Reply To:

Name - Reply Comment

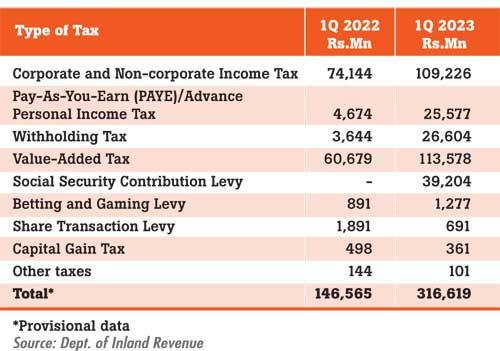

The tax collections by Inland Revenue Department (IRD) rose by a record 216 percent Year-on-Year (YoY) to Rs.316.62 billion in the first quarter of this year driven by changes in the tax policy and gradual recovery of economic activities, according to the Commissioner General of Inland Revenue Department D.R.S. Hapuarachchi.

policy and gradual recovery of economic activities, according to the Commissioner General of Inland Revenue Department D.R.S. Hapuarachchi.

In the quarter under review, revenue from Value-Added Tax (VAT) rose to Rs.113.5 billion from Rs.60.6 billion a year ago, becoming the largest source of tax collections for the IRD, overtaking the corporate and non-corporate income tax collections.

The government increased the VAT rate initially from 8 percent to 12 percent and then to 15 percent with effect from last September while removing a number of VAT exemptions.

In order secure the US$ 3 billion International Monetary Fund (IMF) bailout package, the government also increased the rates of several other taxes from the latter part of last year.

In addition, IRD stated the improvement in tax administration also contributed to the increase in tax collections.

The Corporate and Non-corporate Income Tax collections rose to Rs.109.23 billion in the quarter from Rs.74.14 billion recorded a year ago as the government increased the standard corporate income tax rate to 30 percent with effect from October 1, last year.

Meanwhile, IRD collected Rs.39.2 billion through the Social Security Contribution Levy, which came into effect on first of October last year.

The revenue through Withholding taxes rose to Rs.26.6 billion from Rs.3.64 billion a year ago.

Revenue from Personal Income Taxes for the quarter rose to Rs.25.57 billion from Rs.4.67 billion a year ago.

However, the revenue from Share Transaction Levy declined to Rs.691 million in the quarter from Rs.1.89 billion a year ago due to a sharp drop in stock market transactions. Similarly, the revenue from Capital Gains Tax also declined to Rs.361 million from Rs.498 million a year ago.

The revenue from Betting and Gaming Levy increased to Rs.1.27 billion in the quarter from.Rs.891 million a year ago.

Sri Lanka is expected to increase the tax to GDP ratio to at least 14 percent by 2025 under the current IMF programme. The authorities are also expected to introduce a property tax and gift and inheritance tax before 2025.