Reply To:

Name - Reply Comment

By First Capital Research

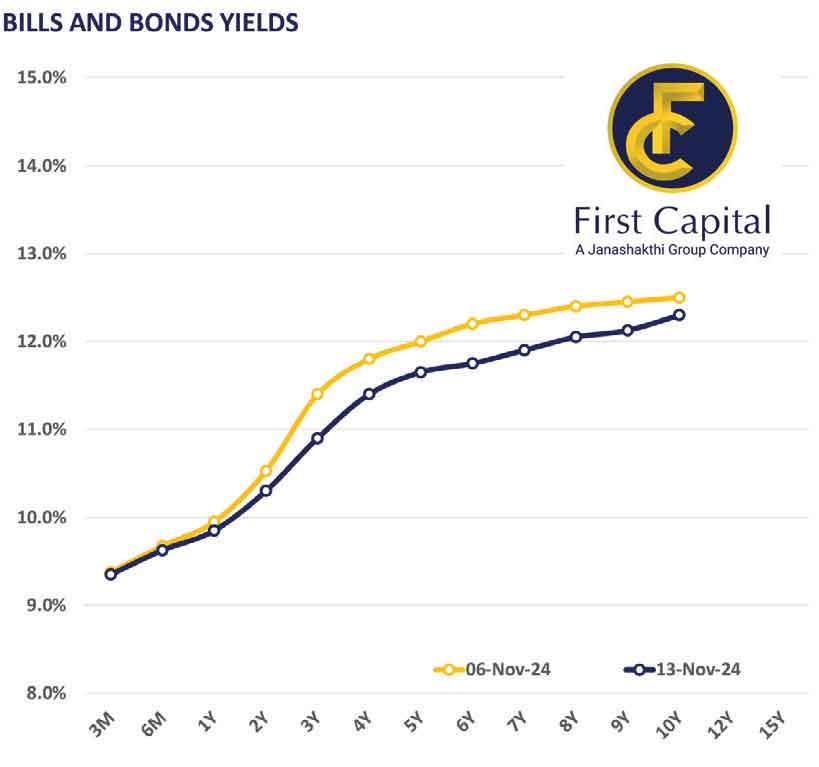

The secondary market yield curve witnessed significant buying interest across the board, particularly during the morning session of trading.

Yields saw a prominent decline in rates, eventually settling slightly above the intraday low, with the market witnessing some profit taking after the bill auction results release.

Amongst the traded maturities, notable trades were amongst the 2027, 2028, 2029, 2030 and 2032 maturities. On the short end of the curve, 15.12.27 traded between the range of 11.10 percent - 10.90 percent. On the belly end of the curve, 15.02.28, 15.03.28, 01.05.28, 01.07.28, 15.10.28 and 15.12.28 traded in the range of 11.25 percent - 11.15 percent, 11.25 percent - 11.15 percent, 11.40 percent - 11.25 percent, 11.40 percent - 11.30 percent, 11.50 percent - 11.35 percent and 11.55 percent - 11.40 percent.

Similarly, 15.09.29 traded between rates of 11.70 percent - 11.50 percent. The long end of the curve also experienced increased interest with 15.10.30 and 15.10.32 trading at rates of 11.85 percent - 11.65 percent and 12.15 percent - 12.00 percent.

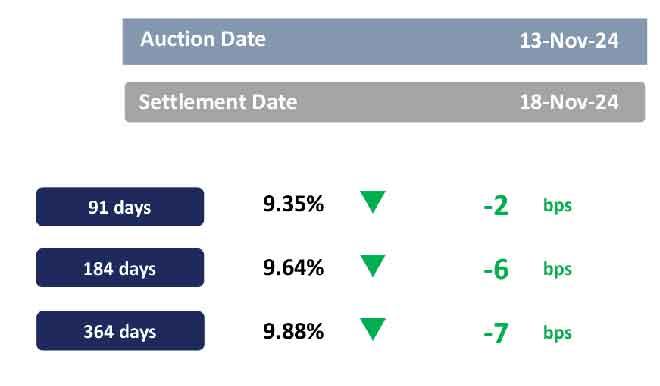

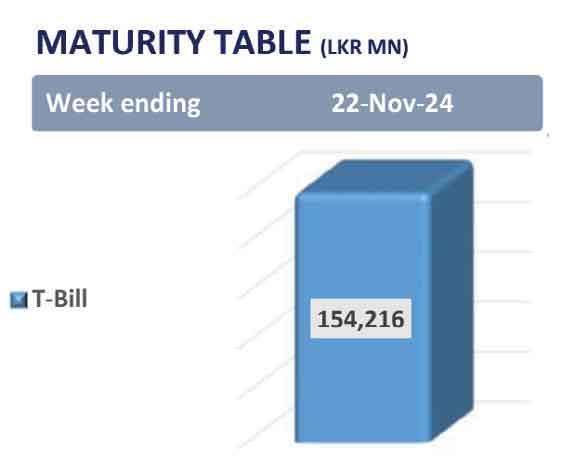

Meanwhile, at the T-bill auction held yesterday, the Central Bank fully accepted the bills offered totalling Rs.147.5 billion. The Central Bank fully subscribed to all three bills, where the three-month T-bill was fully accepted at Rs.62.5 billion, the six-month T-bill was accepted at the offered amount of Rs.65.0 billion and the one-year T-bill was fully accepted at Rs.20.0 billion. The weighted average yield rates saw declines, where the three-month bill saw a decline of 2bps at 9.35 percent. The six-month bill saw a decline of 6bps at 9.64 percent and the one-year bill saw a decline of 7bps at 9.88 percent.

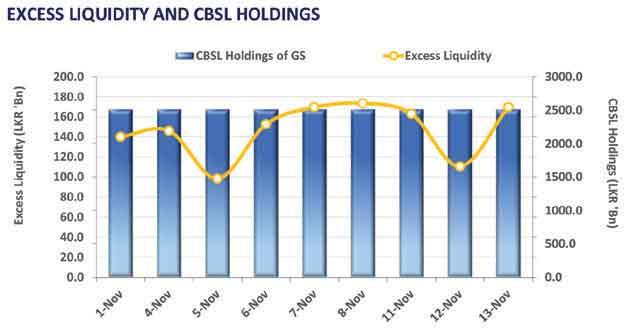

On the external front, the Sri Lankan rupee remained stable against the US dollar, closing at Rs.292.6/US dollar compared to Rs.292.6/US dollar recorded the previous day. The Central Bank holdings of government securities remained unchanged, closing at Rs.2,515.62 billion yesterday.

Overnight liquidity in the banking system expanded to Rs.169.59 billion, from Rs.110.49 billion recorded the previous day.