Reply To:

Name - Reply Comment

Amid the looming recession in the United States and Europe, Sri Lanka’s apparel exports hit a 10-year low in the first quarter of this year with no recovery in sight.

Amid the looming recession in the United States and Europe, Sri Lanka’s apparel exports hit a 10-year low in the first quarter of this year with no recovery in sight.

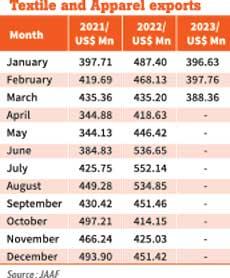

The apparel exports declined by 14.95 percent Year-on-Year (YoY) to US$ 1.18 billion in the first quarter of this year, which is the lowest since the first quarter of 2013, Joint Apparel Association Forum (JAAF) data showed.

Apparel exports to the United States (U.S.) plummeted 21.85 percent YoY to US$ 470.06 million while apparel exports to the European Union (EU) and United Kingdom slowed down by 13.31 percent YoY and 10.10 percent YoY to US$ 344.01 million and US $167.73 million respectively, during the period.

However, apparel exports to other destinations declined only by 2.36 percent YoY to US$ 200.95 million.

In particular, knitted apparel products were sharply down during the period to US$ 678.32 million from US$ 821.32 million a year ago.

March apparel export earnings, which stood at US$ 388.36 million with 10.76 percent YoY decline, were also the lowest in 10 years. On Month-on-Month basis too March recorded a decline with February recoding US$ 397.76 million and January recording US$ 396.63 million.

In March, apparel exports to the U.S. declined by 16.55 percent YoY to US$ 151.72 million while exports to the EU and U.K declined by 7.29 percent YoY and 5.96 percent YoY to US$ 117.50 million and US$ 59.02 million, respectively.

Apparel exports to other markets also declined by 5.90 percent YoY to US$ 60.12 million in March.

According to Sri Lanka Apparel Exporters Association (SLAEA), apparel exports are set to decline by 25-30 percent in the next few months with no recovery in sight.

“We are looking at 25-30 percent drop in apparel exports this year compared to last year. We can’t see any recovery right at this moment,” SLAEA Chairman Indika Liyanahewage told Mirror Business.

In particular, SME sector has become the hardest-hit by the decline in orders from key Western markets.

Sri Lanka earned US$ 5.6 billion from apparel exports in 2022, up 22 percent compared with 2021.

According to JAAF Secretary General Yohan Lawrence, the declining trend will continue into the third quarter of this year due to a demand decline in major export destinations including the US, EU and

the UK.

“With inflation continuing to be high in those countries and the Russia-Ukraine continuing unabated impacting the larger global economic framework, the softening retail sentiment will not look up anytime soon,” Lawrence told Mirror Business.

However, despite the gloomy outlook, the majority of apparel plants are back at work after the April holidays, even the SMEs, which are facing challenges due to the drop in orders, increasing cost of production, taxation, and utility hikes which have impacted their bottom lines drastically, increasing cost of production from last year.

While highlighting the need to protect the existing markets, JAAF reiterated the importance of expanding Sri Lanka’s market access with FTAs with India and China as priority.

“We welcome the announcement that Sri Lanka is looking to join the RECP. These are critical steps if the apparel industry is to continue remain as the largest foreign exchange earner for the country and also one of the largest employers.

Given that this industry is the backbone of the economy at present both in terms of earnings and employment, we have to do everything in our power to boost export volumes while remaining competitive in the global marketplace, given that competition is very intense and price-sensitive,” Lawrence said.