Reply To:

Name - Reply Comment

Cyber risk has emerged as a significant threat to the financial system. An International Monetary Fund (IMF) staff modelling exercise estimates that the average annual losses to financial institutions from cyberattacks could reach a few hundred billion dollars a year, eroding bank profits and potentially threatening financial stability.

Cyber risk has emerged as a significant threat to the financial system. An International Monetary Fund (IMF) staff modelling exercise estimates that the average annual losses to financial institutions from cyberattacks could reach a few hundred billion dollars a year, eroding bank profits and potentially threatening financial stability.

Recent cases show that the threat is real. Successful attacks have already resulted in data breaches in which thieves gained access to confidential information and fraud, such as the theft of US $ 500 million from the Coincheck cryptocurrency exchange. And there is the threat that a targeted institution could be left unable to operate.

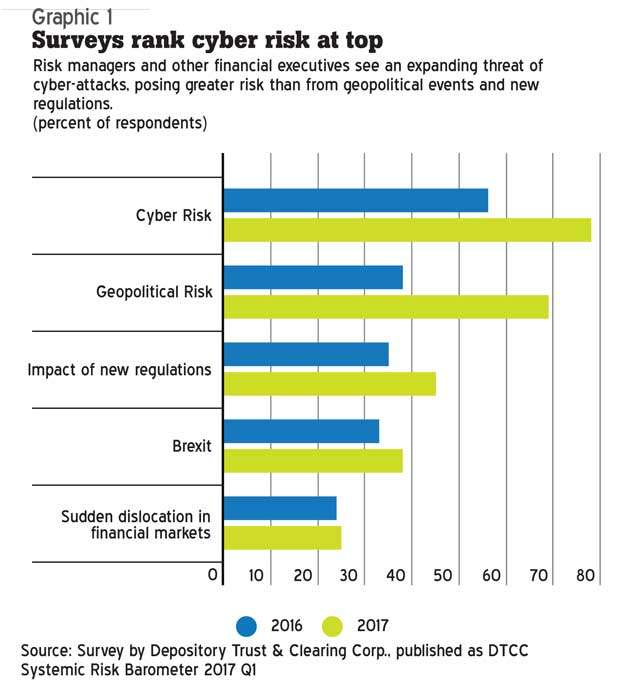

Not surprisingly, surveys consistently show that risk managers and other executives at financial institutions worry most about cyber-attacks, as in Graphic 1.

Financial sector’s vulnerability

The financial sector is particularly vulnerable to cyberattacks. These institutions are attractive targets because of their crucial role in intermediating funds. A successful cyberattack on one institution could spread rapidly through the highly interconnected financial system. Many institutions still use older systems that might not be resilient to cyberattacks. And a successful cyberattack can have direct material consequences through financial losses as well as indirect costs such as diminished reputation.

Recent high-profile cases have increasingly put cyber risk on the agenda of the official sector—including international organisations. However, quantitative analysis of cyber risk is still at an early stage, especially due to the lack of data on the cost of cyberattacks and difficulties in modelling cyber risk. A recent IMF study provides a framework for thinking about potential losses due to cyberattacks with a focus on the financial sector.

Estimating potential losses

The modelling framework uses techniques from actuarial science and operational risk measurement to estimate aggregate losses from cyberattacks. This requires an assessment of the frequency of cyberattacks on financial institutions and an idea of the distribution of losses from such events. Numerical simulations can then be used to estimate the distribution of aggregate cyberattack losses.

We illustrate our framework using a data set covering recent losses due to cyberattacks in 50 countries. This provides an example of how potential losses for financial institutions could be estimated. The exercise is difficult and is made even more challenging by major data gaps on cyber risk. Moreover, thankfully, there has yet been no successful, large-scale cyber-attack on the financial system.

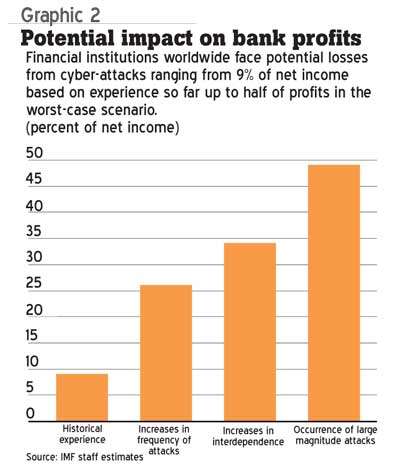

Our results should thus be considered as illustrative. Taken at face value, they suggest that average annual potential losses from cyberattacks may be large, close to 9 percent of banks’ net income globally or around US $ 100 billion. In a severe scenario—in which the frequency of cyberattacks would be twice as high as in the past with greater contagion— losses could be 2½–3½ times as high as this or US $ 270 billion to US $ 350 billion.

The framework could be used to examine extreme risk scenarios involving massive attacks. The distribution of the data we have collected suggests that in such scenarios, representing the worst 5 percent of cases, average potential losses could reach as high as half of banks’ net income, putting the financial sector at risk.

Such estimated losses are several orders of magnitude greater than the present size of the cyber insurance market. Despite recent growth, the insurance market for cyber risk remains small with around US $ 3 billion in premiums globally in 2017. Most financial institutions do not even carry cyber insurance. Coverage is limited and insurers face challenges in evaluating risk because of uncertainty about cyber exposures, lack of data and possible contagion effects.

The way forward

There is much scope to improve risk assessments. Government collection of more granular, consistent and complete data on the frequency and impact of cyberattacks would help assess risk for the financial sector. Requirements to report breaches—such as considered under the EU’s General Data Protection Regulation—should improve knowledge of cyberattacks. Scenario analysis could be used to develop a comprehensive assessment of how cyberattacks could spread and design adequate responses by private institutions and governments.

Further work is needed also to understand how to strengthen the resilience of financial institutions and infrastructures, both to reduce the odds of a successful cyberattack but also to facilitate smooth and rapid recovery. There is also a need to build capacity in the official sector in many parts of the world to monitor and regulate such risks.

In sum, strengthening the regulatory and supervisory frameworks for cyber risk is needed and efforts should focus on effective supervisory practices, realistic vulnerability and recovery testing and contingency planning. The IMF is providing technical assistance to help member countries improve their regulatory and supervisory frameworks.

(Christine Lagarde is Managing Director of International Monetary Fund)