Reply To:

Name - Reply Comment

By First Capital Research

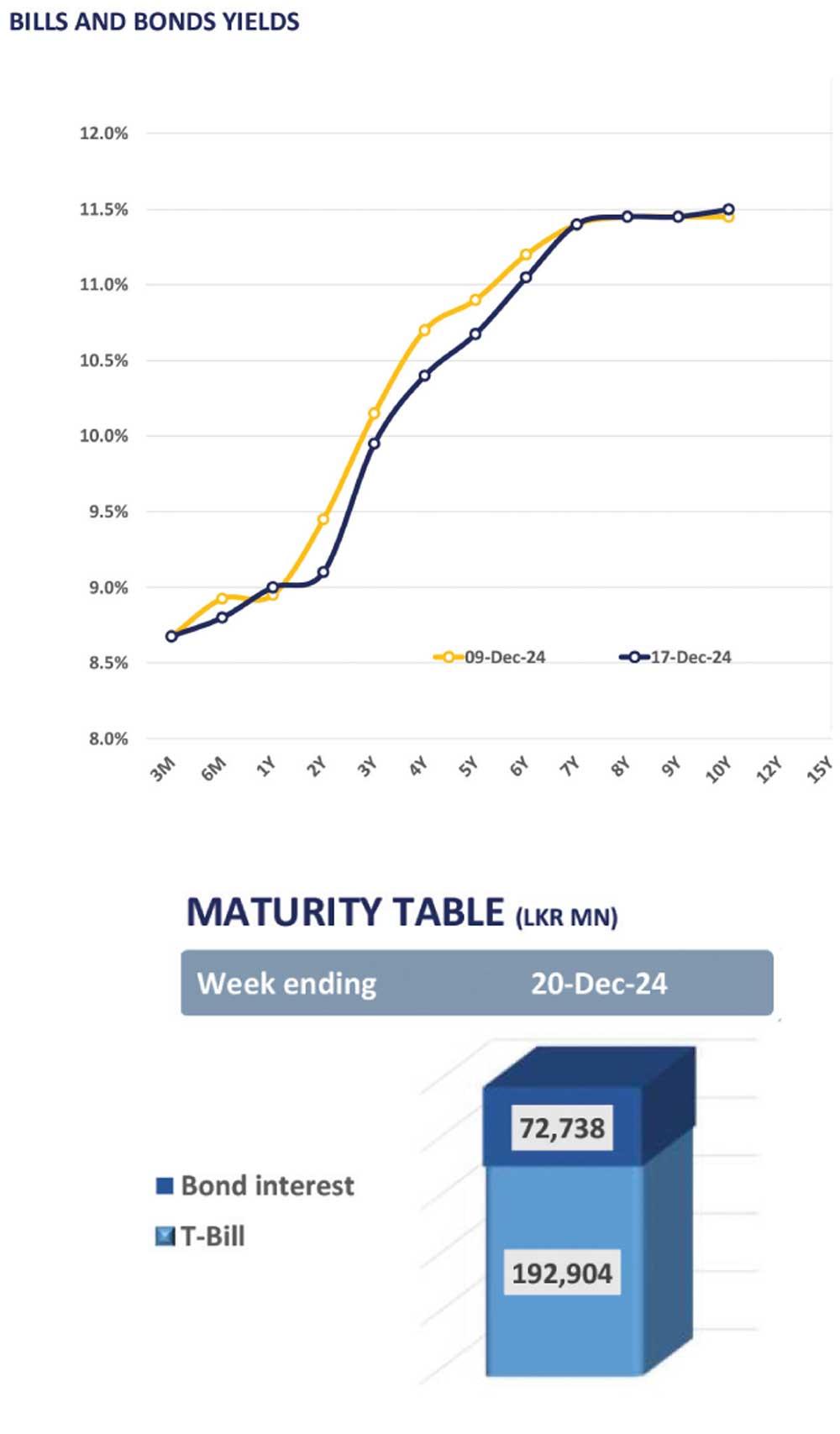

The secondary market yield curve experienced slight buying interest in the belly end of the curve yesterday, where it showed a slight dip.

The secondary market yield curve experienced slight buying interest in the belly end of the curve yesterday, where it showed a slight dip.

The trades were predominantly centered around the 2028 maturities. Amongst the traded maturities, 15.09.27 and 15.12.27 traded in the range of 9.96% - 9.90%.

The 2028 maturities namely 15.02.28 traded between 10.15% to 10.13%, whilst 15.03.28, 01.05-28, 01.07.28 and 15.12.28 maturities were traded at the rates of 10.15%, 10.25%, 10.35% and 10.45%, respectively.

Furthermore, 15.09.29, 01.12.31 and 01.06.33 traded at the rates of 10.70%, 11.35% and 11.42% respectively. During the week ending 13th Dec-24, the AWPLR continued its downward trajectory, experiencing a decline of 27bps to 8.82%.

Moreover, foreign holdings in government securities decreased by 3.1% WoW and registered at Rs. 66.1bn as of 12th Dec-24.

Meanwhile, on the external front, the LKR continued to depreciate against the USD for the 2nd consecutive day, closing at Rs. 290.76/USD, compared to Rs. 290.32/USD recorded the previous day.

Additionally, the LKR depreciated against other major currencies including the GBP, EUR, JPY, CNY, and AUD. CBSL holdings of government securities remained unchanged, closing at Rs. 2,515.62bn yesterday. Overnight liquidity in the banking system further contracted to Rs. 162.84bn from Rs. 202.12bn recorded the previous day.