Many developing countries including Singapore/Malaysia /South Korea and more recently Vietnam and Thailand have succeeded in attracting Foreign Direct Investment (mainly through firm level integration with global MNEs : Multi National Enterprises) to grow their economies exponentially and propel them to the top of the industrialized nations.

The economic climate certainly has changed radically during the last four (4) years, post COVID pandemic and the global recession which follows and which we are riding at this moment in time. Surprisingly the share of FDI into Vietnam from 2021- to the first 8 months of 2022 has jumped nearly 50 percent of the regional Investment flows to

developing Asia.

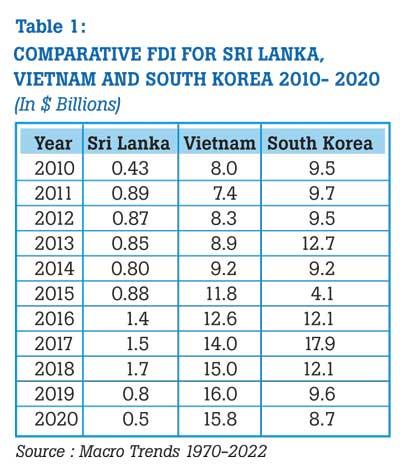

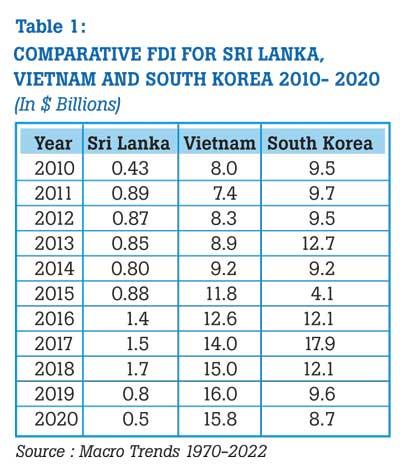

It’s worth looking deeper as to why this is taking place while countries like ours (Sri Lanka) are even losing the little FDI we had been receiving since 2010 (see Table 1).

FDI Story Board

The FDI story board for Sri Lanka does not look too impressive, but the underlying factors for Vietnam’s resurgence in particular has many lessons for Sri Lanka to learn. Vietnam’s attractiveness to investors is so intense that it had registered 70 percent increase from 2020 to 2022. The 2021 FDI globally was US$ 619 billion of which more than one thirds has flowed to South East Asia– (US$175 bn) and US$ 52 bn to South Asia (India attracting most of it in US$ 42 bn).

The explanation for this spurt in growth of FDIs in Vietnam was explained by a doctoral scholar ( Bram Nicholas) from Ho Chi Min City University at a recent seminar where he summarised the growth strategy as follows:

- Effective economic structures (particularly the Investment Promotion Agencies i.e. BOI in Sri Lanka)

- Shorter lead times for approvals

- Stable trade policies (bilateral and multilateral trade agreements especially those with EU/China/HKG and South Korea) .

- Almost zero pressure groups to disturb the equilibrium and 5. Categorical shift from base exports (like ore/produce and apparel) to value added/electronic/manufacturing exports.

Global Investment Competitiveness

The above analysis is supported by the Global Investment Competitiveness Report of the World Bank (2020) which identifies (1) Policy Predictability (2) Regulatory Certainty and (3) targeted Investment promotion as success factors in attracting FDI to locations in the various regions.

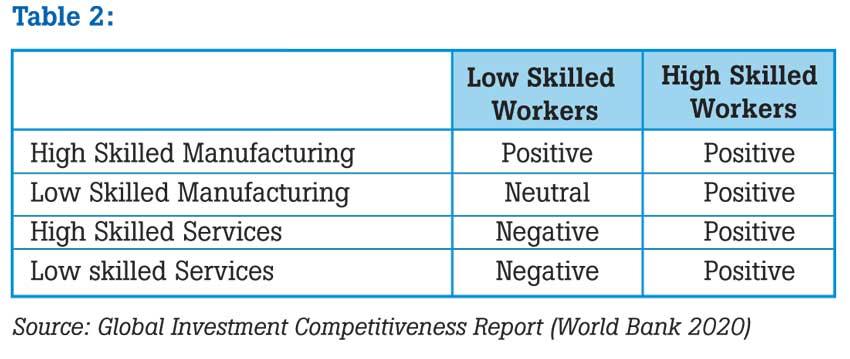

Such macro stability reduces investor risk .Regulatory certainty along with speed of dispute resolution and quality of judicial processes encourage investors to gravitate towards specific locations . The key arbiter in this FDI attractiveness spectrum is ‘worker skills’ interestingly higher skilled workers have a positive correlation with both manufacturing and service sectors:

The survey of the 11 countries by World Bank reveals that FDI disproportionately favours locations /countries with better educated and higher skilled workers compared to lower skilled segments.

Against the backdrop of heightened policy uncertainty in trade and investment, the pandemic has further escalated uncertainty, magnifying investment risks, and depressing foreign investor confidence. So it is critical for countries keen on attracting FDI to address/remedy some of the following.

Key findings of the World Bank survey are:

- Two-thirds of investors (representing US$ 400 bn) report that policy uncertainty due to protectionism and economic nationalism in trade and investment is either ‘important’ or ‘critically important’ in their investment decisions. So, civil society agitation and state action on nationalization will certainly dampen investor interest.

- Investor confidence decreases when the direction of policy making is unclear or unpredictable. Large firms (those with more than 250 employees) have been particularly sensitive to the effects of policy uncertainty.

- The effect of policy uncertainty in trade and investment—combined with domestic factors, such as macroeconomic fundamentals, political developments, and the legal and regulatory environment—are likely to shape foreign investors’ investment plans .

- The top three factors influencing investment decisions are political stability, macroeconomic stability, and a country’s legal and regulatory environment /nearly 9 in 10 businesses consider them to be ‘critically important’ (they rank them ahead of considerations such as low tax rates, low labour and input costs, and access to resource endowments ).

- Large firms (those with more than 250 employees) rank an enabling regulatory environment as their top investment consideration. Investors who encounter major legal and regulatory obstacles are more likely to reduce or withdraw investment.

- In addition to short-term crisis response, governments should address international and domestic sources of policy uncertainty by reaffirming commitments to global and regional trade and investment systems, The GOSL’s efforts to renew/speed up Free Trade Agreements (particularly with Japan/Singapore/China and India ) augurs well.

Investment Promotion Agencies (IPA) and the impact on FDI acceleration

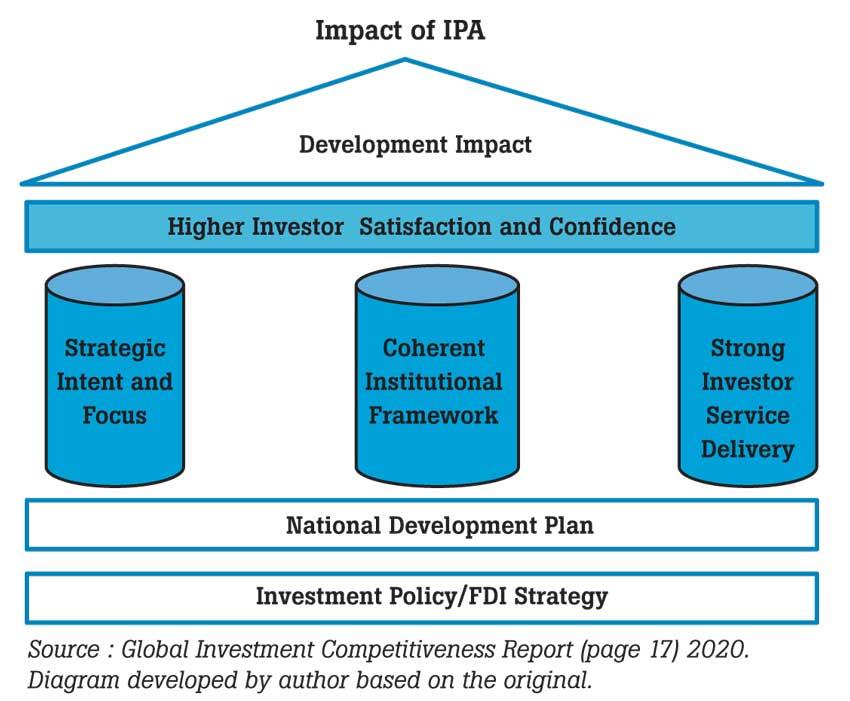

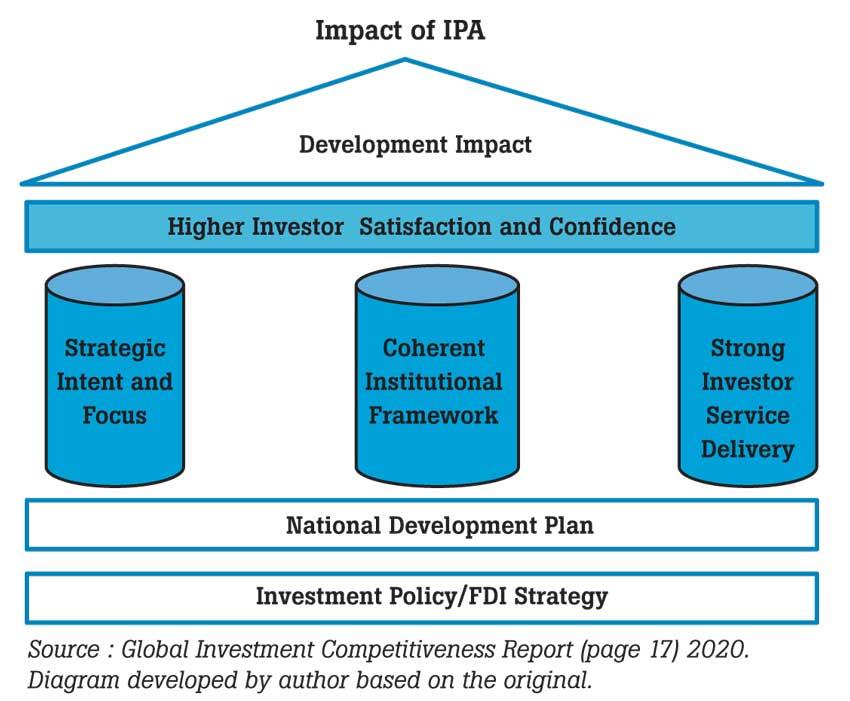

Targeted investment promotion is made easier by a coherent investment infrastructure , sound Investment Policy and FDI strategy. This could be seen in the diagram.

Key success factors of high performing IPAs in developing countries include :

- High-level government support (from the president or prime minister), granting a high priority to investment or foreign direct investment [FDI]) and directly or indirectly championing them would positively influence investors.

- Strong strategic alignment following consultations with public and private sectors and cascading them into a national development plan or FDI strategy and the IPA corporate plans with industry-specific strategies favours FDI decisions.

- A clear, uncontested mandate, ideally focused on investment promotion, especially when restructuring the IPA, including one-stop shops are best performed by a separate public institution that ensures proper delivery of this essential function without compromising the essential investment promotion mandate of the IPA.( i.e. our BOI needs re orienting)

- A high degree of institutional and financial autonomy (or semi autonomy) with flexibility to act according to agreed-upon strategic plans (To hire staff with transparent job qualifications and avoiding political interference ) certainly is seen positively ensuring sustainability through political cycles.

- An independent and well-functioning board of directors or advisory board with strong and active private sector representation to better understand investors is another favored factor.

- A strong investor-centric service orientation to design and provide relevant and high-quality services to investors throughout their investment cycle too supports investment decisions.

- Management and key promotion staff with strong private sector experience, as well as international exposure and language skills, within the IPA’s mix of employees is a must.

- Sufficient and sustained financial resources over three to five-year periods to provide continuity of strategic efforts over the long haul of investment promotion prevents campaigns being abandoned.

The main direction of an investment promotion policy should therefore support (1) Reaffirming trade and FTA commitments (2) Strong Institutions and Good Governance too promote political stability in the eyes of Multi National Enterprise /firms which target developing economies (3) Optimizing macroeconomic policy specially when rolling over debt restructuring is critical. Once confidence is restored inward flows can be relied on for many years. (4) Improving legal frameworks to reduce any dispute resolution time frames would greatly encourage investor confidence too. In many ways the recession and the more cautious outlook of investors should encourage us to better plan and strategize our investment opportunities in the growth sectors.

(The author is a retired Senior Consultant of the IDA, World Bank. An Institutional Specialist in several multilateral donor funded projects including the ADB, JICA and UNDP over twenty years and an equal numbers of years in the private sector. He is a double masters holder MBA (PIM) and M.Sc (OB) Lon. He can be reached at

[email protected])

Many developing countries including Singapore/Malaysia /South Korea and more recently Vietnam and Thailand have succeeded in attracting Foreign Direct Investment (mainly through firm level integration with global MNEs : Multi National Enterprises) to grow their economies exponentially and propel them to the top of the industrialized nations.

Many developing countries including Singapore/Malaysia /South Korea and more recently Vietnam and Thailand have succeeded in attracting Foreign Direct Investment (mainly through firm level integration with global MNEs : Multi National Enterprises) to grow their economies exponentially and propel them to the top of the industrialized nations.