Reply To:

Name - Reply Comment

By Yoshitha Perera

The Covid-19 pandemic has introduced an unpredictable amount of uncertainty to not only the livelihoods of people but also to the global economy. While counties across the world continue a battle to prevent infections while implementing social-distancing strategies, on the other hand they are also attempting to stabilize markets by developing financial interventions. While managing the immediate health crisis at hand, it is also important to discuss the economic stability and the growth rate of the markets. In Sri Lanka experts have already begun measuring what kind of impact the Covid-19 pandemic could result, while they have also conjectured which countries would rebound best and when.

Daily Mirror Insight spoke to a Senior Economic Analyst and a former Director of Central Bank Vincent Mervyn Fernando to help us understand how economists measure the impact of the Covid-19 pandemic on national economies.

Where is the economy heading within the current context?

The Covid-19 pandemic is an extreme event which threatens health and economic security across the globe. Senior Economist Vincent Mervyn Fernando noted that the global pandemic will prevent nearly 24 million people across East Asia and Pacific regions from escaping poverty.

“The economic failure which will come up with Covid-19 pandemic will continue till the end 2022. Therefore, the global economy will not be estimated to recover earlier than 2023. Similarly, Sri Lanka can also expect some growth in the economy after 2023,” Mr. Fernando said.

Highlighting the four ways of measuring the impact of Covid-19 on national economies, Mr. Fernando said that the authorities could measure its impact on economic growth, the foreign sector, government of the economy and the impact on the average lifestyle.

Measuring global economic growth

Economic growth means an increase in money supply, economic output, and productivity. An economy with negative growth rates has declining wage growth and an overall contraction of the money supply.

“In terms of income, we can measure that by considering the rate of economic growth. Economic growth means continuous increase of the real GDP of the economy or real income of the economy” Mr. Fernando said.

Referring to the global economic rate of growth Mr. Fernando said that before the Covid-19 pandemic, from 2017 to 2019 the global economic rate of growth was 3.8% and for the year 2020 authorities forecasted a 3.5% growth.

He said that according to the recent facts shared by the Organization of Economic Corporation and Development (OECD) due to the spread of Covid-19, global economic growth will decline 50% up to 1.5% and this remarkable decline will happen across all advanced economies such as UK, USA and Italy.

“In USA, last year they recorded the rate of economic growth around 3-4% and for the year 2020 they forecasted 3.6% of growth. As a result of pandemic, it will reduce up to 1.5%. The same unfortunate situation will happen in UK as well. They forecasted 1.8% economic growth for the year 2020 but now they will expect only 0.4% rate of economic growth. Meanwhile, Italy will expect 0.3% growth in their economy,” Mr. Fernando noted.

Explaining further Mr. Fernando said that the decline will also happen in emerging markets such as China, India and developing economies in Asia.

“In Asia within the last three years, countries recorded average rate of economic growth of 5-7% and for the year 2020 they forecasted 6.4%. However, comparing the recent facts, the World Bank estimated that the economic growth in Asia would slow to 2.1%, compared with 6.4% predicted,” he said.

Mr. Fernando said that, in China they forecasted an economic growth rate of 6.2% for the year 2020 but now the country will revise that rate as 5.2%. Meanwhile in India, an estimated 7.7% growth earlier will be revised to a rate of 5.3%.

The Economic Fall

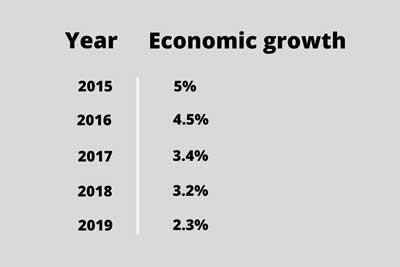

“In Sri Lanka’s point of view growth can be measured from 5% in 2015 but continuously it was recorded a slump of 2.3% till 2019” Mr. Fernando highlighted. The rate of Sri Lanka’s economic growth for past five years as follows.

In the beginning of 2020, the present government forecasted an average growth rate as 6.5% within the next five-year period. However, as a result of Easter Sunday attacks, the Central Bank revised this forecasted growth as only 4.5% for the year 2020, Mr. Fernando said.

“In the first week of March, 2020 Moody’s Analytics and International Monetary Fund (IMF) again revised the earlier forecast economic growth rate for the 2020 as 2.8%,” Mr. Fernando added further.

Sharing his views on the current growth of economy in Sri Lanka, Mr. Fernando noted that as a result of Covid-19 the economic growth may be in the range of 1% or even less in 2020.

Threat to employment

“In Sri Lanka total employment is 8 million of which 3.4 million are in the private sector, 3.2 million fall under the self-employment category and the balance 1.5 million in the government sector,” Mr. Fernando said.

These lock-downs and the Covid-19 prevention measures have resulted in an observable decline in Sri Lanka’s output or income and it will directly affect employment. “Especially there is a high risk to self-employed workers of losing their jobs. That amount is around 32% of the total employment. We can see that only certain activities have the capability to be carried out on a remote basis,” Mr. Fernando said.

Fall in Foreign Sector

Sharing his views on the development of the foreign sector in Sri Lanka, Mr. Fernando noted that the foreign sector is the severely affected area of the economy.

“When we look at the foreign sector, we can ask ourselves four basic questions. What happened to the foreign trade? What happened to the foreign services? What happened to the primary and secondary income sector and what happened to the financial sector?”

He said that in 2018 Sri Lanka’s total foreign exports amounted to USD 12 billion and in 2019 it has increased up to USD 16 billion. For 2020, the Export Development Board (EDB) forecasted USD 18.5 billion earnings from foreign exports. However last week, the EDB had revised the above mentioned target as USD 10.75 billion. “That means nearly USD 8 billion will be declined through foreign trade sector,” he said.

Highlighting the issues in the tourism sector Mr. Fernando said that Sri Lanka is mostly using tourist earnings to balance the gap between foreign trade exports and imports in the country. “In this current situation there are no tourist earnings to the country. Many of Sri Lanka’s major tourism markets will be severely affected in the pandemic situation. Also we were unable to fill the gap between foreign trade exports and imports in the country,” He said.

Mr. Fernando said that every year Sri Lanka earns nearly USD 7 billion from foreign remittance and due to the Covid-19 pandemic situation foreign earnings have been suspended. “In addition to that our foreign imports are also restricted. Normally we import 19% of the total imports from the China, another 19% imports from India, 6% from Singapore and 9% from European countries. In the present situation all the imports were stopped. So therefore, there are no imports and there are no exports. As a result of this situation, our foreign reserves will go down, our overall balance of payments should be minors and as a result our exchange rate depreciated rapidly,” Mr. Fernando said.

Financial Aid

Within this health and economic crisis, the Sri Lankan government had received several loans from different international funds. Senior Economist Vincent Mervyn Fernando noted that the country had already obtained a loan amounting to USD 500 million from China Development Bank. He said that the same institution has agreed to provide another USD 800 million loan to the country.

Meanwhile, World Bank had approved another USD 128.6 million loan to assist the Sri Lankan government.

Highlighting the in-house financial aids Mr. Fernando said that the Central Bank has already provided Rs. 250 billion to the financial sector to provide financial assistance to the persons who are suffering with financial difficulties.

“For the time being we are adopting inward looking economic strategies, as we are highly dependent the on the world economy. If the world economic crashes, it will affect to our country also. For that purpose, we have to change our economic strategy or economic plan,” Mr. Fernando concluded.