Reply To:

Name - Reply Comment

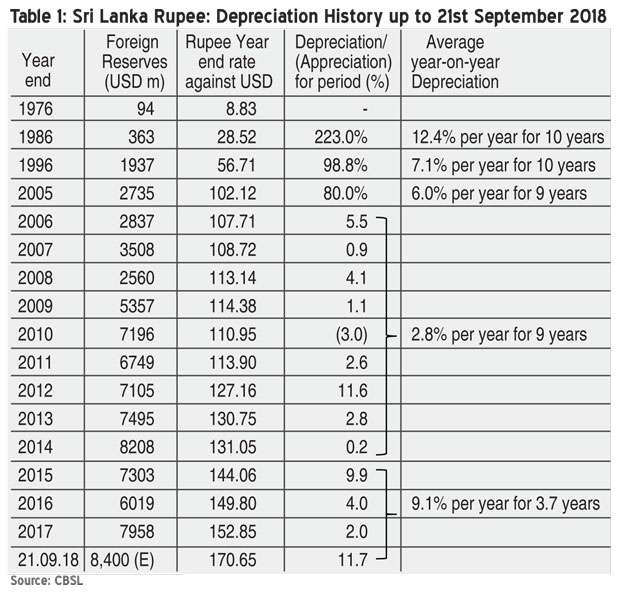

The rupee depreciated by Rs.29 from 2005 to 2014 and the average year-on-year (YoY) depreciation of the Sri Lankan rupee was 2.8 percent per year. The official foreign reserves increased from US $ 2.7 billion to US $ 8.2 billion over the same period.

The rupee depreciated by Rs.29 from 2005 to 2014 and the average year-on-year (YoY) depreciation of the Sri Lankan rupee was 2.8 percent per year. The official foreign reserves increased from US $ 2.7 billion to US $ 8.2 billion over the same period.

In stark contrast, the average YoY depreciation of the rupee from 01.01.2015 to 21.09.2018 was 9.2 percent per year. The official foreign reserves have been almost flat at around US $ 8.4 billion when compared to the level at end-2014. Further, the reserves are expected to decline rapidly from now onwards with the Central Bank (reportedly) having supplied a staggering US $ 60 million (Rs.10,200 million) to the forex market just yesterday, to artificially prop up the crashing rupee.

The government has claimed that the reason for the rapid depreciation of the rupee is the strengthening of the US economy and with that, the US dollar. Many government MPs rush to explain that all currencies have depreciated against the US dollar. To support that contention, the Central Bank has carefully selected certain currencies as examples, while neglecting to mention that several have depreciated much less against the US dollar than the Sri Lankan rupee. Knowledgeable analysts know that such contentions are highly amateurish and not tenable, particularly in the context of the Sri Lankan rupee even depreciating against the Bangladesh, Zimbabwean and Ethiopian currencies.

In any event, all analysts have been fully aware from about an year ago that the US economy has been gradually strengthening and that the US dollar would be stronger from about mid-2018 onwards. That outcome should have been anticipated by the Sri Lankan government and the Central Bank as well and the necessary policy measures should have been implemented well in advance to build up spaces in the Sri Lankan economy in general and the Central Bank’s forex reserves in particular. If the government and Central Bank did not prepare for those challenges and were “caught napping” as they now seem to be indirectly admitting, they have only themselves to blame.

To side-step the present turmoil and shift blame in his characteristic style, the prime minister recently claimed that the rupee has suffered a depreciation of 12 percent in 2012, even after the Central Bank incurred a large loss of its reserves. In that regard, the prime minister needs to be appraised that central banks all over the world carry out such forex interventions in the interest of economic and price stability and that Sri Lanka is no different.

At the same time, it must also be pointed out to him that the Central Bank reserves actually increased by US $ 356 million, from US $ 6,749 million, as at end-2011, to US $ 7,105 as at end-2012 and that therefore, contrary to his claim, there was no loss of reserves in that year even after the forex intervention.

Overall, the Central Bank reserves increased from a significantly low level of US $ 2,735 million as at end-2005 to a comfortable level of US $ 8,208 million by end-2014, under the previous Rajapaksa administration. (Please see Table 1). The Table also reveals that, under Prime Minister Ranil Wickremesinghe, the reserves have decreased considerably from the level of US $ 8,208 million by end-2014, first to US $ 7,303 million by end-2015, then to US $ 6,019 million by end-2016 and thereafter to US $ 7,958 million by end-2017.

Such massive reductions in forex reserves were obviously due to significant interventions by the Central Bank to maintain the value of the rupee. However, it will be noted that even with a net dissipation of US $ 905 million of reserves in 2015, the rupee depreciated by a substantial Rs.13.01 per US dollar (9.9 percent), while in 2016, with a net dissipation of a staggering US $ 1,284 million, the rupee had depreciated by Rs.5.74 (4.0 percent) per US dollar.

Table 1 also shows the level of reserves as well as the depreciation of the Sri Lankan rupee at various time intervals since the liberalisation of the economy in 1977. From that Table it would be seen that the Sri Lankan rupee suffered an average YoY depreciation of a devastating 12.4 percent per year for 10 years from 1977 to 1986, an average YoY depreciation of a highly detrimental 9.9 percent per year for 10 years from 1987 to 1996 and an average YoY depreciation of an equally damaging 6.0 percent per year for nine years from 1997 to 2005.

Thereafter, the Table shows that in the nine years from 2006 to 2014, the rupee has enjoyed its most stable era in recent history, with the average YoY depreciation recording a manageable 2.9 percent; with the depreciation of the rupee in the two years 2013 and 2014 (just before the management of the economy passed to the UNP/SLFP combine) being 2.8 percent and 0.2 percent, respectively.

Since 2015 however, reckless policies adopted by the present authorities had seriously jeopardized the stable trend followed by the rupee from 2006 to 2014. Consequently, the currency had assumed an unstable nature, recording frequent patches of volatility, culminating in the current “out-of-control” phase, which is now spelling disaster for the entire economy.

This de-stability has been compounded by the fact that confusing signals have been emanating from those in authority, almost daily. Prime Minister Ranil Wickremesinghe claims the “depreciation problem” will be fixed in one month but warns that the government may have to curtail imports; Finance Minister Mangala Samaraweera says the Central Bank will not intervene as the reserves have to be safeguarded to settle future debt.

Economic guru and State Minister Harsha Silva announces that the depreciation of the rupee is “beneficial” to the economy but requests high income people to postpone buying luxury cars and to delay trips to Alaska. Finance State Minister Eran Wickremaratne proudly asserts the Sri Lankan rupee is the “strongest currency in Asia”. Governor Dr. Indrajit Coomaraswamy proclaims the Central Bank is “ready to prevent excessive volatility”. Senior Deputy Governor Dr. Nandalal Weerasinghe insists the Central Bank “will intervene aggressively”.

Meanwhile, the International Monetary Fund cautions the Central Bank needs to build up further reserves instead of intervening, while currency dealers refuse to speak, citing instructions from the Central Bank. Through all this, President Sirisena keeps silent, perhaps because he has still not seen the newspaper reports about the rupee’s freefall!

All in all, it is clear that this inept government has dragged the Sri Lankan economy to the brink of disaster and that a massive hotch-potch of policy contradictions has led to the serious undermining of the Sri Lankan rupee. In that pathetic background, this government must be firmly told to stop trotting out lame excuses and blaming the previous government and/or other foreign governments for everything they cannot get right.

The government has also shown in no uncertain terms that they are totally incapable of dealing with the complex problems of the economy and that they are only good at worsening the crisis by their confusing statements and reckless policies. Therefore, the only sensible option now open to the country is to allow the people to forthwith elect a new government that the people believe would be able to save Sri Lanka from the impending economic disaster that is now very close at hand.

(Ajith Nivard Cabraal is former Governor, Central Bank of

Sri Lanka)