Reply To:

Name - Reply Comment

By First Capital Research

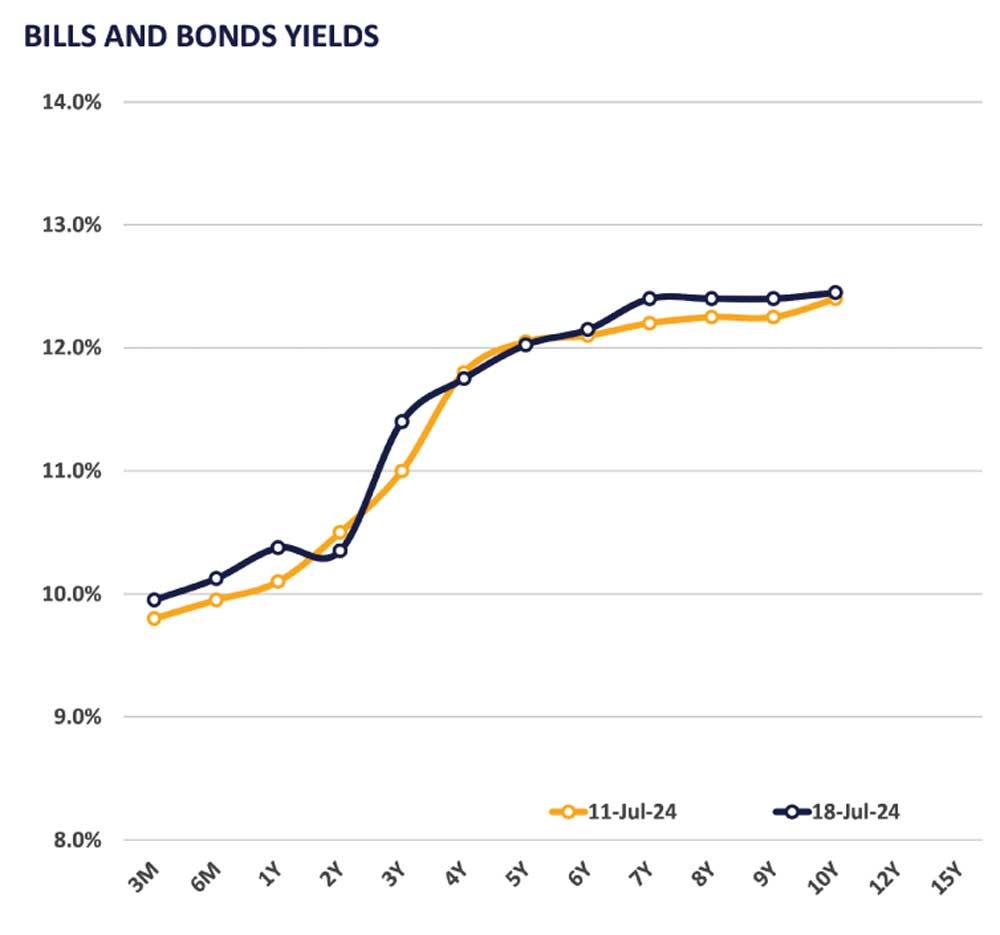

The secondary market moved into the fourth consecutive session of increased buying interest.

The belly end of the yield curve centered buying interest amongst maturities between 2026 to 2028, while the long end of the curve remained steady. Among the traded maturities, short term tenors 01.02.26 traded at a rate of 10.15%.

Meanwhile, mid-term tenors experienced heightened buying interest notably amongst the 2028 maturities with 01.08.26, 15.02.28, 15.03.28, 01.05.28, and 01.07.28 closing trades at 10.35%, 11.68%, 11.75%, 11.75%, and 11.80% respectively.

Similarly, mid-term tenors 01.05.27, 15.12.27, 15.09.29, 15.05.30, and 01.12.31 traded at rates of 11.35%, 11.60%, 12.00%, 12.15%, and 12.40% respectively. Furthermore, in May 2024, Sri Lanka’s private credit surged by Rs. 60.7bn, rebounding from April’s contraction, to reach Rs. 7.4tn.

On the external front, LKR depreciated against the USD, closing at 303.8/USD, compared to 303.3/USD recorded the previous day.

Meanwhile, CBSL Holdings of government securities remained at Rs. 2,595.6bn yesterday. Overnight liquidity in the banking system contracted to Rs. 94.6bn from Rs. 117.2bn recorded the previous day.