Reply To:

Name - Reply Comment

West Container Terminal under construction

Premier blue-chip company John Keells Holdings PLC reported modest top and bottom-line performance for the

|

Krishan Balendra |

three months to June (1Q24), mostly stemming from rupee appreciation and higher interest costs. However, the group observes a positive trend in the broader economy, which is showing signs of rebounding from the lows experienced last year.

Sri Lanka’s largest business conglomerate, with diversified business interests, reported revenues of Rs. 63.78 billion in the April – June 2023 period, down 11 percent from the same period last year.

“During the quarter under review, Sri Lanka continued to witness normal day-to-day activities, with all key macro-economic indicators showing sustained improvement, including inflation and interest rates recording a decline, and the rupee appreciating on the back of improved foreign exchange inflows and confidence,” JKH Chairman Krishan Balendra said.

“While the macroeconomic conditions and overall stability have witnessed sustained and marked improvement, there is a lagged effect in this translating to significantly improving consumer confidence levels, which are already showing signs of recovering gradually,” he added.

JKH shares gained Rs. 1.25 or 0.79 percent yesterday, closing at Rs. 159.00.

The June performance was impacted by the transport and leisure segments, of which the revenues in rupee terms got negatively affected due to the roughly 15 percent appreciation in the rupee against the dollar compared to the opposite impact it had on revenues from the sharp depreciation in the rupee in the corresponding quarter last year.

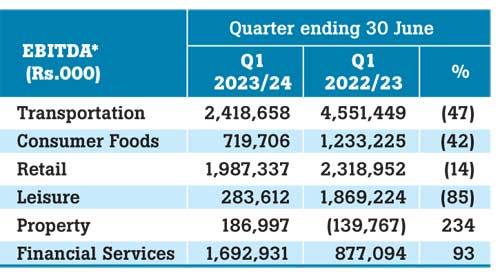

Despite better management of direct costs in the June quarter, the above two segments weighed on the group’s EBITDA, an acronym used for earnings before interest, tax, depreciation, and amortisation, which measures a business’s cash operational performance.

The group’s cost of sales came down by 9.0 percent, reflecting easing producer prices, the group’s management capabilities, and the scale advantage it commands.

The other business interests of the group consist of consumer foods, retail, financial services, commodities broking, and property development.

The group reported an EBITDA of Rs. 9.23 billion in the three months compared to Rs. 13.33 billion in the year-earlier period.

The group reported earnings of Rs. 1.06 a share or Rs. 1.47 billion in the three months under review compared to earnings of Rs. 8.14 a share or Rs. 11.28 billion in the same period last year.

earnings of Rs. 8.14 a share or Rs. 11.28 billion in the same period last year.

This was predominantly due to a Rs. 10.12 billion worth of net exchange gain on dollar-denominated cash holdings at the group level, made possible from the sharp depreciation of the rupee last year. But this has turned into a loss of Rs. 359 million in the quarter under review due to the appreciation in the rupee.

The higher interest rates regime and particularly the interest charged on the convertible debentures issued to HWIC Asia Fund in August 2022 also weighed on the group’s bottom-line.

“The interest recorded on the debenture included a notional non-cash interest of approximately Rs. 750 million, in line with the accounting treatment, due to a significant difference between the market interest rates and the 3 percent interest accrued on the instrument,” JKH said. Commenting on the group’s iconic Cinnamon Life integrated resort, Balendra expressed confidence in entering into a final agreement soon with a leading international gaming operator. “The discussions with leading international gaming operators are progressing well, where the commercial structures and arrangements are being negotiated, with a final agreement expected shortly,” he said.

Balendra also noted that the groundwork on the West Container Terminal (WCT-1) at the Port of Colombo, which is developed by JKH with India’s Adani Ports, is progressing well, with the entirety of the dredging works for both phases completed in May 2023. The construction of the quay wall has been awarded, and preliminary work has commenced.

The Captain family and entities linked to them have over 20 percent stake in JKH.