Business

DIMO Healthcare enhances Jaffna Teaching Hospital’s MRI capabilities

17 Aug 2024

0

0

The healthcare arm of DIMO, also known as DIMO Healthcare recently installed the Siemens Healthineers 3 Tesla MRI Scanner at Jaffna Teaching Hospital. This enabled vital access to advanced healthcare technology for communities in the North region.

SL urged to reassess debt plan and strengthen governance

16 Aug 2024

4

4

Sri Lanka’s political and bureaucratic leaders should reassess the current debt sustainability plan with a fresh Debt Sustainability Analysis (DSA) to establish a realistic path out of the debt crisis, a top economist said, whilst also urging governance reforms to tackle corruption vulnerabilities.

New SEC directive opens doors for more investment advisors

16 Aug 2024

0

0

The Securities and Exchange Commission (SEC) of Sri Lanka has introduced new entry requirements and broadened exemptions for its certification programmes, aiming to enhance professional standards and accessibility in the capital market industry.

ComBank raises Rs. 22.54 bn via biggest rights issue

16 Aug 2024

0

0

The Commercial Bank of Ceylon PLC has announced that it has successfully completed the largest rights issue to date by a bank in Sri Lanka, raising Rs. 22.54 billion to increase the Tier I and total capital of the bank to accommodate and facilitate future business growth.

Amana Bank records 68% growth in PBT and 82% growth in PAT

16 Aug 2024

0

0

Amana Bank mid-year performance in 2024 has outpaced its 2023 first half, with significant growth across multiple key metrics including profitability, advances, deposits, and total assets while also maintaining key health ratios such as CASA and Stage 3 Impairment ratios beyond industry averages.

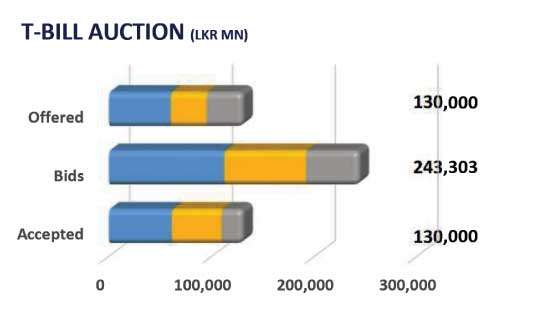

Yield curve stable following heavy selling pressure

16 Aug 2024

0

0

The secondary market yield curve remained broadly steady during yesterday’s session amidst limited activities. Slight buying interest emerged on some mid tenors reversing the selling pressure that prevailed in the previous sessions amidst the spike in last bond auction yields.

FTZMA urges govt. to fast-track ADB-funded container yard

15 Aug 2024

4

4

The Free Trade Zone Manufacturers’ Association (FTZMA) has urged the Sri Lankan government to swiftly implement the proposed Asian Development Bank (ADB)-funded container-clearing yard in Kerawalapitiya, to mitigate the ongoing cargo delays at the Colombo Port.

HNB June quarter gets a lift from sharply lower provisions

15 Aug 2024

0

0

A sharp drop in the provisions made for possible loans and other losses helped lift the profit at Hatton National Bank PLC (HNB) for the quarter ended in June 2024, as the company’s net interest income came under pressure, due to the faster decline in the interest rates charged on loans.

ComBank maintains growth impetus in 2Q despite external pressures

15 Aug 2024

0

0

The Commercial Bank of Ceylon group, comprising of Sri Lanka’s biggest private sector bank and its subsidiaries and an associate, has reported gross income of Rs.163.12 billion for the six months ending June 30, 2024, a decline of 2.71 percent over the corresponding period of 2023.

Industries Ministry public day re-launched after four years

15 Aug 2024

0

0

Third review approved by IMF, SL to get next US$ 333 million tranche

15 Aug 2024

0

0

Niloufer Esufally-Anverally Makes a Stylish Comeback with the Launch of NLFR

15 Aug 2024

0

0

Global Entrepreneurship Week 2024 kicks off across all 25 districts

15 Aug 2024

0

0

Fonterra to proceed with sale process for Consumer businesses

15 Aug 2024

0

0

Newly elected Jaffna MP pays tribute to Prabhakaran

15 Aug 2024

0

0

Another court case against Arjuna Aloysius

15 Aug 2024

0

0

Seeks police security

15 Aug 2024

0

0