Reply To:

Name - Reply Comment

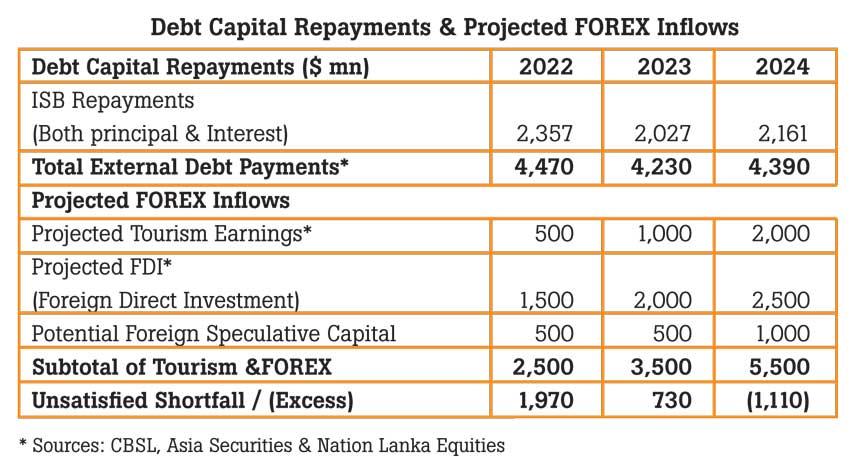

Sri Lanka’s economy is reeling under a foreign currency crisis during pandemic economic turbulence. An old addiction to imports has finally caught up to drain foreign exchange reserves, already straining under large debt repayments in the absence of US$ 5 billion in tourism and sovereign bond inflows.

Sri Lanka’s economy is reeling under a foreign currency crisis during pandemic economic turbulence. An old addiction to imports has finally caught up to drain foreign exchange reserves, already straining under large debt repayments in the absence of US$ 5 billion in tourism and sovereign bond inflows.

Despite doomsday forecasts by some economists advocating a debt restructure, Sri Lanka has several options and combinations of strategies to consider in order to bridge the gap. Sri Lanka seeking a debt restructure would tarnish Sri Lanka’s impeccable credit record since independence and damage its brand in foreign capital markets.

The rating agencies downgraded Sri Lanka to a country rating of CCC for the first time ever after the pandemic, to deny borrowing from international capital markets to finance maturing debts. The downgrades and concerns over rupee valuation prompted foreign investors to withdraw from rupee equity and treasury bond markets to record net capital outflows of around US$ 1 billion, Rs. 149 billion in 2020 and Rs. 42 billion to August in 2021, to further deepen Sri Lanka’s foreign exchange crisis.

The government responded to the pandemic crisis with stimulants of low taxes, low interest rates and printing cash in the example of many central banks across the world exploiting weak demand that helps subdue inflation.

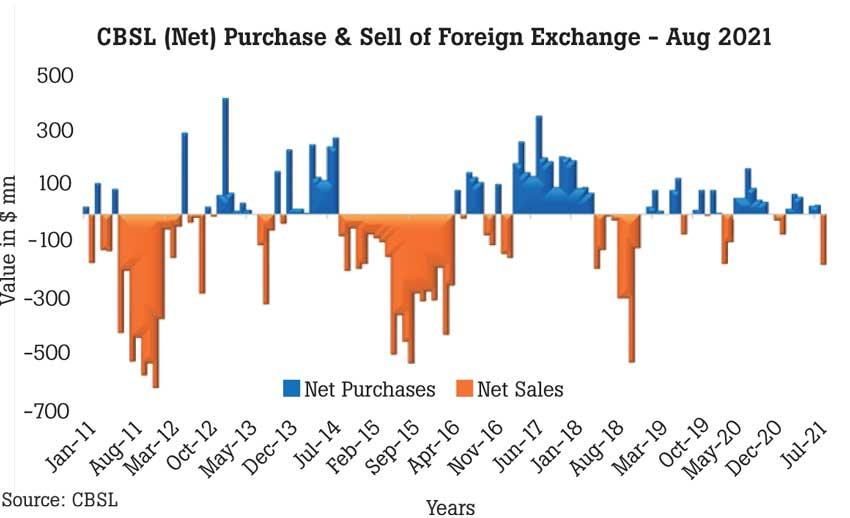

It is commendable that the Central Bank led by former Governor Professor W. D. Lakshman, was able to limit the drain on forex reserves during 2020 and 2021, while honouring all debt commitments (see graph). Over two billion dollars of forex reserves were gifted to importers in 2011/12 and again in 2015/16 in futile attempts to control the exchange rate. The graph reveals a net buying of dollars recently, to reveal an encouraging trend of protecting valuable foreign currency reserves.

Today, exports have rebounded back to US$ 1 billion a month. Despite import and bank restrictions, and a lockdown slow of demand, the trade deficit expanded to surpass US$ 600 million in June and July. The import bill of US$ 11.7 billion up to July in 2021 exceeded the import bills of US$11.3 billion over the same period in 2019 with out any import restrictions. An alarming trend indeed.

If importers anticipate a rupee depreciation, they will naturally accelerate import stocks at the prevailing exchange rate. A dollar perceived as cheap also results in the importation of low value-added products such as gas cookers and kettles, simply because it is cheaper to import than to manufacture locally.The recent trend in expanding imports appears to reflect an elastic demand curve movement of import volumes on the price of

a dollar.

But Sri Lanka is not alone in facing a currency crisis and rating downgrades.

African downgrade crisis

Hippolyte Fofack, Economist & Director of African Export-Import Bank writes in an article “Downgrading Africa’s Development” re-published in Ceylon Today (Aug 11, 2021), that 56 percent of African country ratings have been downgraded by International Rating Agencies, while the global average was 31.8 percent, 28 percent in Asia and only 9 percent in Europe during the last year. The average is 62.5 percent if you include Kenya and Mauritius downgraded early in 2020, “which could trigger disproportionately negative ‘cliff effects’”.

“The downgrades of African sovereigns are underpinned by several factors, but two are especially relevant to the region. The first is the rating agencies’ institutional instinct to preserve their reputational capital. The second concerns so called “perception premiums’ or the overinflated risks. Higher premiums will increase borrowing costs and reduce demand for African public assets. The spill over effects of the downgrades were felt strongly across Africa when the sharp tightening of financial conditions early in the COVID 19 crisis lead to sudden stops and reversals in capital flows.”

South Africa’s net foreign portfolio outflows from bonds and equities exceeded US$ 9.7 billion in 2020. “Fitch announced a dramatic multi-notch downgrade of Gabon’s sovereign rating to CCC from B, largely on the grounds that falling oil prices would widen the country’s twin deficits and undermine the government’s capacity to honour its commitments to external creditors. Although oil prices have since recovered to above pre crisis levels, an upgrade of Gabon’s credit rating seems far from imminent”.

The article further states that “early in the COVID-19 crisis, therefore, the European Securities and Markets Authority cautioned ratings agencies against deepening the downturn through quick-fire downgrades”.

In other words, there is much to question the ‘opinions’ of ratings agencies that seem to “break” national economies and keep them dependent on funding agencies.

Managing forex crisis

The new Central Bank Governor Nivard Cabraal, in a confidence building interview on Bloomberg TV stated that he hopes to row ‘printing cash and asset purchases’ to tighten money supply. The new governor has the honour of obtaining Sri Lanka’s first a credit rating of BB- to issue Sri Lanka first Sovereign Bond in 2007. As part of the “can-do” administration of the time, he cultivated a dialogue with financial markets in Hong Kong with “road shows” to build foreign investor confidence.

Today, the new governor has an equally challenging crisis, to provide solutions to the looming foreign exchange shortage. But the challenges are not insurmountable. The governor has options to consider in 2022, as he unveils the roadmap to recovery

in October.

Amongst them, the ideal solution would be sourcing term loans of two to three billion dollars over 2022 and 2023 with maturity periods passing the ‘bunched up’ repayments in the near term. While it would be ideal to avoid future debt, when retiring old, one would imagine the priority today would be to stay afloat and manage through the pandemic triggered economic crisis until tourism revenue and FDI returns.

In terms of foreign investment, the opportunity to generate dollar inflows through the sale of underutiliszed or mature State assets to foreign investors and the CSE listing of SOEs to attract foreign capital can be considered. The Joint venture arrangement with US based, New Fortress Energy is one such FDI transaction that will also help align future energy infrastructure with our offshore natural

gas resources.

Blackrock has already invested US$ 60 billion in assets in India and plan another US$ 40 billion. Sadly, foreign investment has been politicised as undesirable in Sri Lanka, despite its major success in telecom, ports and tourism industries.

The Port City project has already found initial success with commitments for a majority of its Marina District land plots. Port City and Colombo Financial Centre offer a unique platform to attract foreign capital with new legal structures falling into place.

Increasing treasury bond yields and attractive valuations of the CSE lend opportunities to bring speculative foreign investment back into rupee capital markets. However, in order to attract short term foreign capital into rupee assets, Sri Lanka needs to restore confidence in the stability of the rupee.

Benefits of competitively valued currency

While working capital loans for oil imports would provide relief, the most sustainable solution which includes some short-term pain, would be a strategy to generate a surplus in the Current Account of the Balance of Payments (BoP) i.e. to be foreign currency cash flow positive in the trading of goods and services. Sri Lanka has been living well beyond its means for many decades to record ballooning trade deficits. An obvious tool in achieving this goal is a competitively valued currency that will discourage imports and promote investment, exports and domestic production.

The current strong rupee policy runs counter to the government’s objective of promoting local production. If the rupee is overvalued, it performs the function of a subsidy to any consumer to purchase an imported product over a local substitute. Motor vehicle and fuel imports have enjoyed the subsidized cost of dollars for imports to generate trade deficits of US$ 8 to 10 billion annually over a decade.

Fortunately for Sri Lanka today, many export sectors such as IT and sea food and apparel are growing rapidly. Most export economies such as Japan, Korea and China have become wealthy through trade surpluses to build strong forex reserves. Sri Lanka could help itself with a sustainable currency policy to build reserves, by enabling the rupee to find market value in today’s economic context. It would be better to depreciate the currency than continue with debilitating bank restrictions.

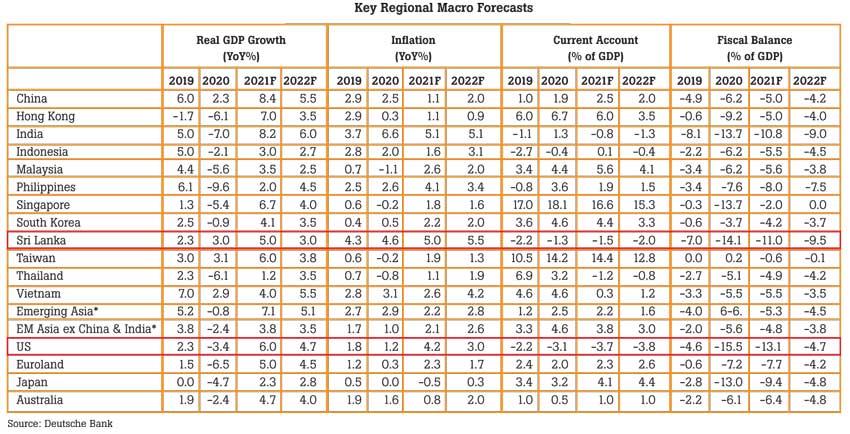

However, managing the budget deficit and inflation, can be challenging during currency depreciation. Yet, inflationary pressures remain weak globally due to the economic slowdown while expanding budget deficit are common during the pandemic. India’s budget deficit ran 13.7 percent in 2020 and is forecasted at 10.8 percent in 2021. India’s Debt to GDP ratio has increased from 70 percent to 90 percent during the pandemic crisis period although forex reserves reached a record US$ 642 billion. Forcing the exchange rate as a tool to control inflation and budget deficits, is usually a short-lived tactic.

The upcoming budget proposal can be expected to reflect fiscal consolidation with increased tax revenue while GDP growth is expected to exceed 5 percent in 2021. A competitively valued currency would help win the confidence of foreign funding agencies. If the government can reach an agreement with the IMF that does not involve a debt restructure, it would help regain the confidence of foreign investors.

Colombo Stock Exchange performance to be the 7th best performing stock market in the world to August in 2021, with increased turnover displayed local confidence in the economic revival of Lanka’s dynamic private sector. The new SEC Act will improve investor confidence and market integrity.

Sri Lanka awaits a crucial budget proposal in November 2021 that will determine our economic destiny.

(The writer is the Managing Director of Ceylon Asset Management)