Reply To:

Name - Reply Comment

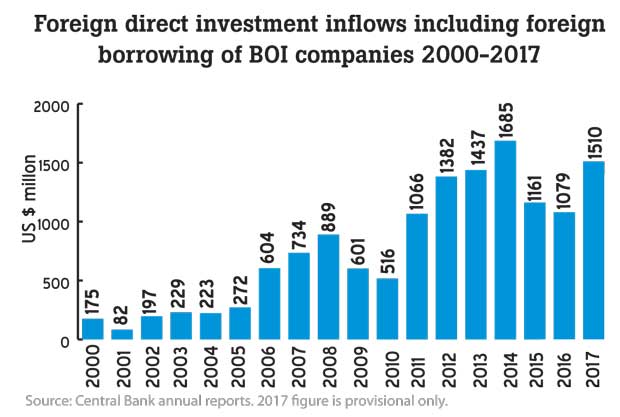

Finance State Minister Eran Wickramaratne, addressing Investor Forum 2018 in Mumbai recently, has said that the government has formulated plans to increase the per capita income to US $ 5,000 and foreign direct investments (FDIs) to US $ 5 billion per year. According to him, Sri Lanka’s economic outlook and investment opportunities are positive. Sri Lanka’s per capita income is around US $ 3,850 and the FDIs, excluding the loans to the Board of Investment (BOI) companies, are even below Rs.1 billion per year.

Finance State Minister Eran Wickramaratne, addressing Investor Forum 2018 in Mumbai recently, has said that the government has formulated plans to increase the per capita income to US $ 5,000 and foreign direct investments (FDIs) to US $ 5 billion per year. According to him, Sri Lanka’s economic outlook and investment opportunities are positive. Sri Lanka’s per capita income is around US $ 3,850 and the FDIs, excluding the loans to the Board of Investment (BOI) companies, are even below Rs.1 billion per year.

For a small economy (US $ 83 billion) like Sri Lanka, with a domestic consumer market of a mere 21 million, even with 2.0-2.5 million foreign travellers, the external demand from the international markets for Sri Lankan products and services is critical, in order to sustain medium-term economic growth.

However, the Sri Lankan external sector performance – balance of trade – remains a critical issue mainly due to a steady deterioration in the competitiveness of the exports, coupled with low productivity, lack of consistent policies, implementation snags, red tape, etc. It is regretted to mention that an export-led growth strategy, which has been practiced for many years, has become a mere slogan.

Recent Central Bank press releases and other economic indicators

The recent Central Bank press releases highlight the positive side.

“Capital inflows reflecting the favourable developments in the external sector, the BOP recorded a surplus of US $ 2,068 million in 2017, while gross official reserves of the country stood at US $ 8 billion as at end-2017,” a Central Bank release said.

These foreign reserves are not ‘earned’ but with additional foreign borrowings, which include the issue of international sovereign bonds and sale proceeds from the Hambantota port transfer, etc. Although the earnings from exports increased in 2017 (US $ 11.4 billion from US $ 10.3 billion), the increase in import expenditure resulted in widening the trade deficit. The year-end run on imports pushes the trade deficit highest since 2012 (US $ 9,620 million)

The Sri Lankan per capita income is stagnated during the last three to four years and it is around US $ 3,850 now. This figure doesn’t really show the income inequality and huge disparity among the rural ‘bottom of the pyramid’ people, where more than 25 percent of the people are living below the poverty indicators set by the World Bank.

Based on the World Bank statistics, the gross domestic product (GDP) per capita for Sri Lanka in 2016 was US $ 22,195 and for Singapore it was US $ 87,832 (ppp adjusted). As far back as 1950s, both countries’ GDP per capita were more or less the same, around US $ 160.

A Sri Lankan high-calibre professional working in Singapore, on a short holiday to Sri Lanka recently told the writer: “It is sad to see that the Sri Lankan economy is deteriorating from bad to worse. Singapore was once a county that benchmarked itself with Sri Lanka for development. However, today they are light years ahead of us and our development is basically the opposite. Further, due to this plight, our country is also losing some of its very best human resources to other countries; such as this will only add to our negative growth.”

Continued inflows by way of tourist earnings and workers’ remittances, however, have contributed in curtailing the expanded trade deficit to a certain extent.

The Central Bank stated: “The cumulative trade deficit increased during 2017, reflecting higher import expenditure caused by weather-related factors, offsetting the notable increase in export earnings.”

The real reasons are many and in my view, it’s due to, in simple terms, “bad management”.

On a cumulative basis, import expenditure recorded its historically highest value of US $ 21 billion in 2017. This was largely led by higher imports of fuel and rice, wheat imports and refined petroleum products during the year. Import expenditure on rice and wheat increased to fulfil the shortage in the domestic market due to serious loss of rice production by as much as 50 percent to a mere 2,300 million metric tonnes during last year compared to the average of 4,600 million metric tonnes during the previous years.

Furthermore, the import expenditure on machinery and equipment declined due to the lower imports of engineering equipment and electrical machinery and equipment. Also, the import of cement and fertilizer declined during the year. India (21.4 percent), China (18.8 percent), the UAE (7.5 percent), Singapore (6.2 percent) and Japan (5 percent) were the main import origins, accounting for about 59 percent of the total imports during 2017.

Persistent savings: Investment gap in Sri Lankan economy

The real issue lies with the shortfall in the investment required for the desired economic growth.

Low levels of FDI inflows have been a chronic issue in the Sri Lankan economy. Therefore, it has to be some kind of an ‘investment-led growth strategy’ that could drive the export sector and economic growth.

As development economists have identified, the obstacles to development are self-reinforcing where, low levels of household income preventing domestic savings, which in turn retard capital formation, thus low investments hinder productivity growth and keep the household income back at low levels. This is the poverty-growth vicious cycle.

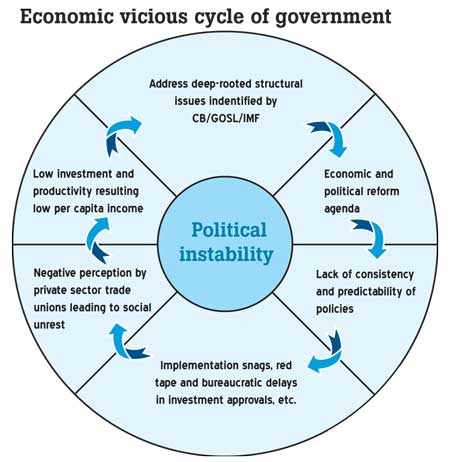

As a result, the successive governments are compelled to borrow funds to finance the deficits. In addition to this, the public sector inefficiency, lack of coordination among ministries and departments and human resource skill gaps, coupled with political instability, have contributed to the poor performance.

Economic vicious cycle cripples public life

The Central Bank has been repeatedly emphasizing the need to address these ‘deep-rooted structural issues’ in the economy, which have prevented the country from maintaining a high and sustainable GDP growth rate over time (Page 27 of CB 2016).

According to the world economic outlook of the International Monetary Fund (IMF)/World Bank, the global economy gained momentum. Therefore, one can argue that the low export performance has been due to the supply-side issues than demand-side and therefore, signing free trade agreements alone will not reverse the trends. The writer has further developed a new economic vicious cycle stemming from lack of policy cohesiveness on the part of the government.

Conclusion

As can be seen, low levels of FDI inflows have been a chronic issue in the Sri Lankan economy. Therefore, a more vibrant ‘investment-led growth strategy’ needs to be implemented that will eventually drive the export sector and the economic growth. The balance of trade remains a critical issue, mainly due to a steady deterioration in the competitiveness of the exports, coupled with low domestic productivity resorting to heavy dependency on import of consumer goods, including rice, wheat, milk, sugar and other staple foods. It seems the fiscal austerity programme recommended by the IMF/World Bank will not reap the benefits and it can lead to more social unrest than solving deep-rooted structural issues.

The policy inconsistencies and poor coordination among ministries and departments and implementation snags need to be addressed and corrected by the government of the day without any further delay. Therefore, inculcating a strong work ethic culture becomes the necessary prerequisite. It is also necessary to enhance investor confidence and have political stability, thus creating a conducive environment to make trade and investments more efficient.

How can this national unity government solve the ‘poverty-growth’ vicious cycle of the people and the country as a whole, when they can’t get over from their own ‘vicious cycle’ as articulated in the writer’s model?

(Jayampathy Molligoda is a Fellow Member of the Institute of Chartered Accountants of Sri Lanka. He has obtained his MBA from the Postgraduate Institute of Management and has also successfully completed an Executive Strategy Programme at Victoria University Melbourne, Australia. He counts over 37 years of executive experience in the fields of financial management, strategic planning and human resource development. At present, he serves as Executive Deputy Chairman of a leading public quoted company. He can be reached at [email protected])