Reply To:

Name - Reply Comment

Loose regulatory guidelines with regard to gold-backed loans have been identified a key contributor to a ‘runaway growth’ in pawning loans, exposing the Sri Lankan banking industry to higher loan defaults, international credit agency Standard & Poor’s (S&P) said in a special report.

Loose regulatory guidelines with regard to gold-backed loans have been identified a key contributor to a ‘runaway growth’ in pawning loans, exposing the Sri Lankan banking industry to higher loan defaults, international credit agency Standard & Poor’s (S&P) said in a special report.

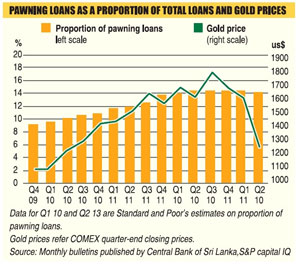

According to S&P, the zero risk weight on pawning loans in the calculation of regulator capital ratios and the absence of restrictions on loan-to-value (LTV) ratios have fuelled to a rapid growth in pawning loans in the Sri Lankan banking sector.

“The zero risk weight in Sri Lanka, in our view, underestimates the risk of price volatility in a commodity such as gold,” S&P said.

“In addition, it provides an incentive for the banks to rapidly grow their pawning portfolio without the need to hold any regulatory capital for this business.”

In neighbouring India, as the rating agency pointed out, the risk weight on pawning loans is as high as 125 percent on gold loans (after deducting collateral value adjusted for potential volatility in the gold prices).

S&P also pointed at the local regulations that restrict forced selling of pawned gold for 12 months from the date of pledge, as a deterrent against banks recovering their costs.

“Such regulations make banks vulnerable to volatility in gold prices during the restricted period.”

“Such regulations make banks vulnerable to volatility in gold prices during the restricted period.”

The rating agency also said that despite the bank lowering their LTVs this under some informal guidance from the Central Bank, there are no limitations on the maximum permissible LTV on pawning loans in Sri Lanka.

“Based on anecdotal information, the average LTVs at origin for banks declined to 60-70 percent in 2013 compared with 80-90 percent last year.

“However, most banks’ LTVs on outstanding loans will likely have spiked, given that global gold prices have already fallen about 27 percent in the first half of 2013. Loans with higher than average LTVs are more affected. We believe that for such loans the collateral value would already be lower than the loan amount.”

S&P also pointed out the non-requirement of submitting credit history of pawning borrowers to the Credit Information Bureau of Sri Lanka (CRIB) will increase the moral hazard and could adversely affect the credit culture, given that default does no harm to an individual’s credit history.

Sri Lankan banks have among the highest exposure to pawning loans as they are at a steep average annual rate of about 50 percent over the past three years, compared with average annual loan growth of 25 percent for the banking industry. Pawning loans constitute 14.4 percent of the total loan book of Sri Lanka’s banks as of March 31, 2013.