Reply To:

Name - Reply Comment

Sri Lanka’s total outstanding government debt stood at Rs.5902.2 billion as at end of May 2012, against Rs.4800.9 billion reported during the same period of 2011, the latest data released by the Central Bank showed.

Sri Lanka’s total outstanding government debt stood at Rs.5902.2 billion as at end of May 2012, against Rs.4800.9 billion reported during the same period of 2011, the latest data released by the Central Bank showed.

Out of the total debt, Rs.3142.5 billion was domestic debt, while foreign debt component stood at Rs.2759.7, up from Rs.2733.2 billion reported in the corresponding period of the previous year.

The government has borrowed Rs.694 billion and Rs.1985.5 billion by selling Treasury bills and Treasury bonds, respectively.

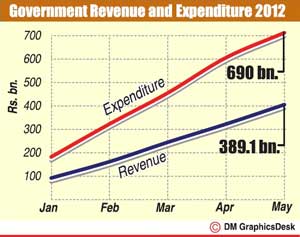

Meanwhile, the data showed that the government’s revenue, including grants stood at Rs.389.1 billion for the JanuaryMay period of the year 2012, up from Rs.357.4 billion recorded in the same period of the previous year.

The tax revenue during the five months rose to Rs.353.3 billion from Rs.315.8 billion in 2011, while non-tax revenue fell to Rs.33.3 billion from Rs.38.5 billion. Revenue from grants also fell to Rs.2.5 billion from Rs.3.1 billion in 2011.

The tax revenue during the five months rose to Rs.353.3 billion from Rs.315.8 billion in 2011, while non-tax revenue fell to Rs.33.3 billion from Rs.38.5 billion. Revenue from grants also fell to Rs.2.5 billion from Rs.3.1 billion in 2011.

The loan installment by the end of May 2012 stood at Rs.189.6 billion, up from Rs.130.5 billion in 2011, while the government’s current expenditure rose to Rs.506.4 billion from Rs.413.1 billion.

Apart from the colossal disparity between the country’s revenue and its debt situation, economists predict that the worsening global economic scenario would likely to add salt to Sri Lanka’s economic wounds.

As they point out, the slow growth in European and American economies is likely to impact on Sri Lanka’s export earnings, while rising oil and food prices will shoot up import expenditure.

The Central Bank last week said that export earnings for the months of June fell US$ 755.8 million from US$ 820.4 in the same month of the previous year, while the export earnings for the first half of the year also declined to US$ 4965 million from US$ 5075.9 million in 1H11.

The trade deficit for the first half stood at US$ 4701.5 million, up by 11.8 year-on-year.

According to economists, global developments are likely to negatively affect Sri Lanka’s economic growth, balance of payment, government revenue and inflation.