Reply To:

Name - Reply Comment

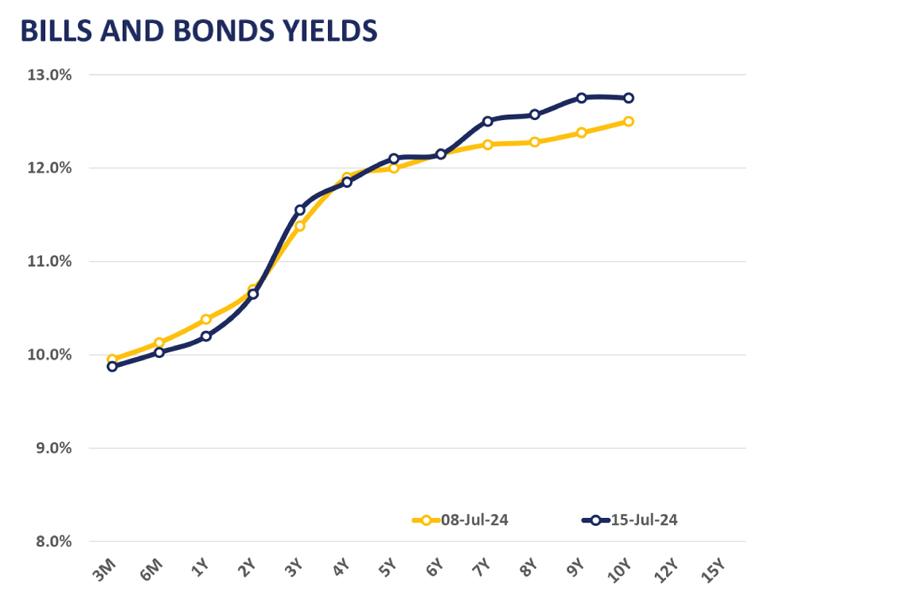

Commencing the week, the secondary market yield curve witnessed a downward trend during the day as most maturities across the curve experienced declines in rates, reversing the trend from the dull market witnessed during the previous sessions.

Furthermore, the maturities spanning from short to mid tenures, namely 2026-2030, witnessed revitalised buying interest amidst active investor participation during the day.

Trades were recorded in moderate volumes on liquid maturities 2026-2030. Accordingly, the 01.02.26 tenure traded at 10.40 percent, 01.06.26 traded at 10.70 percent and 15.12.26 traded at 10.85 percent.

Towards the mid end of the curve, 15.12.27 traded at 11.70 percent, 15.02.28 traded at 11.80 percent, 15.03.28 traded at 11.85 percent, 01.05.28 traded at 10.90 percent and 01.07.28 traded at 11.95 percent.

Moreover, 15.09.29 traded at 12.10 percent whilst 15.05.30 traded at 12.15 percent. On the external side, the Sri Lankan rupee slightly appreciated during the day registering at Rs.302.2.

The average weighted prime lending rate (AWPR) registered at 8.85 percent, recording a decline of 19 basis points for the week ending July 12, 2024.

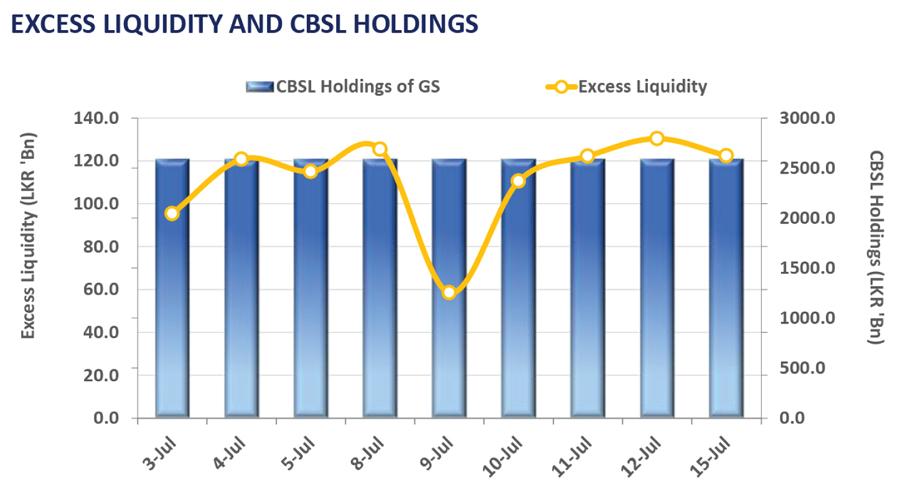

Foreign holdings declined to Rs.53.1 billion for the week ending July 11, 2024. Overnight liquidity declined to Rs.122.4 billion during the day from Rs.130.4 billion recorded during the previous day.