Business

ComBank-CBA introduce NFC-enabled cashless vending machines

22 May 2024

0

0

Sri Lanka will be able to deploy its first credit and debit card-enabled vending machines following a collaboration between Commercial Bank of Ceylon, the country’s biggest private sector bank and Ceylon Business Appliances (CBA), a leading financial technology solutions company. Advancing consumer

DFCC Bank clinches 4 Golds

22 May 2024

0

0

DFCC Bank was honoured for its marketing campaigns on digital platforms with four prestigious Gold awards for outstanding creativity, innovation, effectiveness and corporate social responsibility (CSR) at the illustrious awards ceremony held in Mumbai. The ACEF event, e

Foreign buying continues

22 May 2024

0

0

The ASPI closed in red as a result of price losses in counters such as Ceylon Tobacco Company, SMB Leasing nonvoting and Dialog Axiata with the turnover crossing Rs. 1.3 bn. A similar behaviour was witnessed in the S&P SL20. High net worth and institutional investor participation was noted in John Keells

HNB Assurance group makes strong start to 2024

22 May 2024

0

0

HNB Assurance PLC (HNBA) kicked off the year 2024 on a remarkable note, showcasing robust performance in the first quarter. For the first quarter (1Q) HNB Assurance posted a Gross Written Premium (GWP) of Rs. 3.3 billion while HNB General Insurance

CB has enough dollars to prevent rising dollar value

21 May 2024

19

19

The value of the US dollar and the Sri Lanka Rupee is determined by the supply and demand. If the value of the dollar rises significantly, the Central Bank of Sri Lanka (CBSL) has sufficient dollars to control it, Finance State Minister Ranjith Siambalapitiya said.

State coffers lose billions as Customs officers enjoy unfair benefits

21 May 2024

15

15

The state coffers have been deprived of billions of rupees, as Sri Lanka Customs (SLC) officers enjoy unfair benefits in penalties related to customs offenses and overtime pay, a special audit carried out by the Auditor General on the management/administration of various funds in SLC revealed.

SL proposes 10% levy on annual profits of global tax evasion assets

21 May 2024

8

8

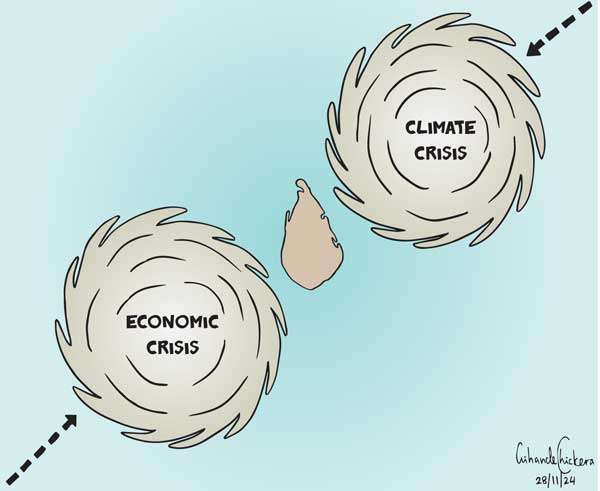

In an effort to support blended finance projects focused on climate change adaptation and mitigation, Sri Lanka proposed a 10 percent levy on the annual profits of global tax evasion assets deposited in tax havens.

Thai delegation in SL to explore opportunities in renewable energy

21 May 2024

1

1

A delegation comprising officials representing Thai agencies and private sector is in Sri Lanka to explore feasibility and understand the potentials in future cooperation and investment in renewable energy, particularly in the electricity generation in Sri Lanka.

March outstanding credit card balance stands at Rs. 148.7 bn

20 May 2024

7

7

Outstanding credit card balance of the licensed commercial banking sector has little changed in March from February despite an uptick signaling the trend that would follow as the consumers grow more optimistic about the economy. The interest rates have fallen to single digit levels.

Govt. revenue in January surge 62% on economic turnaround, higher taxes

20 May 2024

7

7

The revenue to the government, including the grants, rose by a staggering 61.8 percent in January 2024. This is a result of the government raking in billions of rupees out of people’s pockets to appease the International Monetary Fund’s revenue targets.

CBSL further eases monetary policy stance

20 May 2024

7

7

CBSL’s single policy interest rate mechanism comes into effect today

20 May 2024

7

7

Sri Lanka Economic Summit in January 2025

20 May 2024

7

7

Industries Ministry public day re-launched after four years

20 May 2024

7

7

Sri Lanka drenched more this year

20 May 2024

7

7

Govt. taking allegations against Adani seriously

20 May 2024

7

7