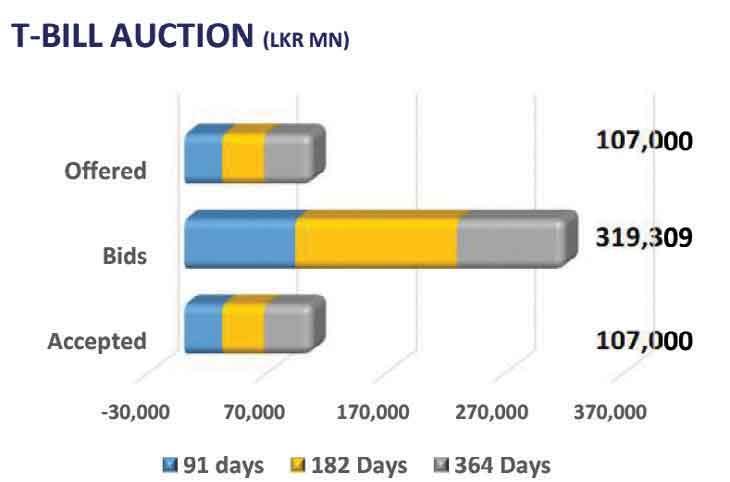

The Central Bank conducted the weekly T-bill auction, raising Rs.107.0 billion, with the total offered amount being fully accepted across all maturities.

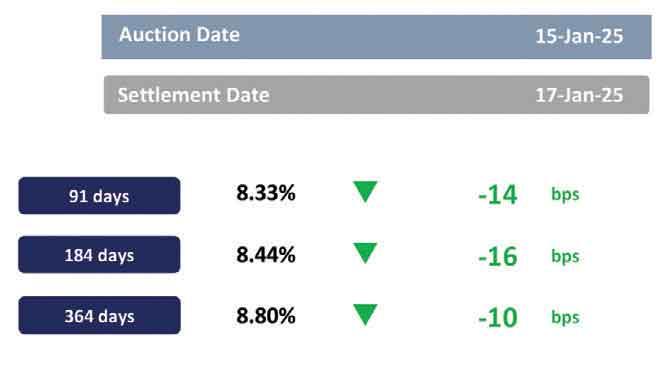

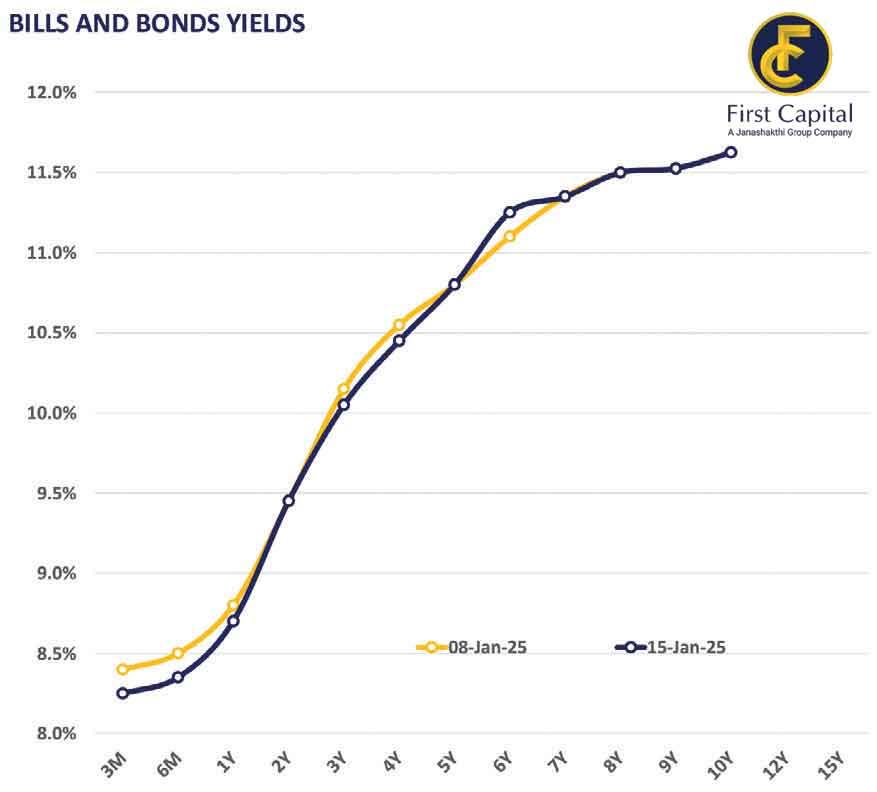

The bids received for all the three maturities exceeded the total offered amount, with the six-month T-bill attracting the most interest, same as the last T-bill auction. Meanwhile, the weighted average yield rates declined across the board for the sixth consecutive week at yesterday’s T-bill auction. The three-month T-bill closed at 8.33 percent (-14bps), the six-month T-bill at 8.44 percent (-16bps) and the one-year T-bill at 8.80 percent (-10bps).

During yesterday’s trading session, the secondary market yield curve experienced moderate trading volumes whilst the post-T-bill auction, the three-month and six-month T-bills traded at the rates of 8.25 percent and 8.35 percent, respectively. Amongst the traded maturities, at the short end 01.02.2026 and 01.06.26 and 01.08.26 bonds traded at the range of 9.15 percent to 9.00 percent, while the 15.09.2027 and 15.10.27 traded at the range of 9.85 percent to 9.80 percent.

Furthermore, towards the mid-end of the curve, 15.03.28 traded in the range of 10.20 percent to 10.10 percent whilst 01.05.28 and 01.07.28 traded in the range of 10.38 percent to 10.26 percent. Towards the belly end, 15.10.28 and 15.12.28 traded at the range of 10.45 percent to 10.40 percent.

Meanwhile, on the external front, the Sri Lankan rupee appreciated against the US dollar, closing at Rs.294.6/US dollar, compared to Rs.295.6/US dollar recorded the previous day. The Central Bank holdings of government securities declined to Rs.2,511.92 billion yesterday. Overnight liquidity in the banking system contracted to Rs.79.61 billion, from Rs.130.26 billion recorded the previous day.