Reply To:

Name - Reply Comment

By First Capital Research

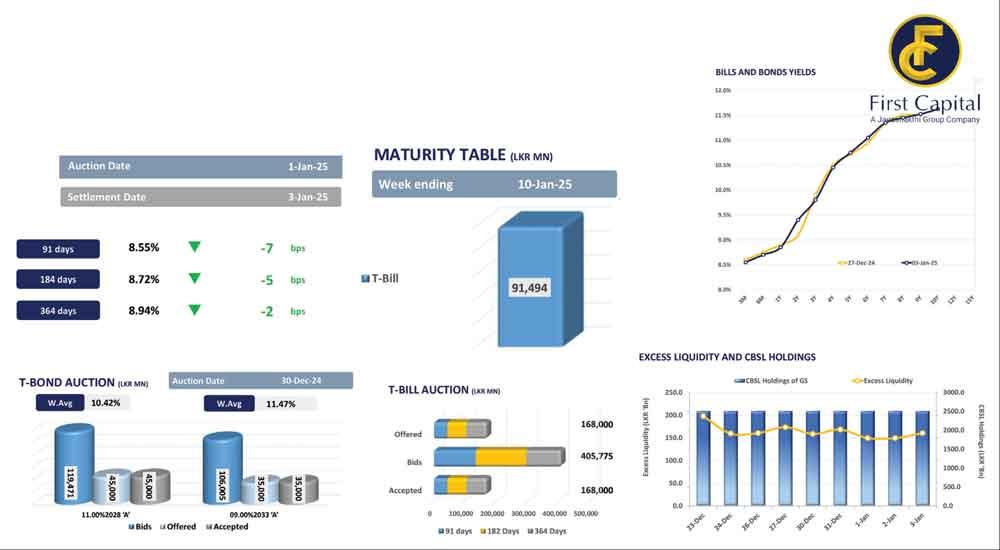

The secondary market yield curve showed mixed activity, with buying interest primarily concentrated on 2026 and 2027 maturities, where 2026 traded between 8.90 percent to 9.50 percent whilst the 2027 maturity traded in the range of 9.90 percent to 9.80 percent.

Meanwhile, the selling pressure was focused on the belly of the curve with 15.02.28, 01.05.28, 15.10.28 and 15.09.29 traded at 10.13 percent, 10.30 percent, 10.40 percent and 10.75 percent, respectively.

Meanwhile, the overnight liquidity level increased and recorded at Rs.160.16 billion compared to the previous day’s level of Rs.149.36 billion. Moreover, the Central Bank holdings continued to remain stagnant at Rs.2,515.62 billion during the day. On the external side, the Sri Lankan rupee appreciated slightly against the greenback and closed at Rs.293.27/US dollar compared to the previous day’s closing of Rs.293.41/US dollar. Similarly, the rupee appreciated against other major currencies, including the GBP, EUR, JPY and CNY. Furthermore, for the week ending December 27, 2024, the AWPLR showed a 34bps and recorded at 9.06 percent compared to the previous week.