Reply To:

Name - Reply Comment

As per the Monetary Law Act (MLA), it is a statutory duty of the Central Bank is to maintain “economic and price stability”. In so doing, the MLA requires the Monetary Board “to maintain the international stability of the Sri Lanka rupee”. Towards that end, the Monetary Board has to maintain an international reserve, which has to be “adequate to meet any foreseeable deficits in the International Balance of Payments”.

As per the Monetary Law Act (MLA), it is a statutory duty of the Central Bank is to maintain “economic and price stability”. In so doing, the MLA requires the Monetary Board “to maintain the international stability of the Sri Lanka rupee”. Towards that end, the Monetary Board has to maintain an international reserve, which has to be “adequate to meet any foreseeable deficits in the International Balance of Payments”.

The MLA provides guidance as to the factors that need to be considered in “International Monetary Stabilization”, which, inter alia, requires the Central Bank to give consideration to “the volume and maturity of the foreign exchange assets and liabilities of (a) the government, (b) the banking institutions and (c) other persons in Sri Lanka”, in carrying out this duty.

One of the policy measures the Monetary Board uses to maintain the stability of the Sri Lankan rupee is the supply and absorption of forex to and from the forex market. In doing so, the Central Bank must attempt to achieve the optimum balance based on the interests of all stakeholders, instead of being guided by external dictates or powerful local influences in the determination of the value of the Sri Lankan rupee.

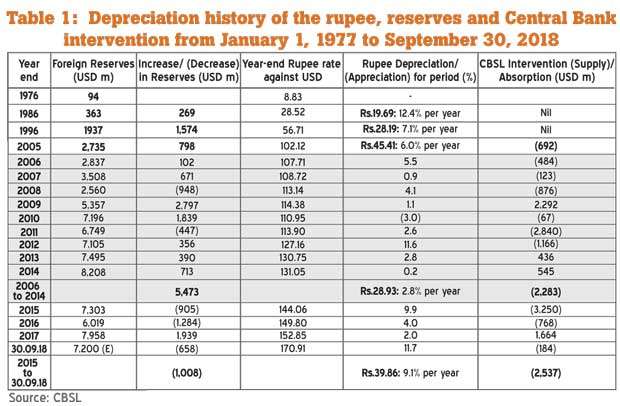

Unfortunately, at present, the Monetary Board seems to be wittingly or unwittingly neglecting this statutory duty, judging by the comments of a spokesman for the Central Bank who indirectly claimed that a “waste” of Central Bank’s forex reserves occurred when the Central Bank intervened in the forex market in 2012 to support the rupee. In that context, in order to evaluate the veracity of such claim, a data series setting out the depreciation history of the rupee, the amount of reserves and the Central Bank’s Interventions in the forex market from January 1, 1977 to September 30, 2018, would be helpful. (Please see Table 1)

In 2012, the rupee depreciated by 11.6 percent while the Central Bank supplied US $ 1,166 million to the forex market. At the same time, the reserves increased by US $ 356 million (over 5 percent) to US $ 7,105 million.

Further, after the rupee “stabilized” at a level of Rs.127.16 per US dolalr by end-2012, it recorded a depreciation of 3 percent over two years even while the Central Bank absorbed forex of US $ 981 million (US $ 436 million in 2013 + US $ 545 million in 2014) into its reserves in those two years.

Hence, any suggestion that there had been a “waste” of reserves during the 2012 intervention is untenable, as the stability that followed the supply of forex in 2012 is ample testimony of the wisdom of that intervention decision in 2012.

In 2011, the Central Bank supplied a significant quantum of forex amounting to US $ 2,840 million to the market but its reserve of US $ 7196 million reduced by only US $ 447 million (6 percent) to US $ 6,749 million. With such an affordable intervention, the Central Bank was able to stabilize the rupee and limit the depreciation to only 2.6 percent, on the back of an appreciation of 3 percent in the previous year.

Thus, it would be observed that over a span of four years 2008 to 2011, the rupee had moved from Rs.113.14 per US $ to Rs.113.90 per US dollar, thereby recording its longest-ever period of “maintaining the international stability of the Sri Lanka rupee” in Sri Lanka’s post-liberalization history. Undoubtedly, that stable platform set the environment for Sri Lanka’s high growth, low inflation, modest interest rates and high business and investor confidence during that era.

Overall, during the nine years, 2006 to 2014, the Central Bank successfully intervened in the forex market (in accordance with its statutory duty) with a net supply of forex of US $ 2,283 million, while simultaneously building up its reserves by a substantial US $ 5,473 million. By doing so, the Central Bank was able to limit the depreciation of the rupee to a manageable 2.8 percent per year over the nine years 2006 to 2014, by far the lowest average depreciation since 1977.

In contrast, the rupee suffered an average depreciation of 12.4 percent per year for 10 years from 1977 to 1986: 7.1 percent per year for 10 years from 1987 to 1996 and 6 percent per year for 9 years, from 1997 to 2005.

Reckless dissipation of country’s reserves

It may also be recollected that during the years 2006 to 2014, Sri Lanka had to face some of the greatest global economic crises in history: the global financial crisis, where a majority of countries (but not Sri Lanka) experienced negative economic growth, the global oil crisis, where the price of crude oil zoomed past US $ 140 per barrel, the global banking crisis, where hundreds of banks, insurance companies and financial institutions crashed all over the world, the global food crisis, where commodity prices rose to unprecedented levels.

|

In addition, Sri Lanka had to finance a bloody war on terror and thereafter allocate substantial funds towards the massive reconstruction effort. Through all these crises, the Sri Lanka economy progressed smoothly without transmitting the global shocks to the people or businesses or government, due to the judicious policies and balanced strategies implemented by the authorities at that time.

However, the benign trend that was painstakingly crafted from 2006 to 2014, with meticulous planning and robust execution, was seriously derailed soon after the ‘Yahapalanaya’ government took office in 2015. In the wake of the bond scam and other unsound economic decisions, acute economic destabilization occurred. As a consequence, the Central Bank indulged in a massive forex intervention spree to defend the rupee by pumping a staggering sum of US $ 3,250 million into the forex market.

Incidentally, that forex outlay in 2015 was US $ 967 million, higher than the entire net supply of US dollars to the forex market during the nine years of the previous administration. Notwithstanding such huge intervention, the rupee depreciated by 9.9 percent during the year, while the reserve suffered a devastating drop of US $ 905 million.

The year 2016 was only marginally better, with an intervention of US $ 768 million, while the reserves plunged by US $ 1,284 million to an alarming level of US $ 6,019 million, leaving the economy highly vulnerable in a volatile external environment. Notwithstanding that substantial loss of reserves and significant intervention, the rupee depreciated by a further 4 percent, on the back of the 9.9 percent depreciation in the previous year.

In that background, a comparison can now be made between the forex intervention of 2012 with that of 2015 and 2016.

In 2012, the Central Bank supplied US $ 1,166 million to the forex market out of reserves that it accumulated during the same year. As a result, the reserve actually increased by US $ 356 million (or 5 percent), although the rupee depreciated by 11.6 percent. In the two years 2015 and 2016, the Central Bank supplied an astonishing US $ 4,018 million to the forex market thereby depleting its reserves by a massive US $ 2,189 million, while the rupee too suffered a depreciation of 13.9 percent.

It is therefore plain to see that what happened in 2015 and 2016 was a reckless dissipation of the country’s reserves without achieving a stable rupee and hence, that adventure could be identified as a serious mismanagement of the rupee.

Fortunately, the year 2017 was more satisfactory, with the depreciation of the rupee being capped at 2 percent, while the Central Bank absorbed a useful US $ 1,664 million from the forex market. This absorption resulted in an overall increase in the reserve by US $ 1,939 million, thereby shoring up the previously depleted reserve to a more respectable level of US $ 7,958 million.

Nevertheless, the authorities overlooked the fact that this relatively satisfactory achievement was mainly due to the acute depreciation of the US dollar against most currencies during year 2017. In fact, the ‘US Dollar Index’, which tracks the performance of the US dollar against a large basket of currencies, shows that the US Dollar Index declined from ‘103’ to ‘90’ in 2017.

Therefore, had the Sri Lankan authorities taken cognisance of that trend, they would have surmised there was a serious likelihood of the US dollar appreciating in 2018 with the strengthening of the US economy and prepared to face such challenge in 2018. Sadly, however, it is now clear that there was no such preparation and the present economic chaos is a direct consequence of that lack of foresight and planning.

2018 has been an unmitigated disaster

The year 2018 has been an unmitigated disaster. Almost all sectors of the economy are now in tatters and the rupee has already suffered a massive depreciation of over 11.7 percent. The Central Bank and the government have gone to great lengths to blame the debacle on President Trump and the US dollar appreciation.

However, the reality is that the US Dollar Index has only moved from a value of ‘90’ in 2017 to a slightly higher ‘95’ by end-September 2018 and has not even reached the index value prevailing at end-2016. Meanwhile, the Central Bank and the government have passively watched this rout of the rupee, while making periodic hollow boasts that they possess large reserves to face any eventuality.

Nevertheless, all forex dealers are aware of the reality and hence do not attach any credibility to these lofty ministerial or Central Bank announcements. Adding to these woes, the Central Bank’s recent disclosure that their reserves are now around US $ 7,200 million only, (which is about US $ 1,000 million less than the 2014 level) is also likely to send shivers down the spines of the worried national and international creditors.

Through this turmoil, the government’s only response seems to be to continue its reckless commercial forex borrowing spree, thus adding to the growing vulnerability. Already, according to the government’s own boasts, at least US $ 3,500 million has been borrowed this year, while more borrowings are said to be in the pipe line through the issue of Panda and Samurai Bonds. These borrowings scheduled for the last three months of this year are possibly to meet the major shortfall in revenue due to the significant downturn of the real economy.

The above analysis would confirm that the management of the rupee over the past three years and nine months has been via knee-jerk, un-planned reactions to unfolding events that should have been anticipated by the policymakers. The bottom line of this chaos is therefore that they have miserably failed in their statutory duty to manage the rupee with timely strategies.

Needless to say, these unintelligent actions of the authorities have cost the country and its economy dearly. As a result, it has now also been confirmed beyond reasonable doubt that the present authorities are incapable of handling the challenges facing the economy.

Therefore, in the interest of the country, it is vital that the Sri Lankan people select a new government that could restore stability to the economy and instil confidence amongst stakeholders once again. It is then and only then, that the economy could be restored to an era of growth and stability.

(Ajith Nivard Cabraal is former Governor of the Central Bank of Sri Lanka)