Reply To:

Name - Reply Comment

From left: Masahiro Nozaki and Peter Breuer

As Sri Lanka on Monday clinched the International Monetary Fund (IMF) Board level approval for its bailout package, and the first tranche of the US$ 3 billion expected to be disbursed within a matter of days, the country’s arduous and long journey towards economic recovery is set to earnestly take off now.

The IMF financing along with the seal of credibility it provides to the bankrupt economy will furnish Sri Lanka with a much-needed breather to negotiate with its creditors for a debt restructuring deal to bring the country’s debt stock back on to the sustainable path and restore macroeconomic stability.

“It is now important for the Sri Lankan authorities and creditors to closely coordinate and make swift progress towards a debt treatment that restores debt sustainability under the EFF-supported programme,” IMF Senior Mission Chief for Sri Lanka Peter Breuer told reporters via a virtual press briefing on the IMF Executive Board approval, yesterday. Sri Lanka is now faced with the extremely challenging task of negotiating and coming to a deal in collaboration with the country’s creditors—both official and private— to regain debt sustainability, a process that could take time as the country should seek an equitable debt treatment plan with all creditors.

The potential risk of a domestic debt restructuring (DDR) still looms over the country and Breuer said to opt for a DDR or not is a call that the local authorities should take after weighing pros and cons.

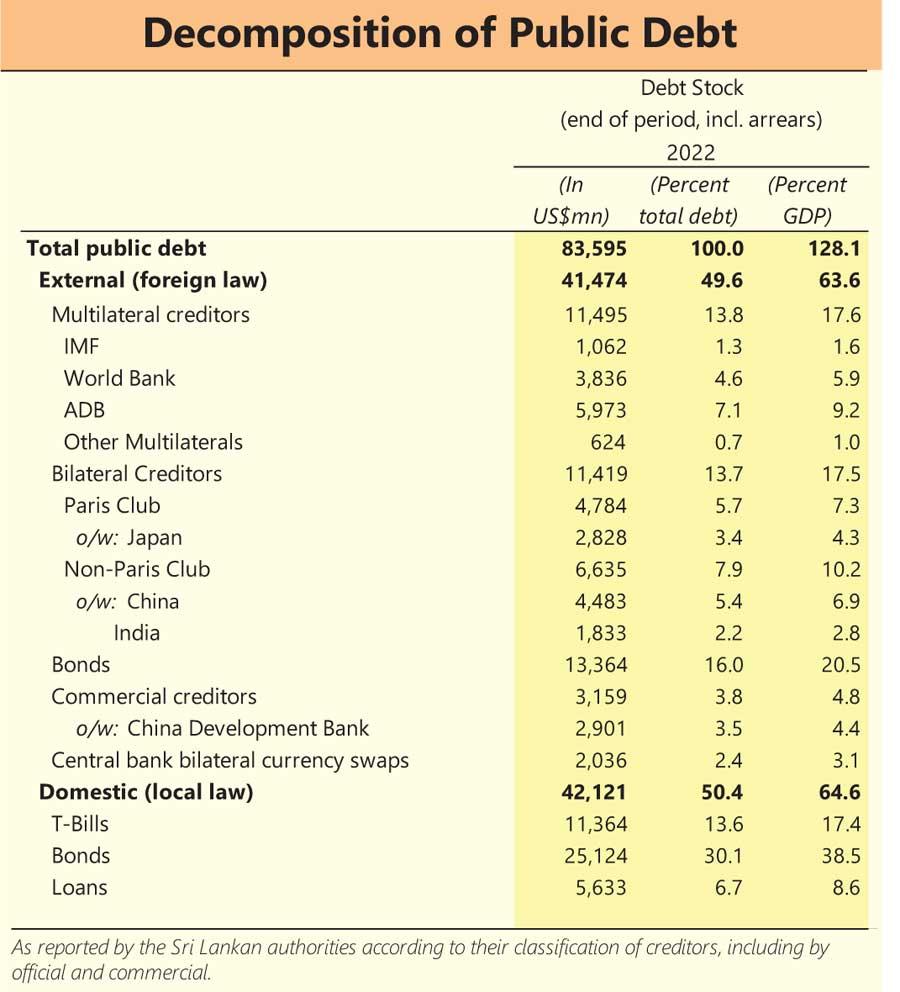

It is yet to be ascertained whether by only restructuring the external debt, Sri Lanka could achieve debt sustainability. Sri Lanka had US$ 41.4 billion foreign debt, which falls under international law and US$ 42.1 billion of domestic debt, which falls under local law, as at end of 2022. Sri Lanka’s debt-to-GDP ratio is projected to have reached 128 percent of GDP in 2022, due to exchange rate depreciation, the fiscal deficit, and negative real GDP growth.

Following fiscal adjustments and debt treatment, Sri Lanka is expected to reduce public debt below 95 percent of GDP by 2032.

Meanwhile, President Ranil Wickremesinghe yesterday said the IMF Board approval serves as an assurance that Sri Lanka has the capacity to restructure its debt and the island nation would no longer be considered as a bankrupt nation.

“Therefore, Sri Lanka can resume engaging in normal economic and business transactions from now on,” Wickremesinghe said.

He also said the import restriction currently in place would be phased out as the country’s external reserves grow strong on a priority basis. He noted that the first round of restriction easing would be on certain essential items such as medicines and goods related to tourism industry.

IMF Chief Mission for Sri Lanka Masahiro Nozaki also said yesterday that the government is expected to phase out the import and exchange restrictions currently in place.

“Authorities will develop a plan for phased removal of import restrictions and exchange restrictions related to BOP. That plan is due by June 2023,” said IMF Mission Chief Masahiro Nozaki responding to a question raised by Mirror Business.

Although Sri Lanka recently relaxed some of the import and exchange restrictions with the easing of the forex situation, rules on forex conversion and bans on certain imported consumer goods still remain.

Meanwhile, Nozaki said the bailout package offered by the IMF this time can be used for both balance of payment (BoP) and fiscal support. “IMF funding can be used to ameliorate funding pressure on the government, to repay debt and cover other expenditure needs,” he said.

Further on the exchange rate, Nozaki said the authorities are expected to commit to implement a flexible exchange rate. “Market will determine exchange rate. Interventions are only expected during adverse market conditions.”

He also said the Central Bank is expected to commit to purchase US$ 1.4 billion from the market this year to bolster the country’s external reserve position. According to IMF projections, Sri Lanka is expected to end this year with US$ 4.4 billion as foreign reserves.