Reply To:

Name - Reply Comment

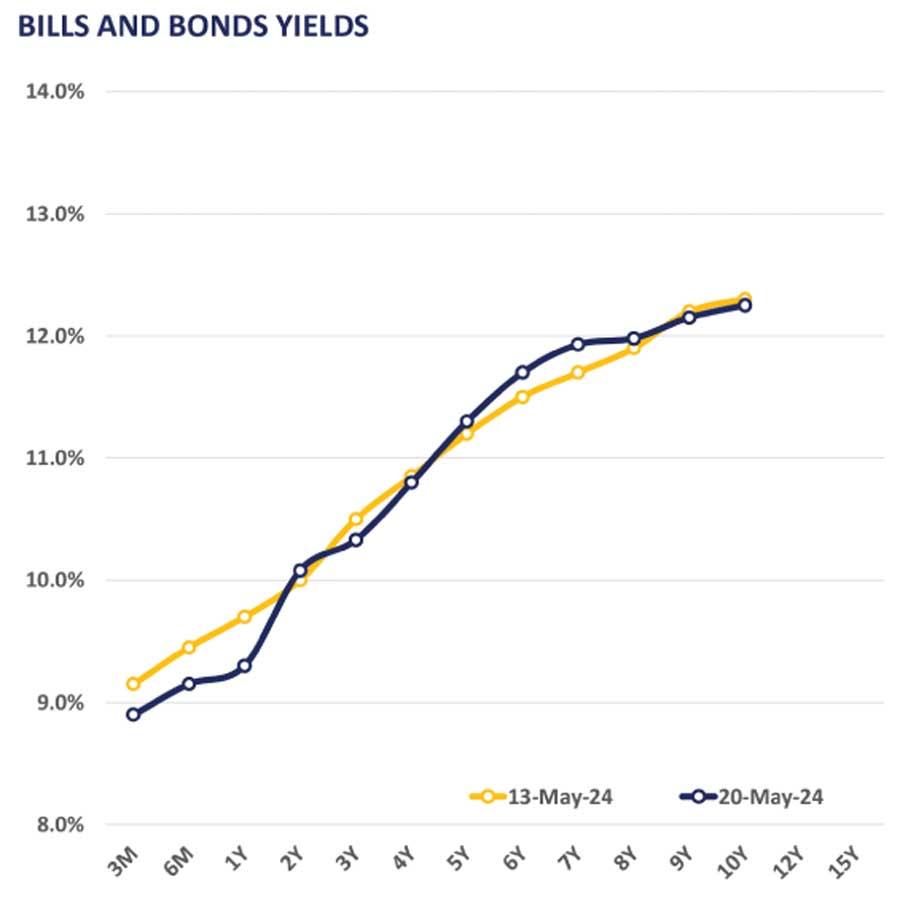

The secondary market yield curve inched up, mainly on the short to mid tenure maturities amidst slight selling interest enticed ahead of the Rs.160.0 billion T-bill auction scheduled for May 21, 2024.

Notably, liquid tenures such as 01.02.26, 01.08.26 and 15.12.26 saw transactions occurring within the range of 10.00 percent to 10.21 percent, with the 15.09.27 maturity changing hands at 10.45 percent.

Furthermore, maturities for 2028, such as 01.05.28, 01.07.28 and 15.01.28, traded within the range of 10.60 percent and 10.80 percent.

Moreover, the mid-end maturities 15.05.30 and 15.10.30 were transacted between 11.65 percent and 11.70 percent, while the tail-end maturity of 01.10.32 traded between 11.90 percent and 11.95 percent.

On the external side, the Sri Lankan rupee appreciated against the greenback closing strongly below the Rs.300.0 mark after a week. During the week ending May 17, 2024, the AWPLR continued its downward trajectory, experiencing a decline of 27 basis points week-on-week (WoW) and concluding at a nearly two-year low of 9.65 percent.

Moreover, foreign holdings in government securities decreased by 1.5 percent WoW and registered at Rs.75.9 billion as of May 16, 2024.