Reply To:

Name - Reply Comment

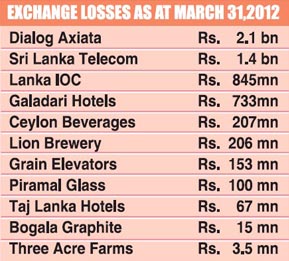

Sri Lanka’s listed corporates so far have incurred over Rs.5.7 billion loss as foreign exchange losses due to the depreciation of the Lankan rupee (LKR) against the US dollar, a quick compilation of data by Mirror Business revealed.

Sri Lanka’s listed corporates so far have incurred over Rs.5.7 billion loss as foreign exchange losses due to the depreciation of the Lankan rupee (LKR) against the US dollar, a quick compilation of data by Mirror Business revealed.

According to market analysts, as some of the listed companies that have borrowings in US dollars have not released their interim financial reports for the quarter ended March 31, 2012, the cumulative loss is likely to increase.

Since last budget in November 2011, LKR has depreciated nearly 14 percent as the country’s exchange rate policy shifted from an interventionist dollar peg to floating exchange regime.

“The Central Bank should be responsible for the exchange losses some of the companies have incurred. They encouraged corporates to opt for dollar borrowings assuring that the rupee will be kept stable against the dollar,” an analyst who preferred anonymity told Mirror Business.

Sri Lanka allowed the rupee to be determined by the market since Feb. 9 after the Central Bank spent more than $2.6 billion since last June to defend the currency, depleting foreign exchange reserves by a third.

However, he also pointed out that the companies themselves are partly responsible for the exchange losses they’ve made.

However, he also pointed out that the companies themselves are partly responsible for the exchange losses they’ve made.

“Almost everyone in the country knew that the LKR was artificially propped up and the Central Bank wouldn’t have been able to keep it up against the dollar in the long run. So they should have had some contingency plan for the worse case scenario,” he opined.

While depreciation of the LKR has become a bane for some companies, it has become a boon for several other listed firms including for the country’s commercial banks as well as the export companies.

Banks like Commercial, Hatton National, Sampath, National Development and Nations Trust posted significant increases in their bottom lines, largely boosted by foreign exchange gains.

However analysts Mirror Business talked to were little skeptical about the mid term or the long term sustainability of these exchange gains, as a few of the commercial banks have raised moneys from foreign sources fot capital requirements.

But they also stressed that since banks confront currency fluctuations almost on a daily basis, they will create strategies to tackle any loss stemming from rupee depreciation.