Reply To:

Name - Reply Comment

National policymakers have been grappling on the right balance between lockdowns (total or partial) and maintaining a functioning economy to safeguard the livelihood of its citizens and viability of its corporate sector. Whilst no solution seems optimal, the need for a well-orchestrated recovery strategy is central to avoid a pro-longedsupply and demand led economic recession.

National policymakers have been grappling on the right balance between lockdowns (total or partial) and maintaining a functioning economy to safeguard the livelihood of its citizens and viability of its corporate sector. Whilst no solution seems optimal, the need for a well-orchestrated recovery strategy is central to avoid a pro-longedsupply and demand led economic recession.

Sri Lanka needs to take a comprehensive review of its vulnerable sectors and put together a targeted strategy with its limited resources to support a rapid recovery.Whilst we need to recognize that this is both a supply and demand driven slowdown addressing the supply side with the right fiscal stimulus is more fundamental to facilitate a

quick recovery.

Economists across the world are debating various stimulus packages to get their countries back on track and shake off the effects of the economic crisis from COVID-19 the novel coronavirus.

As I write the number of infected have surpassed well over one million with no part of the worldsecure from this ravage. As countries struggle to put in place emergency medical personnel, hospital beds and ICU units there are early and encouraging signs that the medical community will take the right measures to push back and eventually contain COVID-19. As the focus on the medical initiatives intensifies the economic policy-makers have been working towards containing theeconomic devastation that is to follow.

The fears for the economy were highlighted by the often-repeated phase ‘if you try zeroing thecoronavirus you will end up zeroing the economy’. The potential economic devastation will be most severe on the most vulnerable poorer segments of the population.

Curfew and total lockdowns

A few countries in the world have enforced complete lockdowns. Most countries have preferreda partial lockdown where essential services such as supermarkets, pharmacies and gas stations are permitted to remain open.

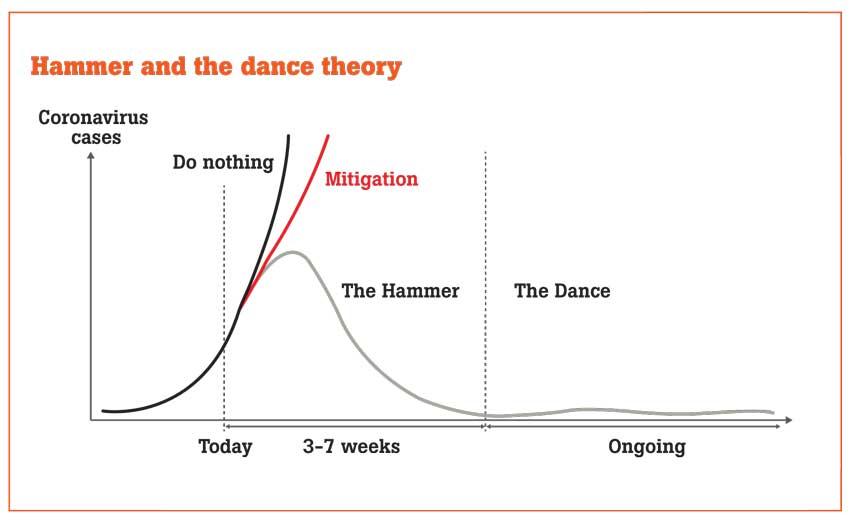

This approach is prevalent in the more developed markets. Several emerging and developing countries including Sri Lanka have opted for a stronger form of lockdown which follows the ‘Hammer and Dance’ theory. The key challenge to this approach is the question on the length of sustainability of the ‘Hammer’ or lock down period.

The success of a prolonged lockdown can only be effective if essential supplies can be made accessible or delivered to vulnerable households. The sufficiency of national resources to facilitate this support net is central to this determination. If the appropriate mechanisms are not in place to address the concerns of the vulnerable segment the short-term measures put in place to arrest the spread of COVID-19 may not be successful over the medium to long term. In light of this, Sri Lanka may need to gradually phase out of the curfew restrictions and move to anintensive testing-based approach to tackle COVID-19 in the

days ahead.

Safeguarding livelihoods

The most vulnerable segment to a pro-longed indefinite curfew is people on daily wages. It is estimated that there are 6-7 million people in the Island depended on daily incomes.

Self-employed and contract-based individuals typically have limited monetary reserves and need direct support to withstand their loss of income. Food security is the immediate concernfor this group as the number of days of the

curfew lengthen.

A prolonged curfew could also lead to job losses with some estimates putting this at around 2 million with no intervention from the state in the short term. A compounding complication in delivering a solution is that a vast majority of this group are not in the formal banking systems making it more difficult to provide direct monetary support.

Scoping stimulus package

Globally a series of economic and fiscal stimuli are being rolled out to try and counter the impacts of COVID -19.The U.S. is now taking a more aggressive stance as the epicentre of the virus shifts to New York and the U.S. Economy begins to feel its effects with unemployment levels surging to new highs.

In Asia, Singapore has one of the largest stimulus packages with US$ 33.7 billion being earmarked to counter COVID -19 fallout. The main trust of the Singapore relief package is to offset wages in the food services sector, provide co-funding to the aviation and tourism sectors and provide direct money to low income households. Most countries globally and in Asia have also put in place multi-billiondollars packages to try and soften the impact of COVID-19.

Sri Lankan roadmap

Sri Lanka needs to take a comprehensive review of the vulnerable sectors and put together a targeted strategy with its limited resources to support a rapid recovery. Whilst we need to recognize that this is both a supply and demand driven slowdown, to get the economy back on track addressing the supply side is more fundamental to facilitate a quick recovery.

On a broader macro level, Sri Lanka will be looking at slower growth, larger budget deficits and deterioration of the Balance of payments (BOP) for 2020. Most economists are now looking at GDP growth to come in around 2-3 percent depending on their views on the length of the epidemic. The budget deficit already primed with the pre COVID-19 tax cuts now needs to account for much higher health related spending programmes and slower revenue collections. On the BOP front, the drop in tourism, remittances and exports will not be offset by a lower fuel bill and import restrictions in place.

Key sectors under tremendous pressure are the Tourism, Apparel Industry, Food services and Transport sectors. Apparel industry executives are estimating an impact of around US$ 1.5 billion with a loss of revenue from the March to June period resulting in about 30 percent lay-offs. Apparel industry accounts for 6 percent of GDP and 40 percent of total exports.

To-date, the State has rolled out several commendable measures on both the fiscal and monetary side. Whilst the monetary initiatives have been robust fiscal stimulus could be more-hard hitting and far-sighted.

The monetary initiatives centred around liquidity injections (from a series of rate cuts and profit transfers) needs to take into far greater account the linkages between monetary stability and the exchange rate soft peg. In particular, the widening of the US$ sovereign credit spreads warrants full attention.

The quantitative easing measures deployed would typically lead to higher inflation and rupee depreciation. In this environment of low demand, inflation pressures maybe better contained and the U.S. economy woes may take some of the sting out of the Rupee depreciation. A sharp fall in the rupee against the dollar raises concerns on the ability to re-pay dollar liabilities.

Fiscal stimulus key to economic management and recovery

On the fiscal font, several short-term measures centred around extension of deadlines for payment of taxes, utility bills, personal loans, grace period for lease payments, etc. have provided much needed immediate relief.

Direct support measures including providing Rs. 5,000 as single payment to low income families, Rs. 50 billion bailout package for COVID-19 hit business can be effective under proper administration and deployment.

Several of the fiscal measures announced, directly impact the banking sector.Whilst the efforts to get the banking sector to share the painis sensible, attempts to use the banking sector as a first line of defence by absorbing a large portion of the full economic impact is fraught with dangers.

The bank sector is already struggling with non-performing loans and is poorly equipped to take a full hit and more importantly a weakened banking sector will make it a huge challenge to engineer the post crisis economic recovery.

The Sri Lankan government in its COVID-19 combat tool-kit has several levers to deploy. The proposed direct pay outs from the Employee’s Provident Fund to its members by the Prime Minister senior advisor Nivard Cabraal is thinking in the right direction. Some other initiatives for the government to consider targeting key vulnerable sectors is partially offsetting of wages in the tourism and apparel industry and provided unpaid leave and work insurance cover for vulnerable segments.

In conclusion, whilst the Presidential Task Force on COVID-19 is focused on containing the virus and supporting livelihoods a separate Task Force needs to be composed to develop the post COVID-19 economic recovery roadmap to ensure the administration vision of ‘Vistas of Prosperity and Splendour’ remain on the horizon.

(The writer is a Singapore-based Investment Banker and former Economist. He has also served on the National Council for Economic Development. This article represents the author’s personal views)