Business

HNB General Insurance launches hotline ‘1303’

07 May 2024

0

0

HNB General Insurance has recently launched their dedicated hotline ‘1303’, unleashing their latest initiative for enhanced customer experience. The new hotline ‘1303’ is set to be a game changer for both the company and for customers alike by elevating convenience and accessibility to new heights. HNB General Insurance has long been committed to delivering exceptional service and care to its customers across Sri Lanka. And the significance of

Vallibel Finance opens new branch in Athurugiriya

07 May 2024

0

0

Vallibel Finance opened a new branch in Athurugiriya recently. The Managing Director of Vallibel Finance Jayantha Rangamuwa, graced the occasion of the inaugural ceremony and declared opened the branch to the public. During the inaugural ceremony, Rangamuwa, highlighted the relationship Vallibel Finance has built with the community in Athurugiriya. He emphasized the company’s dedication to enhancing its offerings and delivering innovative fin

HNB Operations Department achieves ISO certification

07 May 2024

0

0

HNB PLC announced the achievement of ISO 9001:2015 certification for its Inward Remittance, Outward Remittance, and Centralized Operations Departments. The certification not only highlights HNB’s commitment to service excellence but also further strengthens its position in the local and global markets given its alignment to global standards, setting the benchmark for strong Quality Management Systems. “The establishment of centres of excellence

Online financial fraud on the rise: Financial sector stakeholders warn

07 May 2024

0

0

As online financial fraud incidents are on the rise, financial sector stakeholders have called on the public to be cautious and be more vigilant. In a joint statement to the public, the Central Bank of Sri Lanka (CBSL), Sri Lanka’s Bankers Association (SLBA), LankaPay and FinCSIRT said that they have received several reports of online scams targeting mobile devices. “We have been alerted to several incidents of financial fraud which were disguis

Week commences with foreign buying

07 May 2024

0

0

Indices closed in red as a result of price losses in counters such as Commercial Bank, John Keells Holdings and DFCC Bank with the turnover crossing Rs 2.1 Bn. High net worth and institutional investor participation was noted in John Keells Holdings, Diesel & Motor Engineering and Sierra Cables. Mixed interest was observed in National Development Bank, Sunshine Holdings and Royal Ceramics whilst retail interest was noted in SMB Leasing nonvoting,

Slight drop in yields across curve

07 May 2024

0

0

The secondary market continues to observe buying interest amidst moderate volumes, pushing down the rates across the yield curve. Thus, the buying interest was enticed on 15.05.26, 01.06.26 and 15.12.26 between 10.70 percent and 10.50 percent, whilst the 01.05.27 and 15.09.27 maturities traded between 11.07 percent and 10.95 percent. Moreover, mixed activities were seen on the 15.03.28 and 01.07.28 maturities between 11.45 percent and 11.58 per

Vital for SL to remain a competitive location for apparel manufacturing: JAAF

07 May 2024

0

0

As Sri Lanka looks to build back its exports, it is vital that the island nation remains a competitive location for the manufacture of apparel, the Joint Apparel Association Forum (JAAF) said. JAAF Secretary General Yohan Lawrence noted it is prudent to call out the appreciation of the Sri Lankan rupee, as it does not augur well. “We are likely to see a reduction in the value of exports in the next eight to nine months, as the strengthening Sri

Huawei’s comeback gathers pace as quarterly profit surges

07 May 2024

0

0

REUTERS: Huawei Technologies’s net profit leapt 564 percent to 19.65 billion yuan (US $ 2.71 billion) in the first quarter, a regulatory filing by its parent company showed on Tuesday, as it continues to recover from US sanctions. Huawei’s revenue for the quarter to the end of March rose 37 percent to 178.5 billion yuan, the filing to China’s National Interbank Funding Center showed. It did not break down how business units, such as consumer and

Heineken to reopen more than 60 closed pubs

07 May 2024

0

0

BBC: Brewing giant Heineken will reopen 62 pubs that were closed in recent years and invest £39 million in refurbishing hundreds of sites across the UK. The company said the cash injection into its Star Pubs & Bars chain will create more than 1,000 new jobs. The UK pubs industry has been hard hit by closures both during the Covid pandemic and afterwards as cost of living pressures weighed on consumer spending. Between 2021 and 2023, pubs have shu

Colombo bourse to include sukuk products by end-May

07 May 2024

0

0

The Colombo Stock Exchange (CSE) said that efforts are being actively rolled out to introduce sukuk products to the Sri Lankan capital market by the end of this month. A sukuk is an Islamic financial instrument, similar to conventional debt securities and is linked to an underlying asset (normally tangible). From the perspective of the investors, holding a sukuk represents partial ownership of the relevant asset. “Rules are being drafted. Probab

VFS gears up to promote Sri Lanka amid visa woes

07 May 2024

18

18

VFS Global, which is currently facing a backlash, vows to boost Sri Lanka’s global image through a robust marketing plan with Sri Lanka Tourism. However, the details remain under wraps from the tourism authorities, Mirror Business learns.

CBSL further eases monetary policy stance

06 May 2024

0

0

CBSL’s single policy interest rate mechanism comes into effect today

06 May 2024

0

0

Sri Lanka Economic Summit in January 2025

06 May 2024

0

0

Industries Ministry public day re-launched after four years

06 May 2024

0

0

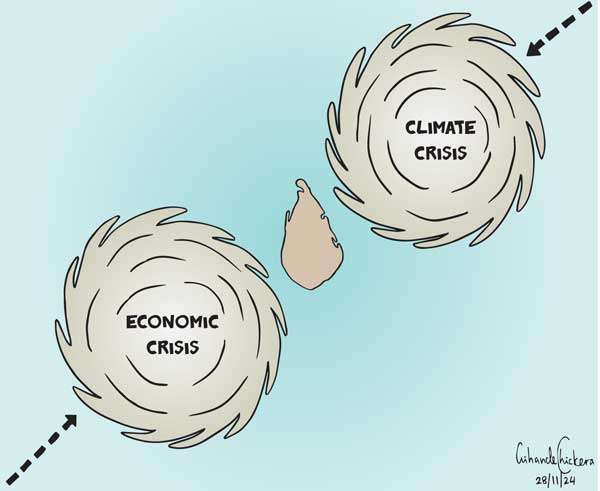

Sri Lanka drenched more this year

06 May 2024

0

0

Govt. taking allegations against Adani seriously

06 May 2024

0

0